Thursday, October 13, 2011

Bionic Contacts

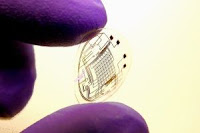

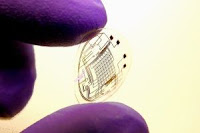

Movie characters from the Terminator to the Bionic Woman use bionic eyes to zoom in on far-off scenes, have useful facts pop into their field of view, or create virtual crosshairs. Off the screen, virtual displays have been proposed for more practical purposes-visual aids to help vision-impaired people, holographic driving control panels and even as a way to surf the Web on the go.

The device to make this happen may be familiar. Engineers at the University of Washington have for the first time used manufacturing techniques at microscopic scales to combine a flexible, biologically safe contact lens with an imprinted electronic circuit and lights.

The device to make this happen may be familiar. Engineers at the University of Washington have for the first time used manufacturing techniques at microscopic scales to combine a flexible, biologically safe contact lens with an imprinted electronic circuit and lights.

"Looking through a completed lens, you would see what the display is generating superimposed on the world outside," said Babak Parviz, a UW assistant professor of electrical engineering. "This is a very small step toward that goal, but I think it's extremely promising." The results were presented in January at the Institute of Electrical and Electronics Engineers' international conference on Micro Electro Mechanical Systems by Harvey Ho, a former graduate student of Parviz's now working at Sandia National Laboratories in Livermore, Calif. Other co-authors are Ehsan Saeedi and Samuel Kim in the UW's electrical engineering department and Tueng Shen in the UW Medical Center's ophthalmology department.

There are many possible uses for virtual displays. Drivers or pilots could see a vehicle's speed projected onto the windshield. Video-game companies could use the contact lenses to completely immerse players in a virtual world without restricting their range of motion. And for communications, people on the go could surf the Internet on a midair virtual display screen that only they would be able to see.

"People may find all sorts of applications for it that we have not thought about. Our goal is to demonstrate the basic technology and make sure it works and that it's safe," said Parviz, who heads a multi-disciplinary UW group that is developing electronics for contact lenses.

The prototype device contains an electric circuit as well as red light-emitting diodes for a display, though it does not yet light up. The lenses were tested on rabbits for up to 20 minutes and the animals showed no adverse effects.

Ideally, installing or removing the bionic eye would be as easy as popping a contact lens in or out, and once installed the wearer would barely know the gadget was there, Parviz said.

Read more:

The device to make this happen may be familiar. Engineers at the University of Washington have for the first time used manufacturing techniques at microscopic scales to combine a flexible, biologically safe contact lens with an imprinted electronic circuit and lights.

The device to make this happen may be familiar. Engineers at the University of Washington have for the first time used manufacturing techniques at microscopic scales to combine a flexible, biologically safe contact lens with an imprinted electronic circuit and lights. "Looking through a completed lens, you would see what the display is generating superimposed on the world outside," said Babak Parviz, a UW assistant professor of electrical engineering. "This is a very small step toward that goal, but I think it's extremely promising." The results were presented in January at the Institute of Electrical and Electronics Engineers' international conference on Micro Electro Mechanical Systems by Harvey Ho, a former graduate student of Parviz's now working at Sandia National Laboratories in Livermore, Calif. Other co-authors are Ehsan Saeedi and Samuel Kim in the UW's electrical engineering department and Tueng Shen in the UW Medical Center's ophthalmology department.

There are many possible uses for virtual displays. Drivers or pilots could see a vehicle's speed projected onto the windshield. Video-game companies could use the contact lenses to completely immerse players in a virtual world without restricting their range of motion. And for communications, people on the go could surf the Internet on a midair virtual display screen that only they would be able to see.

"People may find all sorts of applications for it that we have not thought about. Our goal is to demonstrate the basic technology and make sure it works and that it's safe," said Parviz, who heads a multi-disciplinary UW group that is developing electronics for contact lenses.

The prototype device contains an electric circuit as well as red light-emitting diodes for a display, though it does not yet light up. The lenses were tested on rabbits for up to 20 minutes and the animals showed no adverse effects.

Ideally, installing or removing the bionic eye would be as easy as popping a contact lens in or out, and once installed the wearer would barely know the gadget was there, Parviz said.

Read more:

Rachael Yamagata

Breakup songs aren't supposed to be exuberant, particularly when they're conflicted, but tell that to Rachael Yamagata. In "Even If I Don't," the velvet-voiced singer crafts a tune that's as bittersweet as it is buoyant; it's a perfect paean to the pain inherent in both staying in an unhealthy relationship and letting go. More than anything, it's a postcard to lost potential — a postscript to an ideal that lingers even after reality rears its head.

The result is a refreshing change of pace from black-or-white, love-or-hate breakup songs; a song for those who've survived nasty broken relationships, only to harbor fond memories of better days. If nothing else, Yamagata's refreshingly mature refrain — "Even if I don't, I wanted to" — contains some of the kindest, bravest, most honest words to pop up in a song in a long time.

Lyrics

via: NPR

Wednesday, October 12, 2011

A Critic Selects a Last Meal - Per Se

[ed. NY Times food critic Sam Sifton's last review on the "best restaurant in New York City": Per Se.]

by Sam Sifton

The appetizer is not food so much as a poem about creaminess, a meditation on brine, a sculpture about the delicious. It is a complete introduction to the restaurant and its pleasures.

But perhaps foie gras is more to your liking? At one dinner at Per Se, I had a torchon of moulard duck foie gras from Élevages Périgord in Quebec, served with a crystallized apple chip, some celery-branch batons (taken to 11 on the flavor scale by some compression and sous-vide cooking), Granny Smith apple marmalade, candied walnuts, frisée and juniper-balsamic vinegar. I spread it thickly on brioche toast that a server kept replacing every few minutes, since (he said) it should never be eaten cool. (This is true, as it happens: the bread grows heavy and stiff.) I ate it silently, as one can do only with friends and family, savoring the experience as I might have a massage or a sunset.

Such excitements have a real effect on who ought to go to Per Se and why. The restaurant is not a place to book for a business meal. Nor is it a restaurant for those who do not eat well together. A meal at Per Se can stretch to four to five hours — a long time to sit with anyone, even a client with whom you are trying to close a multimillion-dollar deal. The restaurant more handsomely rewards the companionship of those who love one another as much as they do pleasure and indulgence.

Nor is Per Se a restaurant for those who do not understand that such pleasure comes at a cost. The menu has a set price of $295 a person, excluding wine. Nine or more courses are prepared, along with canapés to start and mignardises to finish. A conversation with a sommelier can easily double the cost of the buy-in. Dinner for two can scratch at $1,000 — or about the same as the median weekly household income in New York State.

By point of context, though, an aisle orchestra seat at the Metropolitan Opera for Donizetti’s “L’Elisir d’Amore” runs $330, also excluding wine.

Read more:

photos: Daniel Krieger for The New York Times

by Sam Sifton

***

Per Se’s signature starter course is Oysters and Pearls, a dish Mr. Keller developed at French Laundry and brought with him when he moved East. It combines a sabayon of pearl tapioca with Island Creek oysters (small, marble-shaped, from Duxbury, south of Boston, fantastic) and a fat clump of sturgeon caviar from Northern California. These arrive in a bowl of the finest porcelain from Limoges. Paired with a glass of golden sémillon from Elderton, they make a fine argument for the metaphor of transubstantiation. The appetizer is not food so much as a poem about creaminess, a meditation on brine, a sculpture about the delicious. It is a complete introduction to the restaurant and its pleasures.

But perhaps foie gras is more to your liking? At one dinner at Per Se, I had a torchon of moulard duck foie gras from Élevages Périgord in Quebec, served with a crystallized apple chip, some celery-branch batons (taken to 11 on the flavor scale by some compression and sous-vide cooking), Granny Smith apple marmalade, candied walnuts, frisée and juniper-balsamic vinegar. I spread it thickly on brioche toast that a server kept replacing every few minutes, since (he said) it should never be eaten cool. (This is true, as it happens: the bread grows heavy and stiff.) I ate it silently, as one can do only with friends and family, savoring the experience as I might have a massage or a sunset.

Such excitements have a real effect on who ought to go to Per Se and why. The restaurant is not a place to book for a business meal. Nor is it a restaurant for those who do not eat well together. A meal at Per Se can stretch to four to five hours — a long time to sit with anyone, even a client with whom you are trying to close a multimillion-dollar deal. The restaurant more handsomely rewards the companionship of those who love one another as much as they do pleasure and indulgence.

Nor is Per Se a restaurant for those who do not understand that such pleasure comes at a cost. The menu has a set price of $295 a person, excluding wine. Nine or more courses are prepared, along with canapés to start and mignardises to finish. A conversation with a sommelier can easily double the cost of the buy-in. Dinner for two can scratch at $1,000 — or about the same as the median weekly household income in New York State.

By point of context, though, an aisle orchestra seat at the Metropolitan Opera for Donizetti’s “L’Elisir d’Amore” runs $330, also excluding wine.

Read more:

photos: Daniel Krieger for The New York Times

Equation: Radiocarbon Dating

by Julie Rehmeyer

Right now, 40,000 feet overhead, a cosmic ray is sending a neutron smashing into a nitrogen atom, smacking a proton out of its nucleus and forming an isotope called carbon-14. Armed with the equation below, archaeologists use these atoms to pinpoint how old the Dead Sea Scrolls are, or the drawings in Chauvet Cave, or Ötzi the Iceman.

Right now, 40,000 feet overhead, a cosmic ray is sending a neutron smashing into a nitrogen atom, smacking a proton out of its nucleus and forming an isotope called carbon-14. Armed with the equation below, archaeologists use these atoms to pinpoint how old the Dead Sea Scrolls are, or the drawings in Chauvet Cave, or Ötzi the Iceman.

Living things constantly consume carbon—through photosynthesis, for plants, and for animals, ingestion of those plants. The atmospheric ratio of carbon-14 to regular carbon-12 remains consistent at one part per trillion, so if something is alive, one-trillionth of its carbon atoms will be C-14. But once a plant or animal dies, its carbon-14 is no longer replenished. C-14 is radioactive and unstable, with a half-life of 5,730 years, which means that half the atoms will turn back into nitrogen over that period. That rate of decay is key to gauging age.

Read more:

Illustration: Mario Hugo

Right now, 40,000 feet overhead, a cosmic ray is sending a neutron smashing into a nitrogen atom, smacking a proton out of its nucleus and forming an isotope called carbon-14. Armed with the equation below, archaeologists use these atoms to pinpoint how old the Dead Sea Scrolls are, or the drawings in Chauvet Cave, or Ötzi the Iceman.

Right now, 40,000 feet overhead, a cosmic ray is sending a neutron smashing into a nitrogen atom, smacking a proton out of its nucleus and forming an isotope called carbon-14. Armed with the equation below, archaeologists use these atoms to pinpoint how old the Dead Sea Scrolls are, or the drawings in Chauvet Cave, or Ötzi the Iceman.Living things constantly consume carbon—through photosynthesis, for plants, and for animals, ingestion of those plants. The atmospheric ratio of carbon-14 to regular carbon-12 remains consistent at one part per trillion, so if something is alive, one-trillionth of its carbon atoms will be C-14. But once a plant or animal dies, its carbon-14 is no longer replenished. C-14 is radioactive and unstable, with a half-life of 5,730 years, which means that half the atoms will turn back into nitrogen over that period. That rate of decay is key to gauging age.

Read more:

Illustration: Mario Hugo

The Next Big Bank Bailout

[ed. Lots of bank and business news these days on Wall Street protests, increased debit card fees, European bail-out maneuvers, and lobbying efforts to repatriate massive offshore tax shelter profits at reduced tax rates. Then there's this, which has been flying under the radar for the last few weeks.]

by Matt Taibbi

Amidst all the bad news coming out of Wall Street and the economy, here’s something good: California has backed out of the talks for the long-awaited foreclosure settlement, now making it far from likely that the so-called “Attorneys General” deal will happen anytime soon.

California Attorney General Kamala Harris sent a letter to state and federal regulators explaining that she pulled out because the proposed settlement amount for banks guilty of bad securitization practices leading up to the mortgage crisis – said to be in the $20 billion range – was too small. From Business Week:

If it does get done, expect a great deal of public debate over whether or not the size of the settlement was sufficient. Did the banks pay enough? Should they have paid ten billion more? Twenty? Even I engaged in a little bit of that some weeks ago.

But if and when that debate takes place, it will actually obscure the real issue, because this settlement is not about getting money from the banks. The deal being contemplated is actually the opposite: a giant bailout.

In fact, any federal foreclosure settlement along the lines of what’s been proposed will amount to a last round of post-2008-crisis bailouts. I talked to one foreclosure activist over the weekend who put it this way: “[The AG settlement] will be a bigger bailout than TARP.”

How? The math actually makes a hell of a lot of sense, when you look at it closely.

Any foreclosure settlement will allow the banks to pay one relatively small bill to cover all of their legal liabilities stemming from the monstrous frauds they all practiced in the years leading up to the 2008 crash (and even afterward), when they all schemed to create great masses of dicey/junk subprime loans and then disguise them as AAA-rated paper for sale to big private investors and institutions like state pension funds and union funds.

To recap the crime: the banks lent money to firms like Countrywide, who in turn created billions in dicey loans, who then sold them back to the banks, who chopped them up and sold them to, among other things, your state’s worker retirement funds.

So this is bankers from Deutsche and Goldman and Bank of America essentially stealing the retirement nest eggs of firemen, teachers, cops, and other actors, as well as the investment monies of foreigners and hedge fund managers. To repeat: this was Wall Street hotshots stealing money from old ladies.

Along the road to this systematic thievery, a great many other, sometimes smaller offenses were committed. One involved the use of the MERS electronic registration system. By law, banks were supposed to register with county-level offices in each state every time they sold or resold a mortgage, and pay fees each time.

But they didn’t, instead registering with the private deed-transfer agency MERS, allowing them to systematically, and illegally, bypass local taxes.

So any “AG settlement” might allow the banks to avoid legal damages being sought from three different set of enraged creditors: the public institutions who invested in these sham securities, the private investors who did the same, and the localities who were cheated out of their taxes.

Let’s take a look at each of those three categories.

Read more:

photo: Justin Sullivan/Getty Images

by Matt Taibbi

Amidst all the bad news coming out of Wall Street and the economy, here’s something good: California has backed out of the talks for the long-awaited foreclosure settlement, now making it far from likely that the so-called “Attorneys General” deal will happen anytime soon.

California Attorney General Kamala Harris sent a letter to state and federal regulators explaining that she pulled out because the proposed settlement amount for banks guilty of bad securitization practices leading up to the mortgage crisis – said to be in the $20 billion range – was too small. From Business Week:

Harris says in a letter to state and federal negotiators that the pending settlement is "inadequate" and gives bank officials too much immunity.I’m convinced that the deal will eventually go through, however, after some further concessions are made. Certainly the absence of both New York (whose Attorney General Eric Schneiderman gamely started this mess by refusing to sign on or abandon his own investigation into corrupt securitization practices) and California will make it difficult for the banks to do any kind of a deal. But there is such an awesome amount of political will to get this deal done in Washington that it almost has to happen before the presidential election season really gets going.

If it does get done, expect a great deal of public debate over whether or not the size of the settlement was sufficient. Did the banks pay enough? Should they have paid ten billion more? Twenty? Even I engaged in a little bit of that some weeks ago.

But if and when that debate takes place, it will actually obscure the real issue, because this settlement is not about getting money from the banks. The deal being contemplated is actually the opposite: a giant bailout.

In fact, any federal foreclosure settlement along the lines of what’s been proposed will amount to a last round of post-2008-crisis bailouts. I talked to one foreclosure activist over the weekend who put it this way: “[The AG settlement] will be a bigger bailout than TARP.”

How? The math actually makes a hell of a lot of sense, when you look at it closely.

Any foreclosure settlement will allow the banks to pay one relatively small bill to cover all of their legal liabilities stemming from the monstrous frauds they all practiced in the years leading up to the 2008 crash (and even afterward), when they all schemed to create great masses of dicey/junk subprime loans and then disguise them as AAA-rated paper for sale to big private investors and institutions like state pension funds and union funds.

To recap the crime: the banks lent money to firms like Countrywide, who in turn created billions in dicey loans, who then sold them back to the banks, who chopped them up and sold them to, among other things, your state’s worker retirement funds.

So this is bankers from Deutsche and Goldman and Bank of America essentially stealing the retirement nest eggs of firemen, teachers, cops, and other actors, as well as the investment monies of foreigners and hedge fund managers. To repeat: this was Wall Street hotshots stealing money from old ladies.

Along the road to this systematic thievery, a great many other, sometimes smaller offenses were committed. One involved the use of the MERS electronic registration system. By law, banks were supposed to register with county-level offices in each state every time they sold or resold a mortgage, and pay fees each time.

But they didn’t, instead registering with the private deed-transfer agency MERS, allowing them to systematically, and illegally, bypass local taxes.

So any “AG settlement” might allow the banks to avoid legal damages being sought from three different set of enraged creditors: the public institutions who invested in these sham securities, the private investors who did the same, and the localities who were cheated out of their taxes.

Let’s take a look at each of those three categories.

Read more:

photo: Justin Sullivan/Getty Images

Current Events: Even a Slovak 'Yes' Will Make No Difference

[ed. I saw a great comment about Slovakia's vote yesterday and the current state of the European Union: like a flea on the tail wagging the dog.]

by Ambrose Evans-Pritchard

Slovakia’s "Nie" last night will not stop the approval of Europe’s revamped bail-out fund (EFSF).

The ultimate outcome has never been in doubt. As in Germany, the opposition backs the bill. In any case, Slovakia’s political class knows that their country will pay a fearful diplomatic price if this drama in the Národná Rada drags on for much longer.

What the Slovak debate has shown us yet again – as if the political storm in Germany over the last two months has not been enough – is that escalating bail-outs are nearing their political limits.

The traumatic affair almost brought down the German government. It has in fact brought down the Slovak government. You can’t keep doing this. Democracies are not to be toyed with.

His objections are unanswerable. How can there be any justification for a state of affairs where a poor but rule-abiding EMU state must bail out a serial violator with twice the per capita income, and triple the level of the pensions – a country which is in any case irretrievably bankrupt? How can it be that the no-bail clause of the Lisbon treaty has been ripped up?

But he also touched on the most neuralgic issue, reminding everybody that the EFSF is "mainly for saving foreign banks". These are French, German, British, Dutch, and Belgian banks, of course.

Mr Sulik is right. The EU-IMF rescue loans have not helped Greece pull out of its downward spiral. They have pushed the country further into bankruptcy. Greek public debt will rise from around 120pc of GDP to 160pc under the rescue programme, and the IMF is pencilling in figures above 180pc.

The rescue loans have rotated into the hands of creditor banks, life insurers, pension funds, and even a few hedge funds. ECB bond purchases have allowed to investors to dump their holdings at reduced loss, shifting the risk to EMU taxpayers. It is a racket for financial elites. A pickpocketing of taxpayers, including poor Slovak taxpayers.

"I’d rather be a pariah in Brussels than have to feel ashamed before my children," he said.

Bravo.

Read more:

image:

by Ambrose Evans-Pritchard

Slovakia’s "Nie" last night will not stop the approval of Europe’s revamped bail-out fund (EFSF).

The ultimate outcome has never been in doubt. As in Germany, the opposition backs the bill. In any case, Slovakia’s political class knows that their country will pay a fearful diplomatic price if this drama in the Národná Rada drags on for much longer.

What the Slovak debate has shown us yet again – as if the political storm in Germany over the last two months has not been enough – is that escalating bail-outs are nearing their political limits.

The traumatic affair almost brought down the German government. It has in fact brought down the Slovak government. You can’t keep doing this. Democracies are not to be toyed with.

***

Slovakia’s cry of defiance has not been entirely pointless. Richard Sulik – the speaker of parliament – has caught a mood of popular disgust that goes far beyond his own country. His objections are unanswerable. How can there be any justification for a state of affairs where a poor but rule-abiding EMU state must bail out a serial violator with twice the per capita income, and triple the level of the pensions – a country which is in any case irretrievably bankrupt? How can it be that the no-bail clause of the Lisbon treaty has been ripped up?

But he also touched on the most neuralgic issue, reminding everybody that the EFSF is "mainly for saving foreign banks". These are French, German, British, Dutch, and Belgian banks, of course.

Mr Sulik is right. The EU-IMF rescue loans have not helped Greece pull out of its downward spiral. They have pushed the country further into bankruptcy. Greek public debt will rise from around 120pc of GDP to 160pc under the rescue programme, and the IMF is pencilling in figures above 180pc.

The rescue loans have rotated into the hands of creditor banks, life insurers, pension funds, and even a few hedge funds. ECB bond purchases have allowed to investors to dump their holdings at reduced loss, shifting the risk to EMU taxpayers. It is a racket for financial elites. A pickpocketing of taxpayers, including poor Slovak taxpayers.

"I’d rather be a pariah in Brussels than have to feel ashamed before my children," he said.

Bravo.

Read more:

image:

New iPhone Conceals Sheer Magic

by David Pogue

What's in a name?

What's in a name?

A lot, apparently. Apple’s new iPhone is called the iPhone 4S. But what people really wanted was the iPhone 5.

The rumors online had predicted the second coming — or, rather, the fifth coming. It would be wedge-shaped! It would be completely transparent! It would clean your basement, pick you up at the airport and eliminate unsightly blemishes!

Instead, what showed up was a new iPhone that looks just like the last one: black or white, glass front and back, silver metal band around the sides. And on paper, at least, the new phone does only four new things.

THING 1: There’s a faster chip, the same one that’s in the iPad 2. More speed is always better, of course. But it’s not like people were complaining about the previous iPhone’s speed.

THING 2: A much better, faster camera — among the best on a phone. It has a resolution of eight megapixels, which doesn’t matter much, and a new, more light-sensitive sensor, which does. Its photos are crisp and clear, with beautiful color. The low-light photos and 1080p high-definition video are especially impressive for a phone. There’s still no zoom and only a tiny LED flash — but otherwise, this phone comes dangerously close to displacing a $200 point-and-shoot digital camera.

THING 3: The iPhone 4S is a world phone. As of Friday, you will be able to buy it from AT&T, Verizon and, for the first time, Sprint ($200, $300 or $400 for the 16-, 32- or 64-gigabyte models). But even if you get your iPhone 4S from Verizon, whose CDMA network is incompatible with the GSM networks used in most other countries, you’ll still be able to make calls overseas, either through Verizon or by inserting another carrier’s SIM card. Call ahead for details.

Each carrier has its selling points. Sprint is the only one with an unlimited iPhone data plan (example: $110 a month for unlimited calling, texting and Internet). AT&T says it has the fastest download speeds. But if you care about calling coverage, Verizon is the way to go.

THING 4: Speech recognition. Crazy good, transformative, category-redefining speech recognition. Exactly as on Android phones, a tiny microphone button appears on the on-screen keyboard; whenever you have an Internet connection, you can tap it when you want to dictate instead of typing. After a moment, the transcription appears. The sometimes frustrating on-screen keyboard is now a glorified Plan B.

Apple won’t admit that it’s using a version of Dragon Dictation, the free iPhone app, but there doesn’t seem to be much doubt; it works and behaves identically. (For example, it occasionally seems to process your utterance but then types nothing at all, just as the Dragon app does.) This version is infinitely better, though, because it’s a built-in keyboard button, not a separate app.

But dictation is only half the story — no, one-tenth of the story. Because in 2010, Apple bought a start-up called Siri, whose technology it has baked into the iPhone 4S.

Siri is billed as a virtual assistant: a crisply accurate, astonishingly understanding, uncomplaining, voice-commanded minion. No voice training or special syntax is required; you don’t even have to hold the phone up to your head. You just hold down the phone’s Home button until you hear a double beep, and then speak casually.

You can say, “Wake me up at 7:35,” or “Change my 7:35 alarm to 8.” You can say, “What’s Gary’s work number?” Or, “How do I get to the airport?” Or, “Any good Thai restaurants around here?” Or, “Make a note to rent ‘Ishtar’ this weekend.” Or, “How many days until Valentine’s Day?” Or, “Play some Beatles.” Or, “When was Abraham Lincoln born?”

In each case, Siri thinks for a few seconds, displays a beautifully formatted response and speaks in a calm female voice.

It’s mind-blowing how inexact your utterances can be. Siri understands everything from, “What’s the weather going to be like in Tucson this weekend?” to “Will I need an umbrella tonight?” (She has various amusing responses for “What is the meaning of life?”)

It’s even more amazing how Siri’s responses can actually form a conversation. Once, I tried saying, “Make an appointment with Patrick for Thursday at 3.” Siri responded, “Note that you already have an all-day appointment about ‘Boston Trip’ for this Thursday. Shall I schedule this anyway?” Unbelievable.

Read more:

illustration: Stuart Goldenberg

What's in a name?

What's in a name? A lot, apparently. Apple’s new iPhone is called the iPhone 4S. But what people really wanted was the iPhone 5.

The rumors online had predicted the second coming — or, rather, the fifth coming. It would be wedge-shaped! It would be completely transparent! It would clean your basement, pick you up at the airport and eliminate unsightly blemishes!

Instead, what showed up was a new iPhone that looks just like the last one: black or white, glass front and back, silver metal band around the sides. And on paper, at least, the new phone does only four new things.

THING 1: There’s a faster chip, the same one that’s in the iPad 2. More speed is always better, of course. But it’s not like people were complaining about the previous iPhone’s speed.

THING 2: A much better, faster camera — among the best on a phone. It has a resolution of eight megapixels, which doesn’t matter much, and a new, more light-sensitive sensor, which does. Its photos are crisp and clear, with beautiful color. The low-light photos and 1080p high-definition video are especially impressive for a phone. There’s still no zoom and only a tiny LED flash — but otherwise, this phone comes dangerously close to displacing a $200 point-and-shoot digital camera.

THING 3: The iPhone 4S is a world phone. As of Friday, you will be able to buy it from AT&T, Verizon and, for the first time, Sprint ($200, $300 or $400 for the 16-, 32- or 64-gigabyte models). But even if you get your iPhone 4S from Verizon, whose CDMA network is incompatible with the GSM networks used in most other countries, you’ll still be able to make calls overseas, either through Verizon or by inserting another carrier’s SIM card. Call ahead for details.

Each carrier has its selling points. Sprint is the only one with an unlimited iPhone data plan (example: $110 a month for unlimited calling, texting and Internet). AT&T says it has the fastest download speeds. But if you care about calling coverage, Verizon is the way to go.

THING 4: Speech recognition. Crazy good, transformative, category-redefining speech recognition. Exactly as on Android phones, a tiny microphone button appears on the on-screen keyboard; whenever you have an Internet connection, you can tap it when you want to dictate instead of typing. After a moment, the transcription appears. The sometimes frustrating on-screen keyboard is now a glorified Plan B.

Apple won’t admit that it’s using a version of Dragon Dictation, the free iPhone app, but there doesn’t seem to be much doubt; it works and behaves identically. (For example, it occasionally seems to process your utterance but then types nothing at all, just as the Dragon app does.) This version is infinitely better, though, because it’s a built-in keyboard button, not a separate app.

But dictation is only half the story — no, one-tenth of the story. Because in 2010, Apple bought a start-up called Siri, whose technology it has baked into the iPhone 4S.

Siri is billed as a virtual assistant: a crisply accurate, astonishingly understanding, uncomplaining, voice-commanded minion. No voice training or special syntax is required; you don’t even have to hold the phone up to your head. You just hold down the phone’s Home button until you hear a double beep, and then speak casually.

You can say, “Wake me up at 7:35,” or “Change my 7:35 alarm to 8.” You can say, “What’s Gary’s work number?” Or, “How do I get to the airport?” Or, “Any good Thai restaurants around here?” Or, “Make a note to rent ‘Ishtar’ this weekend.” Or, “How many days until Valentine’s Day?” Or, “Play some Beatles.” Or, “When was Abraham Lincoln born?”

In each case, Siri thinks for a few seconds, displays a beautifully formatted response and speaks in a calm female voice.

It’s mind-blowing how inexact your utterances can be. Siri understands everything from, “What’s the weather going to be like in Tucson this weekend?” to “Will I need an umbrella tonight?” (She has various amusing responses for “What is the meaning of life?”)

It’s even more amazing how Siri’s responses can actually form a conversation. Once, I tried saying, “Make an appointment with Patrick for Thursday at 3.” Siri responded, “Note that you already have an all-day appointment about ‘Boston Trip’ for this Thursday. Shall I schedule this anyway?” Unbelievable.

Read more:

illustration: Stuart Goldenberg

More Evidence Against Vitamin Use

by Tara Parker-Pope

Two new studies add to the growing body of evidence that taking extra doses of vitamins can do more harm than good.

A study of vitamin E and selenium use among 35,000 men found that the vitamin users had a slightly higher risk of developing prostate cancer, according to a report published Tuesday in The Journal of the American Medical Association. A separate study of 38,000 women in Iowa found a higher risk of dying during a 19-year period among older women who used multivitamins and other supplements compared with women who did not, according to a new report in The Archives of Internal Medicine.

The findings are the latest in a series of disappointing research results showing that high doses of vitamins are not helpful in warding off disease.

“You go back 15 or 20 years, and there were thoughts that antioxidants of all sorts might be useful,” said Dr. Eric Klein, a Cleveland Clinic physician and national study coordinator for the prostate cancer and vitamin E study. “There really is not any compelling evidence that taking these dietary supplements above and beyond a normal dietary intake is helpful in any way, and this is evidence that it could be harmful.”

Read more:

photo: Asimulator, Flickr, Creative Commons

Two new studies add to the growing body of evidence that taking extra doses of vitamins can do more harm than good.

A study of vitamin E and selenium use among 35,000 men found that the vitamin users had a slightly higher risk of developing prostate cancer, according to a report published Tuesday in The Journal of the American Medical Association. A separate study of 38,000 women in Iowa found a higher risk of dying during a 19-year period among older women who used multivitamins and other supplements compared with women who did not, according to a new report in The Archives of Internal Medicine.

The findings are the latest in a series of disappointing research results showing that high doses of vitamins are not helpful in warding off disease.

“You go back 15 or 20 years, and there were thoughts that antioxidants of all sorts might be useful,” said Dr. Eric Klein, a Cleveland Clinic physician and national study coordinator for the prostate cancer and vitamin E study. “There really is not any compelling evidence that taking these dietary supplements above and beyond a normal dietary intake is helpful in any way, and this is evidence that it could be harmful.”

Read more:

photo: Asimulator, Flickr, Creative Commons

Tuesday, October 11, 2011

Current Events: Elizabeth Warren Announces Her Bid for Senate

[ed. She'll fix this @#$%$ herself if she has to. Note: parody alert]

Prescribed Epidemic

by Guy Taylor

An epidemic of Oxycodone abuse has struck America in the last decade. The number of emergency room visits stemming from non-medical abuse of the narcotic prescription painkiller drug rose by 256 percent between 2004 and 2009, according to the U.S. government’s Drug Abuse Warning Network. In March 2010, Washington state Attorney General Rob McKenna said his state was “losing more people to prescription drug overdoses in a typical year than to traffic accidents.” In Florida, the Medical Examiners commission found more than 1,500 people died of Oxycodone overdose in 2010, a four-fold increase over the 350 who died in 2005. The supply of Oxycodone, says Jim Hall, director of the Center for the Study and Prevention of Substance Abuse at Nova Southeastern University, went “far beyond the legitimate medical need of the state.”

In March 2010, Washington state Attorney General Rob McKenna said his state was “losing more people to prescription drug overdoses in a typical year than to traffic accidents.” In Florida, the Medical Examiners commission found more than 1,500 people died of Oxycodone overdose in 2010, a four-fold increase over the 350 who died in 2005. The supply of Oxycodone, says Jim Hall, director of the Center for the Study and Prevention of Substance Abuse at Nova Southeastern University, went “far beyond the legitimate medical need of the state.”The epidemic is not likely to abate soon. The explosion of pain management clinics in Florida, dubbed “pill mills,” prompted the state Legislature last year to close a loophole that had allowed physicians to fill Oxy prescriptions on the spot. Authorities say a half-billion doses of Oxycodone and its generic equivalents were distributed in the state during 2009 alone. An unknown number wound up in the hands of “patients” who had come from out of state to have prescriptions filled by multiple pill mills, before driving home to resell the pills on the black market.

The scope of damage wrought by Oxycodone’s oversupply in Florida is felt nationwide. In Maine, an official from the state’s Office of Substance Abuse sent me an internal spreadsheet showing that more than 4 million prescription painkiller pills had been legally prescribed by state physicians in 2010, five times the amount legally dispensed in 2006. Officials in Ohio went one step further, identifying the per capita amount of opioids being prescribed county-by-county. Jackson County, in the southern part of the state, won the alarming distinction of having more than 130 doses for every resident in 2010. The number of pills prescribed in Ohio has risen by 900 percent since 1997, a powerful indicator that the market for pills has become oversaturated.

“There’s just no way that there’s been a 900 percent increase in pain,” says Stacey Frohnapfel-Hasson, chief of communications for Ohio’s Department of Alcohol and Drug Addiction Services.

A 1,200 percent increase

One of the most disturbing things about the prescription pain pill abuse epidemic is that it could have been avoided, or at least mitigated, if the DEA had fulfilled the responsibilities vested in it under federal law.

***

It’s well known that narcotic prescription drugs sold in the United States must first be approved by U.S. Food and Drug Administration before they can be legally mass produced and marketed. Less known is the fact that the DEA – and specifically, the Office of Diversion Control – then has the power and responsibility to decide how much of a particular drug can be legally manufactured and sent to market each year.The pharmaceutical companies that make Oxycodone and its two dozen generic equivalents — such as Endocodone, Oxyfast and Percocet — are required by law to present an annual application to the Office of Diversion Control seeking approval for a quota of the drug’s annual production. Should a company desire to manufacture more than the previous year, it must request an increase — and the DEA must approve.

***

In 1997, a year after prescription drugmaker Purdue Pharma first brought Oxycontin (the first branded version of Oxycodone) to market, the total production quota approved by the Office of Diversion Control was 8.3 tons. By 2011, it had risen to 105 tons, an officially sanctioned 1,200 percent increase over the same period that saw Oxycodone emerge as what Haislip calls “the Cadillac of America’s prescription drug abuse crisis.”That the DEA allowed for the increases in the face of widespread illegal and non-medical use shows a ”serious lack of accountability and oversight,” says Haislip.

“The DEA is the lone federal agency with the power to decide how much of the drug gets made and put out there; it alone has had all the responsibility to do something about this problem,” he said. “The way I did it for 17 years, which was basically the way it had always been done even before the DEA was the DEA, is that when a significant diversion problem occurred, the quota increase requests would come under greater scrutiny.”

“With Oxy,” said Haislip, “there has been a significant diversion problem since the late 1990s, so the requests should have come under greater scrutiny.” That apparently didn’t happen, he says.

Read more:

Subscribe to:

Comments (Atom)