Sunday, March 31, 2013

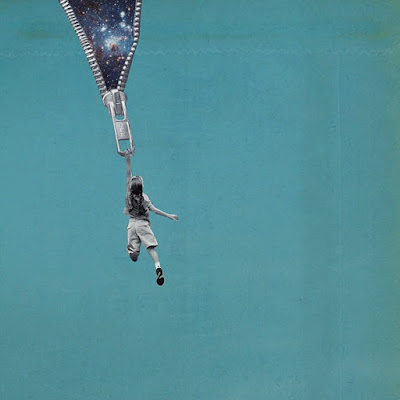

Searching for 'Super Bliss' With Bob Thurman

[ed. Thanks, Deb.]

Can You Have Too Much Solar Energy?

Solar panels line Germany’s residential rooftops and top its low-slung barns. They sprout in orderly rows along train tracks and cover hills of coal mine tailings in what used to be East Germany. Old Soviet military bases, too polluted to use for anything else, have been turned into solar installations.

Twenty-two percent of Germany’s power is generated with renewables. Solar provides close to a quarter of that. The southern German state of Bavaria, population 12.5 million, has three photovoltaic panels per resident, which adds up to more installed solar capacity than in the entire United States.

With a long history of coal mining and heavy industry and the aforementioned winter gloom, Germany is not the country you’d naturally think of as a solar power. And yet a combination of canny regulation and widespread public support for renewables have made Germany an unlikely leader in the global green-power movement—and created a groundswell of small-scale power generation that could upend the dominance of traditional power companies. (...)

You might think Germany would be smug about all its solar success. But, as usual, folks here are full of doubts. Part of the reason solar panels are getting cheaper is competition from China, which is threatening to push more expensive German producers out of business. Last year, German conservatives tried to end solar subsidies entirely, arguing that plummeting prices were encouraging too many people to install solar panels. They said that the subsidies come at the expense of city dwellers without solar-ready roofs, low-income electricity consumers, and investments in other forms of renewable energy. Even environmentalists have begun to grumble about the solar boom, which sucks up half of Germany’s funding for renewables but provides just 20 percent of green power.

The proliferation of privately owned solar has large power companies in Germany worried. For two decades, they’ve been forced to facilitate and finance their competition, helping turn customers into producers. Soon, rooftop solar and other small-scale, locally owned renewables could upset the market for coal and nuclear power.

Here’s why that’s a problem: Renewable energy sources like wind and solar generate power intermittently, dependent on the sun or fickle breezes. Until researchers can find a way to store energy at a large scale, coal and nuclear plants—which can’t simply be switched on and off at will—must be kept running to guarantee a steady stream of electricity when the sun isn’t shining.

by Andrew Curry, Slate | Read more:

Photo by Michaela Rehle/ReutersState-Wrecked: The Corruption of Capitalism in America

The Dow Jones and Standard & Poor’s 500 indexes reached record highs on Thursday, having completely erased the losses since the stock market’s last peak, in 2007. But instead of cheering, we should be very afraid.

Over the last 13 years, the stock market has twice crashed and touched off a recession: American households lost $5 trillion in the 2000 dot-com bust and more than $7 trillion in the 2007 housing crash. Sooner or later — within a few years, I predict — this latest Wall Street bubble, inflated by an egregious flood of phony money from the Federal Reserve rather than real economic gains, will explode, too.

Since the S.&P. 500 first reached its current level, in March 2000, the mad money printers at the Federal Reserve have expanded their balance sheet sixfold (to $3.2 trillion from $500 billion). Yet during that stretch, economic output has grown by an average of 1.7 percent a year (the slowest since the Civil War); real business investment has crawled forward at only 0.8 percent per year; and the payroll job count has crept up at a negligible 0.1 percent annually. Real median family income growth has dropped 8 percent, and the number of full-time middle class jobs, 6 percent. The real net worth of the “bottom” 90 percent has dropped by one-fourth. The number of food stamp and disability aid recipients has more than doubled, to 59 million, about one in five Americans.

So the Main Street economy is failing while Washington is piling a soaring debt burden on our descendants, unable to rein in either the warfare state or the welfare state or raise the taxes needed to pay the nation’s bills. By default, the Fed has resorted to a radical, uncharted spree of money printing. But the flood of liquidity, instead of spurring banks to lend and corporations to spend, has stayed trapped in the canyons of Wall Street, where it is inflating yet another unsustainable bubble.

When it bursts, there will be no new round of bailouts like the ones the banks got in 2008. Instead, America will descend into an era of zero-sum austerity and virulent political conflict, extinguishing even today’s feeble remnants of economic growth.

This dyspeptic prospect results from the fact that we are now state-wrecked. With only brief interruptions, we’ve had eight decades of increasingly frenetic fiscal and monetary policy activism intended to counter the cyclical bumps and grinds of the free market and its purported tendency to underproduce jobs and economic output. The toll has been heavy.

As the federal government and its central-bank sidekick, the Fed, have groped for one goal after another — smoothing out the business cycle, minimizing inflation and unemployment at the same time, rolling out a giant social insurance blanket, promoting homeownership, subsidizing medical care, propping up old industries (agriculture, automobiles) and fostering new ones (“clean” energy, biotechnology) and, above all, bailing out Wall Street — they have now succumbed to overload, overreach and outside capture by powerful interests. The modern Keynesian state is broke, paralyzed and mired in empty ritual incantations about stimulating “demand,” even as it fosters a mutant crony capitalism that periodically lavishes the top 1 percent with speculative windfalls.

Over the last 13 years, the stock market has twice crashed and touched off a recession: American households lost $5 trillion in the 2000 dot-com bust and more than $7 trillion in the 2007 housing crash. Sooner or later — within a few years, I predict — this latest Wall Street bubble, inflated by an egregious flood of phony money from the Federal Reserve rather than real economic gains, will explode, too.

Since the S.&P. 500 first reached its current level, in March 2000, the mad money printers at the Federal Reserve have expanded their balance sheet sixfold (to $3.2 trillion from $500 billion). Yet during that stretch, economic output has grown by an average of 1.7 percent a year (the slowest since the Civil War); real business investment has crawled forward at only 0.8 percent per year; and the payroll job count has crept up at a negligible 0.1 percent annually. Real median family income growth has dropped 8 percent, and the number of full-time middle class jobs, 6 percent. The real net worth of the “bottom” 90 percent has dropped by one-fourth. The number of food stamp and disability aid recipients has more than doubled, to 59 million, about one in five Americans.

So the Main Street economy is failing while Washington is piling a soaring debt burden on our descendants, unable to rein in either the warfare state or the welfare state or raise the taxes needed to pay the nation’s bills. By default, the Fed has resorted to a radical, uncharted spree of money printing. But the flood of liquidity, instead of spurring banks to lend and corporations to spend, has stayed trapped in the canyons of Wall Street, where it is inflating yet another unsustainable bubble.

When it bursts, there will be no new round of bailouts like the ones the banks got in 2008. Instead, America will descend into an era of zero-sum austerity and virulent political conflict, extinguishing even today’s feeble remnants of economic growth.

This dyspeptic prospect results from the fact that we are now state-wrecked. With only brief interruptions, we’ve had eight decades of increasingly frenetic fiscal and monetary policy activism intended to counter the cyclical bumps and grinds of the free market and its purported tendency to underproduce jobs and economic output. The toll has been heavy.

As the federal government and its central-bank sidekick, the Fed, have groped for one goal after another — smoothing out the business cycle, minimizing inflation and unemployment at the same time, rolling out a giant social insurance blanket, promoting homeownership, subsidizing medical care, propping up old industries (agriculture, automobiles) and fostering new ones (“clean” energy, biotechnology) and, above all, bailing out Wall Street — they have now succumbed to overload, overreach and outside capture by powerful interests. The modern Keynesian state is broke, paralyzed and mired in empty ritual incantations about stimulating “demand,” even as it fosters a mutant crony capitalism that periodically lavishes the top 1 percent with speculative windfalls.

by David Stockman, NY Times | Read more:

Image: Mark PerniceSaturday, March 30, 2013

How the Process Works - An Outsider's Guide to Cherry Point

[ed. I'm back. To celebrate, I'm posting an opinion piece I wrote before I left about a proposed coal export facility planned here in the Pacific Northwest. The project is officially called the Gateway Pacific Terminal, but everyone just refers to it as Cherry Point (the site where the terminal will be built). You can read more about it here. It seems to be a pretty big deal, with exports projected to reach 50 million tons a year, supported by 18 trains a day, each 1.5 miles long, snaking through the cities and countrysides of Washington state. I'm not sure how many readers are interested in the technical details of how the National Environmental Policy Act (NEPA) works, but these general guidelines could probably be applied to just about any kind of large project, anywhere.]

As a recent resident of

this beautiful state it didn't take long to notice a significant

controversy brewing over development of a proposed coal export

facility at Cherry Point. Those 'No Coal' yard signs sprouting

everywhere - seemingly competing for the title of state flower - were my first

indication that something might be up. Then, last fall, project scoping

hearings provided more detail about the project's design giving the

public its first opportunity to comment, generating an

impressive statewide turnout and much impassioned testimony. Since

then, I've spent some time learning what I can but so far haven't formed an opinion one way or another. However, I have noticed that

most of the attention to date has focused on the project's potential

threats and benefits. I'd like to add another voice to the discussion

by offering a perspective on how the process itself might

unfold leading up to a final decision.

As a recent resident of

this beautiful state it didn't take long to notice a significant

controversy brewing over development of a proposed coal export

facility at Cherry Point. Those 'No Coal' yard signs sprouting

everywhere - seemingly competing for the title of state flower - were my first

indication that something might be up. Then, last fall, project scoping

hearings provided more detail about the project's design giving the

public its first opportunity to comment, generating an

impressive statewide turnout and much impassioned testimony. Since

then, I've spent some time learning what I can but so far haven't formed an opinion one way or another. However, I have noticed that

most of the attention to date has focused on the project's potential

threats and benefits. I'd like to add another voice to the discussion

by offering a perspective on how the process itself might

unfold leading up to a final decision.

How The Process

Works – An Outsider's Guide to Cherry Pt.

As a recent resident of

this beautiful state it didn't take long to notice a significant

controversy brewing over development of a proposed coal export

facility at Cherry Point. Those 'No Coal' yard signs sprouting

everywhere - seemingly competing for the title of state flower - were my first

indication that something might be up. Then, last fall, project scoping

hearings provided more detail about the project's design giving the

public its first opportunity to comment, generating an

impressive statewide turnout and much impassioned testimony. Since

then, I've spent some time learning what I can but so far haven't formed an opinion one way or another. However, I have noticed that

most of the attention to date has focused on the project's potential

threats and benefits. I'd like to add another voice to the discussion

by offering a perspective on how the process itself might

unfold leading up to a final decision.

As a recent resident of

this beautiful state it didn't take long to notice a significant

controversy brewing over development of a proposed coal export

facility at Cherry Point. Those 'No Coal' yard signs sprouting

everywhere - seemingly competing for the title of state flower - were my first

indication that something might be up. Then, last fall, project scoping

hearings provided more detail about the project's design giving the

public its first opportunity to comment, generating an

impressive statewide turnout and much impassioned testimony. Since

then, I've spent some time learning what I can but so far haven't formed an opinion one way or another. However, I have noticed that

most of the attention to date has focused on the project's potential

threats and benefits. I'd like to add another voice to the discussion

by offering a perspective on how the process itself might

unfold leading up to a final decision.

First, some background.

I'm a retired habitat biologist with the Alaska Department of Fish

and Game. I spent nearly 30 years of my career involved in

environmental policy, planning, permitting and coordination on

hundreds of large and small-scale development projects throughout

Alaska, many of which required National Environmental Policy Act

(NEPA) determinations and other regulatory reviews. The advice that

follows is directed at opponents of the project - not because I identify with their cause, but because I believe a level playing

field generally produces the best public policy results. Project

advocates are undoubtedly well organized and moving forward with

their objectives which should include securing all necessary permits

with a minimum of financial commitments, and avoiding legal threats

that could result in costly and prolonged litigation. They have the

money, the connections, and the motivation. They don't need advice.

But if opponents are to be successful in neutralizing some of those

advantages they could benefit from having a better understanding of

how the process typically works.

So, here are some

guidelines:

1. Opponents will

always be playing defense. Get used to it. Think of it like a

football game. Project advocates are executing a game plan they think

will take them to the end zone. It should be assumed they've

considered every detail leading up to that result and are working

behind the scenes to strengthen their position, with contingency

plans in place for known vulnerabilities. It shouldn't be surprising,

given the scope of the project, that there are probably well worn

paths throughout the hallways of Olympia, and (since China is

involved) maybe even the State and Commerce Departments. Along the

way they'll probably introduce new plays (project redesigns,

mitigation, legislation) that will position themselves to win. The

defense can nullify or parry those plays, but in the end success is

usually defined as a tied game, 0 - 0. Status quo. Opponents will never

win on the strength of a single spectacular play (e.g., some killer

issue) but they can anticipate the opposing team's strategy and act

accordingly. Which brings us to the next point.

2. No issue is of

overriding significance. Every issue has a constituency and there

will always be someone or some group that will expect their concerns

to be given top priority in the decision-making process. That's not

going to happen. There is no moral imperative box that can be checked

in a systematic and objective analysis, no a priori standing

given to any specific issue. Everything is negotiable or can be

mitigated, unless there are conflicts with existing law in which case

exceptions may be granted or design modifications required.

Everything is on the table until all the final hands are played. The

corollary to this is that not all issues are equal. Some are big,

some are small; some have direct effects, some indirect; some are

easily resolved, some are pernicious; some are simply expressions of

individual and community values. It's the NEPA document's

responsibility to sort all this out and describe why some issues are

more relevant than others, and what can be done about them. There is

no issue that takes precedence over all others, except perhaps the

financial solvency or commitment of the project's applicant.

3. Bureaucrats are

your friends (and your enemies). We could review the standard

NEPA process and describe how decisions are supposed to be made - for

example, by citing Council on Environmental Quality (CEQ) guidelines,

relevant case law, etc., but that wouldn't matter much in this

discussion. A bullet-proof process is a basic expectation grounded in

law. So, if you don't want to be sued or have your project consigned

to some interminable administrative purgatory, the smartest thing to

do if you're a project proponent or agency tasked with preparing the

NEPA document is to get the facts right and let the chips fall where

they may. This includes doing all the necessary science, economic

analyses, social surveys, and other technical reviews that provide

the best information possible so that the process itself

is unassailable. If it isn't, the lawyers will let you know.

Nevertheless, behind

this 'process' there are other ways in which the outcome of the final

decision can be decided, not necessarily related to the information

at hand. Bureaucrats aren't robots. Like everyone else they have

personal opinions and professional motivations that can influence the

way data are weighted and presented and how mitigation measures are

developed (the NEPA analyses have been sub-contracted out to

consultants, CH2M Hill, which adds another layer of opacity to the

process, while the State has it's own State Environmental Policy Act

(SEPA) review, which can sometimes result in tension between state

and federal interests). As a practical matter, an effective strategy

would include finding out who's doing what, who their supervisors

are, and try to develop working relationships with as many people as

possible so that, at a minimum, information sharing can occur as the

process unfolds (caveat: the breadth and quality of that information

can vary widely depending upon the personnel involved and the

relationships one develops). Sometimes it's the only way to get a

sense of what's going on behind the scenes if you want to affect a

beneficial outcome. It also helps if you can provide something in

return, like critical information that analysts may not have at their

disposal (something lobbyists do to great effect).

4. Mitigation.

Mitigation measures lurk at the

heart of every NEPA analyisis. From an agency standpoint, they are

the most important factor affecting a project's viability (political

considerations aside). It's the tool regulators use to respond to

various issues after all analyses have been digested, and the

mechanism by which legal requirements are enforced (since mitigation

measures ultimately end up as stipulations in project permits). If

there are any differences between state and federal perspectives,

this is where they'll likely be worked out. The process of developing

mitigation measures also represents a time when interactions between

agencies and the applicant are usually the most contentious, every

mitigation measure representing an additional cost to the project's

bottom line (along with potential legal exposure should later actions

be found not to be in compliance)

Now, think a moment

about who will be attending those mitigation meetings when these

requirements are being hashed out (meetings which are usually

iterative, distributed, and rarely, if ever, open to the public):

you'll have the agencies, the applicant, occasionally consultants

(from either side), and perhaps a lawyer or two. That's it. That's

why it's so important to find out what's going on with

the Draft EIS as

it is being developed,

and why opponents will always be playing defense.

5. Expect political

meddling. What can you say

about politicians (in polite company, anyway). They're motivated by

mysterious forces: constituent issues, donor dollars, astroturfing

campaigns, media controversies, petitions, public perceptions, and

any number of other things. All I know is, based on my experience,

one should always expect political meddling. The bigger the project,

the more the meddling; although it usually never takes the form of a

direct attack since that would be too alienating to opposing

supporters and potential donors (and political collegues, if they are

forced to choose sides). Instead what you're more likely to see are

bills that nibble around the edges, limiting or expanding options

that directly or indirectly affect a project's feasibility:

transportation corridor improvements, modified zoning or land use

designations, limited or expanded municipal and state authorities,

that kind of thing. Also, expect behind the scenes manuervering to

include old fashioned horse trading on pet issues, and budgetary

threats to agencies that are perceived not to be on board with the

game plan (see item #3). An effective strategy is to develop

relationships with key politcal staff that are inclined toward your

positions and use them to keep abreast of what's going on, in the

process building trust and potentially influencing support. Again, it

always helps to provide something in return – campaign assistance,

community council coordination, help with voter initiatives,

grassroots organizing, etc.

6. A final decision

will be based on public policy. What is public policy? Basically,

it's the sum total of all issues, expectations, influences, and

politics that are brought to bear over the course of the analysis.

It's also a reflection of the character of a state – it's history,

it's economy, it's leadership, and it's vision. In other words, it's

a balancing act. It's the biggest and most subjective element in the

entire review process. The Administrator of the lead federal agency

assigned to the task of developing the NEPA documents will eventually

render a Final Record of Decision (ROD) based upon all relevant

information, including a review of mitigation measures to avoid,

ameliorate, rehabilitate, restore or replace values that are likely

to be impacted, but the true fate of the project will have been

decided long before in numerous regulatory skirmishes and behind the

scenes manuevering. Despite the fact that the ROD is a federal

document, the State of Washington will decide whether the project

gets a green light or not because it has permits of its own to issue,

and is conducting a concurrent SEPA review. That's both good and bad.

Good in the sense that the people most affected by any decision will

ultimately decide it's fate, bad because state politicians are

notoriously short sighted and overly beholden to parochial and/or

corrosive influences that have nothing to do with good public policy

(I'm using my experience in Alaska here; who knows, maybe

Washington's politicians posses the wisdom of the original founding

fathers). And remember, state employees preparing the SEPA documents

are accountable to those politicians. I can say from experience that

I've never seen a large project die as a result of technical issues.

It always comes down to economics or politics, usually both.

The fact that the

proposed Cherry Point facility is an important component of a larger

network of connected interests that begin with large mining

operations in Wyoming and Montana, which then feed into large

transportation and shipping conglomerates, which then impact a number of

northwestern state communities and local economies, and ultimately

contribute to China's national energy and security objectives, means

that political pressures are likely to be high. Because of this,

project opponents might consider doing everything they can to

coordinate with national environmental groups, lobby Congress and

their legislators, develop grassroots and media campaigns, and

encourage a national dialog similar to what we see with issues like

the Keystone XL pipeline and Arctic National Wildlife Refuge (which,

as an aside, are both proxies for larger issues: global climate

change, and the legitimacy of Wilderness designations, respectively).

I know I didn't hear about Cherry Point until I got here, which tells

you either how clueless I am or how low it currently flies under the

national radar.

Finally, I'd only add

one other thing and that is: success doesn't have to be a zero-sum

game. Sometimes the best public policy ends not in a tie, but with

each side extracting enough concessions so that what's left is

something beneficial to both the economy and the larger environment.

It is possible. Just remember the old saying: it's not a problem,

it's an opportunity.

by markk

Saturday, March 23, 2013

I Grew Up in the Future

What is it supposed to be? I asked, getting the milk out of the fridge and making myself some muesli.

Well, she said, you joined a social network on your phone, and then you could express opinions about things. You could send something to your friends, and they would say if they liked it or they didn’t like it — on their phones.

That sounds really stupid, I said.

But, as I don’t think I need to stress, the idea turned out to have legs. In my defence, the first iPhone was still six months away. And though I was one of the first few million users of Facebook, the ‘Like’ button wouldn’t come along for years.

The future arrived much earlier in our house than anywhere else because my mother is an emerging technologies consultant. Her career has included stints as a circus horse groom, a tropical agronomist in Mauritania, and a desktop publisher. But for most of my life she has lived by her unusual ability to see beyond the glitchy demos of new tech to the faint outlines of another reality, just over the horizon. She takes these trembling hatchlings of ideas by the elbow, murmurs reassurances, and runs as fast as she can into the unknown.

When the web and I were both young, in the mid-1990s (with 10,000 pages and a third-grade education to our respective names), video conferencing was my mom’s thing. We had our county’s first T1 fibre-optic line thanks to her, and I grew up in a house full of webcams, shuddering and starting with pictures of strangers in Hong Kong, New York and the Netherlands, to whom I’d have to wave when I got home from school. Later on, when I bought a webcam for the first time, I could not believe you had to pay for them — I thought of them as a readily available natural resource, spilling out from cardboard boxes under beds.

My mother worked with companies who wanted to develop software and hardware for video conferencing, and she wrote reports about the state of the market, which, at that point, was a slender stream of early adopters. Internet connections were so slight, and the hardware so bulky and expensive, that it was slow going — tech start-ups launched with fanfare and sank within months, unable to stay afloat on the ethereal promise of everyone, everywhere, seeing each other talk. The promise, too, of never having to travel for business was not as appealing as the start-ups thought it would be.

But my mom is a futurist, that peculiar subclass of optimists who believe they can see the day after tomorrow coming. In the 1990s, she ordered pens customised with her consultancy name and the slogan: ‘Remember when we could only hear each other?’ Years later, when an unopened box of them surfaced in her office, she laughed and laughed. It would be another several years before Skype with video brought the rest of the world up to speed with her pens.

And by that point, she’d moved on.

by Veronique Greenwood, Aeon | Read more:

Photo by Everett Collection / Rex Features

Unfit for Work

In the past three decades, the number of Americans who are on disability has skyrocketed. The rise has come even as medical advances have allowed many more people to remain on the job, and new laws have banned workplace discrimination against the disabled. Every month, 14 million people now get a disability check from the government.

The federal government spends more money each year on cash payments for disabled former workers than it spends on food stamps and welfare combined. Yet people relying on disability payments are often overlooked in discussions of the social safety net. People on federal disability do not work. Yet because they are not technically part of the labor force, they are not counted among the unemployed.

The federal government spends more money each year on cash payments for disabled former workers than it spends on food stamps and welfare combined. Yet people relying on disability payments are often overlooked in discussions of the social safety net. People on federal disability do not work. Yet because they are not technically part of the labor force, they are not counted among the unemployed.

In other words, people on disability don't show up in any of the places we usually look to see how the economy is doing. But the story of these programs -- who goes on them, and why, and what happens after that -- is, to a large extent, the story of the U.S. economy. It's the story not only of an aging workforce, but also of a hidden, increasingly expensive safety net.

For the past six months, I've been reporting on the growth of federal disability programs. I've been trying to understand what disability means for American workers, and, more broadly, what it means for poor people in America nearly 20 years after we ended welfare as we knew it. Here's what I found.

In Hale County, Alabama, 1 in 4 working-age adults is on disability. On the day government checks come in every month, banks stay open late, Main Street fills up with cars, and anybody looking to unload an old TV or armchair has a yard sale.

Sonny Ryan, a retired judge in town, didn't hear disability cases in his courtroom. But the subject came up often. He described one exchange he had with a man who was on disability but looked healthy.

"Just out of curiosity, what is your disability?" the judge asked from the bench.

"I have high blood pressure," the man said.

"So do I," the judge said. "What else?"

"I have diabetes."

"So do I."

There's no diagnosis called disability. You don't go to the doctor and the doctor says, "We've run the tests and it looks like you have disability." It's squishy enough that you can end up with one person with high blood pressure who is labeled disabled and another who is not. (...)

People don't seem to be faking this pain, but it gets confusing. I have back pain. My editor has a herniated disc, and he works harder than anyone I know. There must be millions of people with asthma and diabetes who go to work every day. Who gets to decide whether, say, back pain makes someone disabled?

As far as the federal government is concerned, you're disabled if you have a medical condition that makes it impossible to work. In practice, it's a judgment call made in doctors' offices and courtrooms around the country. The health problems where there is most latitude for judgment -- back pain, mental illness -- are among the fastest growing causes of disability.

by Chana Joffe-Walt, NPR | Read more:

The federal government spends more money each year on cash payments for disabled former workers than it spends on food stamps and welfare combined. Yet people relying on disability payments are often overlooked in discussions of the social safety net. People on federal disability do not work. Yet because they are not technically part of the labor force, they are not counted among the unemployed.

The federal government spends more money each year on cash payments for disabled former workers than it spends on food stamps and welfare combined. Yet people relying on disability payments are often overlooked in discussions of the social safety net. People on federal disability do not work. Yet because they are not technically part of the labor force, they are not counted among the unemployed.In other words, people on disability don't show up in any of the places we usually look to see how the economy is doing. But the story of these programs -- who goes on them, and why, and what happens after that -- is, to a large extent, the story of the U.S. economy. It's the story not only of an aging workforce, but also of a hidden, increasingly expensive safety net.

For the past six months, I've been reporting on the growth of federal disability programs. I've been trying to understand what disability means for American workers, and, more broadly, what it means for poor people in America nearly 20 years after we ended welfare as we knew it. Here's what I found.

In Hale County, Alabama, 1 in 4 working-age adults is on disability. On the day government checks come in every month, banks stay open late, Main Street fills up with cars, and anybody looking to unload an old TV or armchair has a yard sale.

Sonny Ryan, a retired judge in town, didn't hear disability cases in his courtroom. But the subject came up often. He described one exchange he had with a man who was on disability but looked healthy.

"Just out of curiosity, what is your disability?" the judge asked from the bench.

"I have high blood pressure," the man said.

"So do I," the judge said. "What else?"

"I have diabetes."

"So do I."

There's no diagnosis called disability. You don't go to the doctor and the doctor says, "We've run the tests and it looks like you have disability." It's squishy enough that you can end up with one person with high blood pressure who is labeled disabled and another who is not. (...)

People don't seem to be faking this pain, but it gets confusing. I have back pain. My editor has a herniated disc, and he works harder than anyone I know. There must be millions of people with asthma and diabetes who go to work every day. Who gets to decide whether, say, back pain makes someone disabled?

As far as the federal government is concerned, you're disabled if you have a medical condition that makes it impossible to work. In practice, it's a judgment call made in doctors' offices and courtrooms around the country. The health problems where there is most latitude for judgment -- back pain, mental illness -- are among the fastest growing causes of disability.

by Chana Joffe-Walt, NPR | Read more:

Image: Brinson Banks for NPR

What Coke Contains

Each can originated in a small town of 4,000 people on the Murray River in Western Australia called Pinjarra. Pinjarra is the site of the world’s largest bauxite mine. Bauxite is surface mined — basically scraped and dug from the top of the ground. The bauxite is crushed and washed with hot sodium hydroxide, which separates it into aluminum hydroxide and waste material called red mud. The aluminum hydroxide is cooled, then heated to over a thousand degrees celsius in a kiln, where it becomes aluminum oxide, or alumina. The alumina is dissolved in a molten substance called cryolite, a rare mineral first discovered in Greenland, and turned into pure aluminum using electricity in a process called electrolysis. The pure aluminum sinks to the bottom of the molten cryolite, is drained off and placed in a mold. It cools into the shape of a long cylindrical bar. The bar is transported west again, to the Port of Bunbury, and loaded onto a container ship bound for — in the case of Coke for sale in Los Angeles — Long Beach.

The bar is transported to Downey, California, where it is rolled flat in a rolling mill, and turned into aluminum sheets. The sheets are punched into circles and shaped into a cup by a mechanical process called drawing and ironing — this not only makes the can but also thins the aluminum. The transition from flat circle to something that resembles a can takes about a fifth of a second. The outside of the can is decorated using a base layer of urethane acrylate, then up to seven layers of colored acrylic paint and varnish that is cured using ultra violet light, and the inside of the can is painted too — with a complex chemical called a comestible polymeric coating that prevents any of the aluminum getting into the soda. So far, this vast tool chain has only produced an empty, open can with no lid. The next step is to fill it.

Coca-Cola is made from a syrup produced by the Coca-Cola Company of Atlanta. The main ingredient in the formula used in the United States is a sweetener called high-fructose corn syrup 55, so named because it is 55 per cent fructose or “fruit sugar” and 42 per cent glucose or “simple sugar” — the same ratio of fructose to glucose as natural honey. HFCS is made by grinding wet corn until it becomes cornstarch. The cornstarch is mixed with an enzyme secreted by a rod-shaped bacterium called Bacillus and an enzyme secreted by a mold called Aspergillus. This process creates the glucose. A third enzyme, also derived from bacteria, is then used to turn some of the glucose into fructose.

The second ingredient, caramel coloring, gives the drink its distinctive dark brown color. There are four types of caramel coloring — Coca Cola uses type E150d, which is made by heating sugars with sulfite and ammonia to create bitter brown liquid. The syrup’s other principal ingredient is phosphoric acid, which adds acidity and is made by diluting burnt phosphorus (created by heating phosphate rock in an arc-furnace) and processing it to remove arsenic.

by Kevin Ashton, Medium | Read more:

Image: uncredited, h/t YMFY

Friday, March 22, 2013

The Circus of Fashion

We were once described as “black crows” — us fashion folk gathered outside an abandoned, crumbling downtown building in a uniform of Comme des Garçons or Yohji Yamamoto. “Whose funeral is it?” passers-by would whisper with a mix of hushed caring and ghoulish inquiry, as we lined up for the hip, underground presentations back in the 1990s.

Today, the people outside fashion shows are more like peacocks than crows. They pose and preen, in their multipatterned dresses, spidery legs balanced on club-sandwich platform shoes, or in thigh-high boots under sculptured coats blooming with flat flowers.

There is likely to be a public stir when a group of young Japanese women spot their idol on parade: the Italian clothes peg Anna Dello Russo. Tall, slim, with a toned and tanned body, the designer and fashion editor is a walking display for designer goods: The wider the belt, the shorter and puffier the skirt, the more outré the shoes, the better. The crowd around her tweets madly: Who is she wearing? Has she changed her outfit since the last show? When will she wear her own H&M collection? Who gave her those mile-high shoes?!

You can hardly get up the steps at Lincoln Center, in New York, or walk along the Tuileries Garden path in Paris because of all the photographers snapping at the poseurs. Cameras point as wildly at their prey as those original paparazzi in Fellini’s “La Dolce Vita.” But now subjects are ready and willing to be objects, not so much hunted down by the paparazzi as gagging for their attention.

by Suzy Menkes, NY Times | Read more:

Marcy Swingle/Gastrochic; Avenue Magazine; Kamel Lahmadi/Style and the CityPhotographers in the Tuileries in Paris.The Glass Arm

On a warm, windy day in Tampa, everyone—fans, coaches, other pitchers—stops what they’re doing to watch Brett Marshall throw. It’s just a warm-up, with no actual game action scheduled for a few more days, so he’s not really letting it fly, but he doesn’t have to. Everyone is still staring.

It’s not the velocity, although that’s there. It’s not the distinctive thump of the ball hitting the catcher’s mitt the way it does only for those blessed with such lightning arms. It’s how easy it looks. Each motion looks like the last motion, which looks like the last motion, which looks like the last motion. The fastball comes in at a consistent 94 mph, but it’s the changeup, widely considered his best pitch, that you have to keep an eye out for; the arm action is perfectly deceptive for being so repeatable. Marshall looks fluid and simple, like he could throw forever. To watch him pitch is to think that throwing a baseball is the most natural thing in the world. When he finishes, a group of fans standing on a walkway above burst into applause. He has simply been playing catch.

In the clubhouse afterward, Marshall is taking a sip of water and checking his iPhone with his non-throwing hand. He is 22 years old and seems unaware of the show he’s just put on. The display is over, just another workout session in a career full of them. Marshall has been in the Yankees organization for five seasons, and has climbed through the team’s minor-league ranks at the exact pace you’d want him to. He will likely spend this season in Triple-A Scranton, one stop from the bigs, where guaranteed contracts and the major-league-minimum salary of $490,000 a year, at the very least, await. If he puts up the kind of numbers scouts think he’s capable of—double-digit wins, with a 4.00 ERA, 175 innings a season, say—he could well earn $10 million a year or more. He’s on the verge of becoming a millionaire and playing for the New York Yankees in front of the entire world. And he knows it could all blow up in a second. “You just want your arm to hold up,” he says. “You have to not think about it. I do not, man. Not at all.”

There’s something strange about almost every snapshot ever taken of a professional baseball pitcher while he’s in his windup or his release: They look grotesque. A pitcher throwing, when you freeze the action mid-movement, does not look dramatically different from a basketball player spraining his ankle or a football player twisting his knee. His arm is almost hideously contorted.

“It is an unnatural motion,” says former Mets pitcher and current MLB Network analyst Al Leiter, who missed roughly three years of his career with arm injuries. “If it were natural, we would all be walking around with our hands above our heads. It’s not normal to throw a ball above your head.”

Ever since Moneyball, baseball has had just about everything figured it out. General managers know that on-base percentage is more important than batting average, that college players are more reliable draft targets than high-school players, that the sacrifice bunt is typically a waste of an out. The game has never been more closely studied or better understood. And yet, even now, no one seems to have a clue about how to keep pitchers from getting hurt.

Pitchers’ health has always been a vital part of the game, but it’s arguably never been more important than it is today. In the post-Bonds-McGwire-Sosa era (if not necessarily the post-PED era), pitching is dominant to a degree it hasn’t been in years. In the past three seasons, MLB teams scored an average of roughly 4.3 runs per game. The last time the average was anywhere near as low was 1992, at 4.12. In 2000, the heyday of Bonds & Co., it was 5.14. A team with great pitching is, in essence, a great team. Pitchers themselves have never stood to gain, or lose, as much as they do now. The last time scoring was this low, the average baseball salary had reached $1 million for the first time and the minimum salary was $109,000. Now that average salary is $3.2 million. Stay healthy, and you’re crazy-rich. Blow out your elbow, and it’s back to hoping your high-school team needs a coach.

And yet, for all the increased importance of pitching, pitchers are getting hurt more often than they used to. In 2011, according to research by FanGraphs.com, pitchers spent a total of 14,926 days on the disabled list. In 1999, that number was 13,129. No one is sure why this is happening, or what to do about it, but what is certain is that teams are trying desperately to divine answers to those questions. Figuring out which pitchers are least likely to get hurt and helping pitchers keep from getting hurt is the game’s next big mystery to solve, the next market inefficiency to be exploited. The modern baseball industry is brilliant at projecting what players will do on the field. The next task is solving the riddle of how to keep them on it.

It’s not the velocity, although that’s there. It’s not the distinctive thump of the ball hitting the catcher’s mitt the way it does only for those blessed with such lightning arms. It’s how easy it looks. Each motion looks like the last motion, which looks like the last motion, which looks like the last motion. The fastball comes in at a consistent 94 mph, but it’s the changeup, widely considered his best pitch, that you have to keep an eye out for; the arm action is perfectly deceptive for being so repeatable. Marshall looks fluid and simple, like he could throw forever. To watch him pitch is to think that throwing a baseball is the most natural thing in the world. When he finishes, a group of fans standing on a walkway above burst into applause. He has simply been playing catch.

In the clubhouse afterward, Marshall is taking a sip of water and checking his iPhone with his non-throwing hand. He is 22 years old and seems unaware of the show he’s just put on. The display is over, just another workout session in a career full of them. Marshall has been in the Yankees organization for five seasons, and has climbed through the team’s minor-league ranks at the exact pace you’d want him to. He will likely spend this season in Triple-A Scranton, one stop from the bigs, where guaranteed contracts and the major-league-minimum salary of $490,000 a year, at the very least, await. If he puts up the kind of numbers scouts think he’s capable of—double-digit wins, with a 4.00 ERA, 175 innings a season, say—he could well earn $10 million a year or more. He’s on the verge of becoming a millionaire and playing for the New York Yankees in front of the entire world. And he knows it could all blow up in a second. “You just want your arm to hold up,” he says. “You have to not think about it. I do not, man. Not at all.”

There’s something strange about almost every snapshot ever taken of a professional baseball pitcher while he’s in his windup or his release: They look grotesque. A pitcher throwing, when you freeze the action mid-movement, does not look dramatically different from a basketball player spraining his ankle or a football player twisting his knee. His arm is almost hideously contorted.

“It is an unnatural motion,” says former Mets pitcher and current MLB Network analyst Al Leiter, who missed roughly three years of his career with arm injuries. “If it were natural, we would all be walking around with our hands above our heads. It’s not normal to throw a ball above your head.”

Ever since Moneyball, baseball has had just about everything figured it out. General managers know that on-base percentage is more important than batting average, that college players are more reliable draft targets than high-school players, that the sacrifice bunt is typically a waste of an out. The game has never been more closely studied or better understood. And yet, even now, no one seems to have a clue about how to keep pitchers from getting hurt.

Pitchers’ health has always been a vital part of the game, but it’s arguably never been more important than it is today. In the post-Bonds-McGwire-Sosa era (if not necessarily the post-PED era), pitching is dominant to a degree it hasn’t been in years. In the past three seasons, MLB teams scored an average of roughly 4.3 runs per game. The last time the average was anywhere near as low was 1992, at 4.12. In 2000, the heyday of Bonds & Co., it was 5.14. A team with great pitching is, in essence, a great team. Pitchers themselves have never stood to gain, or lose, as much as they do now. The last time scoring was this low, the average baseball salary had reached $1 million for the first time and the minimum salary was $109,000. Now that average salary is $3.2 million. Stay healthy, and you’re crazy-rich. Blow out your elbow, and it’s back to hoping your high-school team needs a coach.

And yet, for all the increased importance of pitching, pitchers are getting hurt more often than they used to. In 2011, according to research by FanGraphs.com, pitchers spent a total of 14,926 days on the disabled list. In 1999, that number was 13,129. No one is sure why this is happening, or what to do about it, but what is certain is that teams are trying desperately to divine answers to those questions. Figuring out which pitchers are least likely to get hurt and helping pitchers keep from getting hurt is the game’s next big mystery to solve, the next market inefficiency to be exploited. The modern baseball industry is brilliant at projecting what players will do on the field. The next task is solving the riddle of how to keep them on it.

by Will Leitch, NY Magazine | Read more:

Photo: Pari DukovicThursday, March 21, 2013

Lockheed Martin's Herculean Efforts

When I was a kid obsessed with military aircraft, I loved Chicago's O'Hare airport. If I was lucky and scored a window seat, I might get to see a line of C-130 Hercules transport planes parked on the tarmac in front of the 928th Airlift Wing's hangars. For a precious moment on takeoff or landing, I would have a chance to stare at those giant gray beasts with their snub noses and huge propellers until they passed from sight.

When I was a kid obsessed with military aircraft, I loved Chicago's O'Hare airport. If I was lucky and scored a window seat, I might get to see a line of C-130 Hercules transport planes parked on the tarmac in front of the 928th Airlift Wing's hangars. For a precious moment on takeoff or landing, I would have a chance to stare at those giant gray beasts with their snub noses and huge propellers until they passed from sight.What I didn't know then was why the Air Force Reserve, as well as the Air National Guard, had squadrons of these big planes eternally parked at O'Hare and many other airports and air stations around the country. It’s a tale made to order for this time of sequestration that makes a mockery of all the hyperbole about how any spending cuts will "hollow out" our forces and "devastate" our national security.

Consider this a parable to help us see past the alarmist talking points issued by defense contractor lobbyists, the public relations teams they hire, and the think tanks they fund. It may help us see just how effective defense contractors are in growing their businesses, whatever the mood of the moment.

Meet the Herk

The C-130 Hercules is a mid-sized transport airplane designed to airlift people or cargo around a theater of operations. It dates back to the Korean War, when the Air Force decided that it needed a next generation ("NextGen") transport plane. In 1951, it asked for designs, and Lockheed won the competition. The first C-130s were delivered three years after the war ended.

The C-130 Hercules, or Herk for short, isn't a sexy plane. It hasn't inspired hit Hollywood films, though it has prompted a few photo books, a beer, and a "Robby the C-130" trilogy for children whose military parents are deployed. It has a fat sausage fuselage, that snub nose, overhead wings with two propellers each, and a big back gate that comes down to load and unload up to 21 tons of cargo.

The Herk can land on short runways, even ones made of dirt or grass; it can airdrop parachutists or cargo; it can carry four drones under its wings; it can refuel aircraft; it can fight forest fires; it can morph into a frightening gunship. It's big and strong and can do at least 12 types of labor -- hence, Hercules.

Too Much of a Good Thing

Here's where the story starts to get interesting. After 25 years, the Pentagon decided that it was well stocked with C-130s, so President Jimmy Carter’s administration stopped asking Congress for more of them.

Lockheed was in trouble. A few years earlier, the Air Force had started looking into replacing the Hercules with a new medium-sized transport plane that could handle really short runways, and Lockheed wasn't selected as one of the finalists. Facing bankruptcy due to cost overruns and cancellations of programs, the company squeezed Uncle Sam for a bailout of around $1 billion in loan guarantees and other relief (which was unusual back then, as William Hartung points out his magisterial Prophets of War: Lockheed Martin and the Making of the Military-Industrial Complex).

Then a scandal exploded when it was revealed that Lockheed had proceeded to spend some $22 million of those funds in bribes to foreign officials to persuade them to buy its aircraft. This helped prompt Congress to pass the Foreign Corrupt Practices Act.

So what did Lockheed do about the fate of the C-130? It bypassed the Pentagon and went straight to Congress. Using a procedure known as a congressional "add-on" -- that is, an earmark -- Lockheed was able to sell the military another fleet of C-130s that it didn’t want.

To be fair, the Air Force did request some C-130s. Thanks to Senator John McCain, the Government Accountability Office (GAO) did a study of how many more C-130s the Air Force requested between 1978 and 1998. The answer: Five.

How many did Congress add on? Two hundred and fifty-six.

As Hartung commented, this must “surely [be] a record in pork-barrel politics.”

by Jeremiah Goulka, TomDispatch | Read more:

Image via: Flightglobal

One of Us

That is technical language, but it speaks to a riddle age-old and instinctive. These thoughts begin, for most of us, typically, in childhood, when we are making eye contact with a pet or wild animal. I go back to our first family dog, a preternaturally intelligent-seeming Labrador mix, the kind of dog who herds playing children away from the street at birthday parties, an animal who could sense if you were down and would nuzzle against you for hours, as if actually sharing your pain. I can still hear people, guests and relatives, talking about how smart she was. “Smarter than some people I know!” But when you looked into her eyes—mahogany discs set back in the grizzled black of her face—what was there? I remember the question forming in my mind: can she think? The way my own brain felt to me, the sensation of existing inside a consciousness, was it like that in there?

For most of the history of our species, we seem to have assumed it was. Trying to recapture the thought life of prehistoric peoples is a game wise heads tend to leave alone, but if there’s a consistent motif in the artwork made between four thousand and forty thousand years ago, it’s animal-human hybrids, drawings and carvings and statuettes showing part man or woman and part something else—lion or bird or bear. Animals knew things, possessed their forms of wisdom. They were beings in a world of countless beings. Taking their lives was a meaningful act, to be prayed for beforehand and atoned for afterward, suggesting that beasts were allowed some kind of right. We used our power over them constantly and violently, but stopped short of telling ourselves that creatures of alien biology could not be sentient or that they were incapable oftrue suffering and pleasure. Needing their bodies, we killed them in spite of those things.

Only with the Greeks does there enter the notion of a formal divide between our species, our animal, and every other on earth. Today in Greece you can walk by a field and hear two farmers talking about an alogo, a horse. An a-logos. No logos, no language. That’s where one of their words for horse comes from. The animal has no speech; it has no reason. It has no reason because it has no speech. Plato and Aristotle were clear on that. Admire animals aesthetically, perhaps, or sentimentally; otherwise they’re here to be used. Mute equaled brute. As time went by, the word for speech became the very word for rationality, the logos, an identification taken up by the early Christians, with fateful results. For them the matter was even simpler. The animals lack souls. They are all animal, whereas we are part divine.

by John Jeremiah Sullivan, Lapham's Quarterly | Read more:

Image: Anguish (1880), by August Friedrich SchenckSee No Evil: The Case of Alfred Anaya

Anaya’s customers typically took advantage of this deal when their fiendishly loud subwoofers blew out or their fiberglass speaker boxes developed hairline cracks. But in late January 2009, a man whom Anaya knew only as Esteban called for help with a more exotic product: a hidden compartment that Anaya had installed in his Ford F-150 pickup truck. Over the years, these secret stash spots—or traps, as they’re known in automotive slang—have become a popular luxury item among the wealthy and shady alike. This particular compartment was located behind the truck’s backseat, which Anaya had rigged with a set of hydraulic cylinders linked to the vehicle’s electrical system. The only way to make the seat slide forward and reveal its secret was by pressing and holding four switches simultaneously: two for the power door locks and two for the windows. (...)

The forefather of modern trap making was a French mechanic who went by the name of Claude Marceau (possibly a pseudonym). According to a 1973 Justice Department report, Marceau personally welded 160 pounds of heroin into the frame of a Lancia limousine that was shipped to the US in 1970—a key triumph for the fabled French Connection, the international smuggling ring immortalized in film.

Traps like Marceau’s may be difficult to detect, but they require significant time and expertise to operate. The only way to load and unload one of these “dumb” compartments is by taking a car apart, piece by piece. That makes economic sense for multinational organizations like the French Connection, which infrequently transport massive amounts of narcotics between continents. But domestic traffickers, who must ferry small shipments between cities on a regular basis, can’t sacrifice an entire car every time they make a delivery. They need to be able to store and retrieve their contraband with ease and then reuse the vehicles again and again.

Early drug traffickers stashed their loads in obvious places: wheel wells, spare tires, the nooks of engine blocks. Starting in the early 1980s, however, they switched to what the Drug Enforcement Administration refers to as “urban traps”: medium-size compartments concealed behind electronically controlled facades. The first such stash spots were usually located in the doors of luxury sedans; trap makers, who are often moonlighting auto body specialists, would slice out the door panels and then attach them to the motors that raised and lowered the windows. They soon moved on to building traps in dashboards, seats, and roofs, with button-operated doors secured by magnetic locks. Over time, the magnets gave way to hydraulic cylinders, which made the doors harder to dislodge during police inspections.

By the early 1990s, however, drug traffickers had discovered that these compartments had two major design flaws. The first was that the buttons and switches that controlled the traps’ doors were aftermarket additions to the cars. This made them too easy to locate—police were being trained to look for any widgets that hadn’t been installed on the assembly line.

Second, opening the traps was no great challenge once a cop identified the appropriate button: The compartment’s door would respond to a single press. Sometimes the police would even open traps by accident; a knee or elbow would brush against a button during a vigorous search, and a brick of cocaine would appear as if by magic.

Trap makers responded to the traffickers’ complaints by tapping into the internal electrical systems of cars. They began to connect their compartments to those systems with relays, electromagnetic switches that enable low-power circuits to control higher-power circuits. (Relays are the reason, for example, that the small act of turning an ignition key can start a whole engine.) Some relays won’t let current flow through until several input circuits have been completed—in other words, until several separate actions have been performed. By wiring these switches into cars, trap makers could build compartments that were operated not by aftermarket buttons but by a car’s own factory-installed controls.

by Brendan I. Koerner, Wired | Read more:

Illustration: Paul PopeWhen TED Lost Control of Its Crowd

“Wow. Such f---ing bullsh-t.”

No, this is not a snippet from the latest Quentin Tarantino film. It’s Stanford professor Jay Wacker responding, on the Q&A site Quora, to the now-infamous TEDx talk “Vortex-Based Mathematics.”

No, this is not a snippet from the latest Quentin Tarantino film. It’s Stanford professor Jay Wacker responding, on the Q&A site Quora, to the now-infamous TEDx talk “Vortex-Based Mathematics.”A member had posed the question “Is Randy Powell saying anything in his 2010 TEDxCharlotte talk, or is it just total nonsense?” Wacker, a particle physicist, was unambiguous: “I am a theoretical physicist who uses (and teaches) the technical meaning of many of the jargon terms that he’s throwing out. And he is simply doing a random word association with the terms. Basically, he’s either (1) insane, (2) a huckster going for fame or money, or (3) doing a Sokal’s hoax on TED. I’d bet equal parts 1 & 2.”

Powell’s talk had been given in September 2010, at what was one of numerous local TEDx gatherings spun off by TED, a nonprofit that puts on highly respected global conferences about ideas. But the talk went relatively unnoticed until the spring of 2012, when a few influential science bloggers discovered it—and excoriated it. One dared his readers to see how much of the talk they could get through before they had to be “loaded into an ambulance with an aneurysm.” Another simply described it as “sweet merciful crap.” By August the uproar had gone mainstream, as other questionable TEDx content was uncovered. The New Republic wrote, “TED is no longer a responsible curator of ideas ‘worth spreading.’ Instead it has become something ludicrous.” As others piled on, TED staffers called Powell and asked him to send the research backing up his claims. He never did.

The TEDxCharlotte talk, which had received tremendous applause when delivered, was one of thousands produced annually by an extended community of people who neither get paid by nor officially work for TED but who are nonetheless capable of damaging its brand.

When it was founded, in 1984, TED (which stands for “Technology, Entertainment, and Design”) brought together a few hundred people in a single annual conference in California. Today, TED is not just an organizer of private conferences; it’s a global phenomenon with $45 million in revenues. In 2006 the nonprofit decided to make all its talks available free on the internet. (They are now also translated—by volunteers—into more than 90 languages.) Three years later it decided to further democratize the idea-spreading process by letting licensees use its technology and brand platform. This would allow anyone, anywhere, to manage and stage local, independent TEDx events. Licenses are free, but event organizers must apply for them and submit to light vetting. Since 2009 some 5,000 events have been held around the world. (Disclosure: I spoke at the main TED event in February this year.) (...)

Crowds will organize themselves far faster than you could manage, which is great when they’re holding events for you around the world—like TEDxKibera and TEDxAntarcticPeninsula—but not so great when they’re setting up ones that feature “experts” in pseudoscience topics like “plasmatics,” crystal healing, and Egyptian psychoaromatherapy, all of which were presented at TEDxValenciaWomen in December 2012. That conference was described by one disappointed viewer as “a mockery...that hurt, in this order, TED, Valencia, women, science, and common sense.” Within 24 hours commentators on Reddit had picked up the charge; by the next day more than 5,000 people had weighed in on Reddit, Twitter, or other social channels.

Two months earlier, in October 2012, TED had removed Randy Powell’s “Vortex-Based Mathematics” video and had begun to respond to public concerns about that particular talk on a few influential websites like Quora. But those small steps did not address the fundamental problem: The TED name had become associated with bad content, as the chortle-inducing lineup of TEDxValenciaWomen made clear. People who didn’t even know the specifics of those situations but had grown to dislike what TED represented used the occasion to trash the brand—both for its perceived elitism and, somewhat paradoxically, for dumbing down ideas. An angry mob was forming. The dialogue was mean. And, organizationally, it was life threatening because the very premise of TED was being questioned.

by Nilofer Merchant, HBR | Read more:

Artwork: Jacob Hashimoto, Forests Collapsed Upon Forests, 2009, acrylic, paper, thread, bamboo, wood, Martha Otero Gallery, Los Angeles. Photo: Curtis Steinback

We Really Don't Own Our Stuff Anymore

We live in a digital age, and even the physical goods we buy are complex. Copyright is impacting more people than ever before because the line between hardware and software, physical and digital has blurred.

The issue goes beyond cellphone unlocking, because once we buy an object — any object — we should own it. We should be able to lift the hood, unlock it, modify it, repair it … without asking for permission from the manufacturer.

But we really don’t own our stuff anymore (at least not fully); the manufacturers do. Because modifying modern objects requires access to information: code, service manuals, error codes, and diagnostic tools. Modern cars are part horsepower, part high-powered computer. Microwave ovens are a combination of plastic and microcode. Silicon permeates and powers almost everything we own.

This is a property rights issue, and current copyright law gets it backwards, turning regular people — like students, researchers, and small business owners — into criminals. Fortune 500 telecom manufacturer Avaya, for example, is known for suing service companies, accusing them of violating copyright for simply using a password to log in to their phone systems. That’s right: typing in a password is considered “reproducing copyrighted material.”

Manufacturers have systematically used copyright in this manner over the past 20 years to limit our access to information. Technology has moved too fast for copyright laws to keep pace, so corporations have been exploiting the lag to create information monopolies at our expense and for their profit. After years of extensions and so-called improvements, copyright has turned Mickey Mouse into a monster who can never die.

It hasn’t always been that way. Copyright laws were originally designed to protect creativity and promote innovation. But now, they are doing exactly the opposite: They’re being used to keep independent shops from fixing new cars. They’re making it almost impossible for farmers to maintain their equipment. And, as we’ve seen in the past few weeks, they’re preventing regular people from unlocking their own cellphones.

This isn’t an issue that only affects the digerati; farmers are bearing the brunt as well. Kerry Adams, a family farmer in Santa Maria, California, recently bought two transplanter machines for north of $100,000 apiece. They broke down soon afterward, and he had to fly a factory technician out to fix them.

Because manufacturers have copyrighted the service manuals, local mechanics can’t fix modern equipment. And today’s equipment — packed with sensors and electronics — is too complex to repair without them. That’s a problem for farmers, who can’t afford to pay the dealer’s high maintenance fees for fickle equipment.

Adams gave up on getting his transplanters fixed; it was just too expensive to keep flying technicians out to his farm. Now, the two transplanters sit idle, and he can’t use them to support his farm and his family.

This isn’t an issue that only affects the digerati.

God may have made a farmer, but copyright law doesn’t let him make a living.

by Kyle Wiens, Wired | Read more:

Image: Hugh MacLeod / gapingvoid ltdBecoming the All-Terrain Human

Kilian Jornet Burgada is the most dominating endurance athlete of his generation. In just eight years, Jornet has won more than 80 races, claimed some 16 titles and set at least a dozen speed records, many of them in distances that would require the rest of us to purchase an airplane ticket. He has run across entire landmasses (Corsica) and mountain ranges (the Pyrenees), nearly without pause. He regularly runs all day eating only wild berries and drinking only from streams. On summer mornings he will set off from his apartment door at the foot of Mont Blanc and run nearly two and a half vertical miles up to Europe’s roof — over cracked glaciers, past Gore-Tex’d climbers, into the thin air at 15,781 feet — and back home again in less than seven hours, a trip that mountaineers can spend days to complete. A few years ago Jornet ran the 165-mile Tahoe Rim Trail and stopped just twice to sleep on the ground for a total of about 90 minutes. In the middle of the night he took a wrong turn, which added perhaps six miles to his run. He still finished in 38 hours 32 minutes, beating the record of Tim Twietmeyer, a legend in the world of ultrarunning, by more than seven hours. When he reached the finish line, he looked as if he’d just won the local turkey trot.

Come winter, when most elite ultrarunners keep running, Jornet puts away his trail-running shoes for six months and takes up ski-mountaineering racing, which basically amounts to running up and around large mountains on alpine skis. In this sport too, Jornet reigns supreme: he has been the overall World Cup champion three of the last four winters. (...)

Jornet has won dozens of mountain footraces up to 100 miles in length and six world titles in Skyrunning, a series of races of varying distances held on billy-goat terrain. “Other Top 5 or 10 ultramarathoners can show up for a race, and he’ll just be jogging along, biding his time, enjoying their company until it’s time to go,” Bryon Powell, the editor in chief of the Web site iRunFar.com, told me. In the longest races, which can last 24 hours, he’s been known to best the competition by an hour or more. Lauri van Houten, executive director of the International Skyrunning Federation, calls Jornet “God on earth.” (...)

Even among top athletes, Jornet is an outlier. Take his VO2 max, a measure of a person’s ability to consume oxygen and a factor in determining aerobic endurance. An average male’s VO2 max is 45 to 55 ml/kg/min. A college-level 10,000-meter runner’s max is typically 60 to 70. Jornet’s VO2 max is 89.5 — one of the highest recorded, according to Daniel Brotons Cuixart, a sports specialist at the University of Barcelona who tested Jornet last fall. Jornet simply has more men in the engine room, shoveling coal. “I’ve not seen any athletes higher than the low 80s, and we’ve tested some elite athletes,” says Edward Coyle, director of the Human Performance Laboratory at the University of Texas at Austin, who has studied the limits of human exercise performance for three decades.

Come winter, when most elite ultrarunners keep running, Jornet puts away his trail-running shoes for six months and takes up ski-mountaineering racing, which basically amounts to running up and around large mountains on alpine skis. In this sport too, Jornet reigns supreme: he has been the overall World Cup champion three of the last four winters. (...)

Jornet has won dozens of mountain footraces up to 100 miles in length and six world titles in Skyrunning, a series of races of varying distances held on billy-goat terrain. “Other Top 5 or 10 ultramarathoners can show up for a race, and he’ll just be jogging along, biding his time, enjoying their company until it’s time to go,” Bryon Powell, the editor in chief of the Web site iRunFar.com, told me. In the longest races, which can last 24 hours, he’s been known to best the competition by an hour or more. Lauri van Houten, executive director of the International Skyrunning Federation, calls Jornet “God on earth.” (...)

Even among top athletes, Jornet is an outlier. Take his VO2 max, a measure of a person’s ability to consume oxygen and a factor in determining aerobic endurance. An average male’s VO2 max is 45 to 55 ml/kg/min. A college-level 10,000-meter runner’s max is typically 60 to 70. Jornet’s VO2 max is 89.5 — one of the highest recorded, according to Daniel Brotons Cuixart, a sports specialist at the University of Barcelona who tested Jornet last fall. Jornet simply has more men in the engine room, shoveling coal. “I’ve not seen any athletes higher than the low 80s, and we’ve tested some elite athletes,” says Edward Coyle, director of the Human Performance Laboratory at the University of Texas at Austin, who has studied the limits of human exercise performance for three decades.

by Christopher Soloman, NY Times | Read more:

Photo: Levon Biss for The New York TimesWednesday, March 20, 2013

Desalinization with Less Energy

A defense contractor better known for building jet fighters and lethal missiles says it has found a way to slash the amount of energy needed to remove salt from seawater, potentially making it vastly cheaper to produce clean water at a time when scarcity has become a global security issue.

The process, officials and engineers at Lockheed Martin Corp say, would enable filter manufacturers to produce thin carbon membranes with regular holes about a nanometer in size that are large enough to allow water to pass through but small enough to block the molecules of salt in seawater. A nanometer is a billionth of a meter.

Because the sheets of pure carbon known as graphene are so thin - just one atom in thickness - it takes much less energy to push the seawater through the filter with the force required to separate the salt from the water, they said.

The development could spare underdeveloped countries from having to build exotic, expensive pumping stations needed in plants that use a desalination process called reverse osmosis.

"It's 500 times thinner than the best filter on the market today and a thousand times stronger," said John Stetson, the engineer who has been working on the idea. "The energy that's required and the pressure that's required to filter salt is approximately 100 times less." (...)

Stetson, who began working on the issue in 2007, said if the new filter material, known as Perforene, was compared to the thickness of a piece of paper, the nearest comparable filter for extracting salt from seawater would be the thickness of three reams of paper - more than half a foot thick.

"It looks like chicken wire under a microscope, if you could get an electron microscope picture of it," he said. "It's all little carbon atoms tied together in a diaphanous, smooth film that's beautiful and continuous. But it's one atom thick and it's a thousand time stronger than steel."

The process, officials and engineers at Lockheed Martin Corp say, would enable filter manufacturers to produce thin carbon membranes with regular holes about a nanometer in size that are large enough to allow water to pass through but small enough to block the molecules of salt in seawater. A nanometer is a billionth of a meter.

Because the sheets of pure carbon known as graphene are so thin - just one atom in thickness - it takes much less energy to push the seawater through the filter with the force required to separate the salt from the water, they said.

The development could spare underdeveloped countries from having to build exotic, expensive pumping stations needed in plants that use a desalination process called reverse osmosis.

"It's 500 times thinner than the best filter on the market today and a thousand times stronger," said John Stetson, the engineer who has been working on the idea. "The energy that's required and the pressure that's required to filter salt is approximately 100 times less." (...)

Stetson, who began working on the issue in 2007, said if the new filter material, known as Perforene, was compared to the thickness of a piece of paper, the nearest comparable filter for extracting salt from seawater would be the thickness of three reams of paper - more than half a foot thick.

"It looks like chicken wire under a microscope, if you could get an electron microscope picture of it," he said. "It's all little carbon atoms tied together in a diaphanous, smooth film that's beautiful and continuous. But it's one atom thick and it's a thousand time stronger than steel."

by David Alexander, Reuters | Read more: