Saturday, July 13, 2013

Google Logic: Why Google Does the Things it Does

A favorite pastime among people who watch the tech industry is trying to figure out why Google does things. The Verge was downright plaintive about it the other day (link), and I get the question frequently from financial analysts and reporters. But the topic also comes up regularly in conversations with my Silicon Valley friends.

It’s a puzzle because Google doesn’t seem to respond to the rules and logic used by the rest of the business world. It passes up what look like obvious opportunities, invests heavily in things that look like black holes, and proudly announces product cancellations that the rest of us would view as an embarrassment. Google’s behavior drives customers and partners nuts, but is especially troubling to financial analysts who have to tell people whether or not to buy Google’s stock. Every time Google has a less than stellar quarter, the issue surges up again.

As I wrote recently when discussing Dell (link), it’s a mistake to assume there’s a logical reason for everything a company does. Sometimes managers act out of fear or ignorance or just plain stupidity, and trying to retrofit logic onto their actions is as pointless as a primitive shaman using goat entrails to explain a volcano.

But in Google’s case, I think its actions do make sense – even the deeply weird stuff like the purchase of Motorola. The issue, I believe, is that Google follows a different set of rules than most other companies. Apple uses “Think Different” as its slogan, but in many ways Google is the company that truly thinks differently. It’s not just marching to a different drummer; sometimes I think it hears an entirely different orchestra.

Google’s orchestra is unique because of three factors: corporate culture, governance, and personal politics. Let’s start with the culture.

by Michael Mace, Mobile Opportunity | Read more:

Image via:

Sex on Campus: She Can Play That Game, Too

At 11 on a weeknight earlier this year, her work finished, a slim, pretty junior at the University of Pennsylvania did what she often does when she has a little free time. She texted her regular hookup — the guy she is sleeping with but not dating. What was he up to? He texted back: Come over. So she did. They watched a little TV, had sex and went to sleep.

Their relationship, she noted, is not about the meeting of two souls.

Their relationship, she noted, is not about the meeting of two souls.

“We don’t really like each other in person, sober,” she said, adding that “we literally can’t sit down and have coffee.”

Ask her why she hasn’t had a relationship at Penn, and she won’t complain about the death of courtship or men who won’t commit. Instead, she’ll talk about “cost-benefit” analyses and the “low risk and low investment costs” of hooking up.

“I positioned myself in college in such a way that I can’t have a meaningful romantic relationship, because I’m always busy and the people that I am interested in are always busy, too,” she said.

“And I know everyone says, ‘Make time, make time,’ ” said the woman, who spoke on the condition of anonymity but agreed to be identified by her middle initial, which is A. “But there are so many other things going on in my life that I find so important that I just, like, can’t make time, and I don’t want to make time.”

It is by now pretty well understood that traditional dating in college has mostly gone the way of the landline, replaced by “hooking up” — an ambiguous term that can signify anything from making out to oral sex to intercourse — without the emotional entanglement of a relationship.

Until recently, those who studied the rise of hookup culture had generally assumed that it was driven by men, and that women were reluctant participants, more interested in romance than in casual sexual encounters. But there is an increasing realization that young women are propelling it, too. (...)

As lengthy interviews over the school year with more than 60 women at Penn indicated, the discussion is playing out in the lives of a generation of women facing both broader opportunities and greater pressures than perhaps any before, both of which helped shape their views on sex and relationships in college.

Typical of elite universities today, Penn is filled with driven young women, many of whom aspire to be doctors, lawyers, politicians, bankers or corporate executives like Facebook’s Sheryl Sandberg or Yahoo’s Marissa Mayer. Keenly attuned to what might give them a competitive edge, especially in a time of unsure job prospects and a shaky economy, many of them approach college as a race to acquire credentials: top grades, leadership positions in student organizations, sought-after internships. Their time out of class is filled with club meetings, sports practice and community-service projects. For some, the only time they truly feel off the clock is when they are drinking at a campus bar or at one of the fraternities that line Locust Walk, the main artery of campus.

These women said they saw building their résumés, not finding boyfriends (never mind husbands), as their main job at Penn. They envisioned their 20s as a period of unencumbered striving, when they might work at a bank in Hong Kong one year, then go to business school, then move to a corporate job in New York. The idea of lugging a relationship through all those transitions was hard for many to imagine. Almost universally, the women said they did not plan to marry until their late 20s or early 30s.

In this context, some women, like A., seized the opportunity to have sex without relationships, preferring “hookup buddies” (regular sexual partners with little emotional commitment) to boyfriends. Others longed for boyfriends and deeper attachment. Some women described a dangerous edge to the hookup culture, of sexual assaults and degrading encounters enabled by drinking and distinguished by a lack of emotional connection.

The women interviewed came from all corners of Penn’s population. They belonged to sororities (or would never dream of it), reported for the school newspaper, sang or danced in performance groups, played sports. Some spent almost every weekend night at a “downtown” (a fraternity party at a nightclub, where men paid for bottle service) or at a campus bar. Others preferred holing up in the library or hanging out with the theater crowd. They came from all over the country, and as far away as China and Africa. Some had gone to elite private high schools; others were on full scholarship. They came from diverse racial backgrounds, and several were first-generation immigrants. They were found in a wide variety of ways, from chance encounters in coffee shops to introductions from friends.

Their relationship, she noted, is not about the meeting of two souls.

Their relationship, she noted, is not about the meeting of two souls.“We don’t really like each other in person, sober,” she said, adding that “we literally can’t sit down and have coffee.”

Ask her why she hasn’t had a relationship at Penn, and she won’t complain about the death of courtship or men who won’t commit. Instead, she’ll talk about “cost-benefit” analyses and the “low risk and low investment costs” of hooking up.

“I positioned myself in college in such a way that I can’t have a meaningful romantic relationship, because I’m always busy and the people that I am interested in are always busy, too,” she said.

“And I know everyone says, ‘Make time, make time,’ ” said the woman, who spoke on the condition of anonymity but agreed to be identified by her middle initial, which is A. “But there are so many other things going on in my life that I find so important that I just, like, can’t make time, and I don’t want to make time.”

It is by now pretty well understood that traditional dating in college has mostly gone the way of the landline, replaced by “hooking up” — an ambiguous term that can signify anything from making out to oral sex to intercourse — without the emotional entanglement of a relationship.

Until recently, those who studied the rise of hookup culture had generally assumed that it was driven by men, and that women were reluctant participants, more interested in romance than in casual sexual encounters. But there is an increasing realization that young women are propelling it, too. (...)

As lengthy interviews over the school year with more than 60 women at Penn indicated, the discussion is playing out in the lives of a generation of women facing both broader opportunities and greater pressures than perhaps any before, both of which helped shape their views on sex and relationships in college.

Typical of elite universities today, Penn is filled with driven young women, many of whom aspire to be doctors, lawyers, politicians, bankers or corporate executives like Facebook’s Sheryl Sandberg or Yahoo’s Marissa Mayer. Keenly attuned to what might give them a competitive edge, especially in a time of unsure job prospects and a shaky economy, many of them approach college as a race to acquire credentials: top grades, leadership positions in student organizations, sought-after internships. Their time out of class is filled with club meetings, sports practice and community-service projects. For some, the only time they truly feel off the clock is when they are drinking at a campus bar or at one of the fraternities that line Locust Walk, the main artery of campus.

These women said they saw building their résumés, not finding boyfriends (never mind husbands), as their main job at Penn. They envisioned their 20s as a period of unencumbered striving, when they might work at a bank in Hong Kong one year, then go to business school, then move to a corporate job in New York. The idea of lugging a relationship through all those transitions was hard for many to imagine. Almost universally, the women said they did not plan to marry until their late 20s or early 30s.

In this context, some women, like A., seized the opportunity to have sex without relationships, preferring “hookup buddies” (regular sexual partners with little emotional commitment) to boyfriends. Others longed for boyfriends and deeper attachment. Some women described a dangerous edge to the hookup culture, of sexual assaults and degrading encounters enabled by drinking and distinguished by a lack of emotional connection.

The women interviewed came from all corners of Penn’s population. They belonged to sororities (or would never dream of it), reported for the school newspaper, sang or danced in performance groups, played sports. Some spent almost every weekend night at a “downtown” (a fraternity party at a nightclub, where men paid for bottle service) or at a campus bar. Others preferred holing up in the library or hanging out with the theater crowd. They came from all over the country, and as far away as China and Africa. Some had gone to elite private high schools; others were on full scholarship. They came from diverse racial backgrounds, and several were first-generation immigrants. They were found in a wide variety of ways, from chance encounters in coffee shops to introductions from friends.

by Kate Taylor, NY Times | Read more:

Image: Elizabeth D. Herman for The New York TimesFriday, July 12, 2013

Zhao Shao’ang (1905-1998) and Yang Shanshen (1913-2004) Series: China Guardian Hong Kong 2012 Autumn Auctions

via:

Culinary School: The Pros and Cons of Culinary Education

Culinary school enrollment has swelled in recent years; more people than ever are chasing a dream of running a kitchen or flipping an omelette on television. And like most institutions of higher education, tuition rates have shot up as well.

The best known culinary schools in the country come with price tags that range anywhere from $35,000 to $54,000 for a two-year associate's degree or up to about $109,000 for a bachelor's degree. All this for a career path that traditionally starts with a $10 an hour job doing back-breaking work for insane hours and over holidays. And, while the salary does improve with time, cooking is rarely going to be a lucrative profession.

So is going to culinary school worth it? There's not one right answer to the long-debated question. It depends on a lot of factors, including the costs of culinary school, the alternatives, career aspirations, and temperament. There are passionate arguments on all sides.

Chefs, restaurateurs, educators, students, and newly-minted line cooks from across the country shared with Eater their thoughts on the value of culinary school. They all agreed that education is valuable, but their opinions differed on how to get it for the greatest value. What lies ahead is a look at the pros and cons of going to culinary school. (...)

Any time you're throwing down tens of thousands of dollars on education, it helps to know what you're doing with it. Perhaps even more so in the case of a trade like cooking. Tuition is high and average salaries for many jobs in the food service industry are low. A cost-benefit analysis for culinary school tuition will calculate differently for the cook who plans to work their way up the line in a New York City restaurant and the cook who wants to take a higher-paying corporate or private chef gig.

There are all kinds of jobs available to culinary school grads: working in all facets of a restaurant, from the line to the host stand to the wine cellar, pastry kitchen, and beyond; research and development for a corporation like McDonald's; overseeing the kitchen at a hotel, resort or on a cruise liner; and so much more. During the 2011-2012 academic year at the Culinary Institute of America, about 54 percent of incoming freshmen expressed interest in working in some capacity at an independent restaurant upon graduation, according to communications director Jeff Levine. Another 27 percent were interested in working at hotels or resorts, while 17 percent were considering careers at restaurant chains or other corporate food jobs. But, according to Levine, about 70 to 80 percent of CIA graduates do go to work in restaurant or hotel/resort kitchens when they leave Hyde Park.

So what are the average salary expectations for these two career paths? Well, according to the most recent Chef Salary Report on StarChefs.com, in 2010 an executive chef could stand to make $65,983 ($81,039 in hotels), a chef de cuisine had an average salary of $51,114 ($55,405 in hotels), a sous chef made $39,478 ($42,906 in hotels) and a pastry chef made $43,123 ($46,547 in hotels). For those hotel and corporate chefs who are making more than those who work in restaurants, culinary school may be less of a financial challenge.

The best known culinary schools in the country come with price tags that range anywhere from $35,000 to $54,000 for a two-year associate's degree or up to about $109,000 for a bachelor's degree. All this for a career path that traditionally starts with a $10 an hour job doing back-breaking work for insane hours and over holidays. And, while the salary does improve with time, cooking is rarely going to be a lucrative profession.

So is going to culinary school worth it? There's not one right answer to the long-debated question. It depends on a lot of factors, including the costs of culinary school, the alternatives, career aspirations, and temperament. There are passionate arguments on all sides.

Chefs, restaurateurs, educators, students, and newly-minted line cooks from across the country shared with Eater their thoughts on the value of culinary school. They all agreed that education is valuable, but their opinions differed on how to get it for the greatest value. What lies ahead is a look at the pros and cons of going to culinary school. (...)

Any time you're throwing down tens of thousands of dollars on education, it helps to know what you're doing with it. Perhaps even more so in the case of a trade like cooking. Tuition is high and average salaries for many jobs in the food service industry are low. A cost-benefit analysis for culinary school tuition will calculate differently for the cook who plans to work their way up the line in a New York City restaurant and the cook who wants to take a higher-paying corporate or private chef gig.

There are all kinds of jobs available to culinary school grads: working in all facets of a restaurant, from the line to the host stand to the wine cellar, pastry kitchen, and beyond; research and development for a corporation like McDonald's; overseeing the kitchen at a hotel, resort or on a cruise liner; and so much more. During the 2011-2012 academic year at the Culinary Institute of America, about 54 percent of incoming freshmen expressed interest in working in some capacity at an independent restaurant upon graduation, according to communications director Jeff Levine. Another 27 percent were interested in working at hotels or resorts, while 17 percent were considering careers at restaurant chains or other corporate food jobs. But, according to Levine, about 70 to 80 percent of CIA graduates do go to work in restaurant or hotel/resort kitchens when they leave Hyde Park.

So what are the average salary expectations for these two career paths? Well, according to the most recent Chef Salary Report on StarChefs.com, in 2010 an executive chef could stand to make $65,983 ($81,039 in hotels), a chef de cuisine had an average salary of $51,114 ($55,405 in hotels), a sous chef made $39,478 ($42,906 in hotels) and a pastry chef made $43,123 ($46,547 in hotels). For those hotel and corporate chefs who are making more than those who work in restaurants, culinary school may be less of a financial challenge.

It's worth pointing out, though, that it often takes years of working as a line cook for grim hourly wages before making that kind of money. And the survey notes that while salary levels for those who had obtained culinary degrees or certifications are higher than non-grads, it warns that "the salary gap — while increasing — isn't as big as you might think."

by Amy McKeever, Eater | Read more:

Photo: Daniel KriegerI look Good in my Pork Pie Hat

I look good in my pork pie hat. I do. People see me walking towards them on the sidewalk and they judge how much longer they will have to wait before they can compliment me in a voice that isn’t a yell.

Some days I borrow one of my dad’s fly-fishing flies and put it in the band and it adds color and flare and my girlfriend compliments it. Yes, I look good in my pork pie hat.

I look good in other hats too: baseball, fedora, driver’s, tweed, beanie. But the standby is my pork pie hat, which launches me into the upper crust of the crowd anywhere from concerts for very cool bands to dive bars to covertly drinking on public beaches.

I look good in other hats too: baseball, fedora, driver’s, tweed, beanie. But the standby is my pork pie hat, which launches me into the upper crust of the crowd anywhere from concerts for very cool bands to dive bars to covertly drinking on public beaches.

Say, for instance, I’m at my friend’s underground restaurant. I’ll start to compliment him on his cooking and he’ll cut me off and say, “Dude, that hat. You look good in that.”

I’ll accept the compliment gracefully and play it off like I was unsure about wearing it or not. But really, I know I look phenomenal in it. I’ve always looked phenomenal in it. There was never any warm-up period for me and my pork pie hat.

“Are you in a band?” asks the grocer at my local bodega.

“Are you a poet?” asks the cute barista at my neighborhood café.

“Are you from New York?” asks the clerk at the pop-up store selling quirky T-shirts and boutique chewing gum.

“No,” I say. “Why do you ask?” Just pretending like I don’t know that it is my trusty pork pie hat that gives these people the impression that I am an urban artist who lives on rice and beans and passion for his creative pursuits, instead of on his father’s bank account and his grandfather’s clothing.

I see my pictures on Facebook: sepia-toned Instagrams of me at a backyard barbecue, at the park on a weekday afternoon, drinking cans of beer on my friend’s buddy’s sister’s porch. Yes. I look good in my pork pie hat.

I remember that day on the porch. It was chill and dope and rad. Two police officers walked by at some point. One gave me this long look that I knew meant, “Get a job, lazy ass. But damn, what a hat.”

This is not a passing trend. This is not my bow tie, or my duct tape shoes, or my mustache. This pork pie hat – my pork pie hat – is here to stay atop my slightly balding head, perched as a beacon of coolness and charm and uniqueness for many, many years to come.

Some days I borrow one of my dad’s fly-fishing flies and put it in the band and it adds color and flare and my girlfriend compliments it. Yes, I look good in my pork pie hat.

I look good in other hats too: baseball, fedora, driver’s, tweed, beanie. But the standby is my pork pie hat, which launches me into the upper crust of the crowd anywhere from concerts for very cool bands to dive bars to covertly drinking on public beaches.

I look good in other hats too: baseball, fedora, driver’s, tweed, beanie. But the standby is my pork pie hat, which launches me into the upper crust of the crowd anywhere from concerts for very cool bands to dive bars to covertly drinking on public beaches.Say, for instance, I’m at my friend’s underground restaurant. I’ll start to compliment him on his cooking and he’ll cut me off and say, “Dude, that hat. You look good in that.”

I’ll accept the compliment gracefully and play it off like I was unsure about wearing it or not. But really, I know I look phenomenal in it. I’ve always looked phenomenal in it. There was never any warm-up period for me and my pork pie hat.

“Are you in a band?” asks the grocer at my local bodega.

“Are you a poet?” asks the cute barista at my neighborhood café.

“Are you from New York?” asks the clerk at the pop-up store selling quirky T-shirts and boutique chewing gum.

“No,” I say. “Why do you ask?” Just pretending like I don’t know that it is my trusty pork pie hat that gives these people the impression that I am an urban artist who lives on rice and beans and passion for his creative pursuits, instead of on his father’s bank account and his grandfather’s clothing.

I see my pictures on Facebook: sepia-toned Instagrams of me at a backyard barbecue, at the park on a weekday afternoon, drinking cans of beer on my friend’s buddy’s sister’s porch. Yes. I look good in my pork pie hat.

I remember that day on the porch. It was chill and dope and rad. Two police officers walked by at some point. One gave me this long look that I knew meant, “Get a job, lazy ass. But damn, what a hat.”

This is not a passing trend. This is not my bow tie, or my duct tape shoes, or my mustache. This pork pie hat – my pork pie hat – is here to stay atop my slightly balding head, perched as a beacon of coolness and charm and uniqueness for many, many years to come.

by Ryan O'Neill, McSweeneys | Read more:

Image: via:

Post-Scarcity Economics by Tom Streithorst

When Roosevelt was inaugurated in 1933, “one third of the nation was ill-clothed, ill-housed, ill-fed” because close to one third of the nation was also unemployed. Were they all working, they could also be clothed, housed, fed. Conventional economics, what Keynes called the “Treasury View,” believed that supply should be driven down to the level of demand. Keynes and Roosevelt figured why not drive demand up to the level of supply instead? Combining idleness with scarcity was criminal. Instead, demand should be stimulated to meet the economy’s productive capacity.

World War II finally ended the Depression and proved Keynes right. New Deal deficit spending was too small, too timid to restore the animal spirits of entrepreneurs battered by years of debt deflation. War is the least productive, most destructive of human activities with negative economic benefit, but the US government, by printing money and using it to hire workers knocked unemployment, which had been close to 20 percent in 1938 down to barely over 1 percent six years later.

It is important to understand that making bombs and blowing up cities is not what shrunk unemployment. It was the printing of money, the hiring of workers, the creation of demand by deficit spending. Had the US government spent as much as it had on fighting Hitler on promoting the arts, or building schools or even digging ditches and then filling them, it would have had just as beneficial an economic effect as did the war. Blowing stuff up is the opposite of investment. From an economic point of view, bombs and bullets are purely consumption goods, not nearly as beneficial as education or infrastructure. The reason defence spending has become the common means of stimulating demand is largely political. Conservatives who cannot stomach deficit spending for any other reason are willing to forgo their hard money prejudices in time of national emergency.

When the war ended, policy makers feared that without the stimulus of defence spending, the United States and the world would sink back into recession. The end of wars had been the cause of economic slowdowns in 1818, after the Napoleonic Wars, and in 1919, after World War I, and indeed, 1946 saw the US GDP shrink slightly. But the economy soon recovered and for the next 25 years, the world experienced the greatest growth in its history. The fundamental source of Golden Age growth was rising incomes that brought millions out of poverty and into the middle class. Their demand for luxuries that were fast becoming necessities created a mass consumer market, and corporations grew rapidly by satisfying it. In 1939, 25 percent of Americans didn’t have running water, only 65 percent had indoor toilets, and none had television.

The rich grew richer during the Golden Age, but so did everyone else. Golden Age policies of progressive taxation, unionization, regulation are the opposite of what conservatives advocate today, but they were much more successful than the supply side policies that have dominated our more inequitable era. Inflation adjusted GDP growth was greater in the 1950s, 1960s, and even 1970s, than it ever has been since.

In the 1970s, for a variety of reasons, corporate profitability went south. The positive feedback loop that raised the income of workers and businessmen alike fell apart. The Golden Age depended on capital and labour cooperating, and both profiting. In the 1970s, their social pact fell apart. The inflation of that era can be seen as capital and labor each trying to shift the cost of oil price hikes to the other. At first, organized labour won that battle and grabbed a larger share of the pie. Workers, especially organized workers did well in the 1970s. Wage growth, even taking inflation into account, was greater than it ever has been since. Capital, on the other hand, had a terrible decade. From 1966 to 1982, the stock market fell more than three quarters in real terms. Bonds did even worse. With inflation greater than nominal interest rates, putting money into the bank meant that after a year you had less money than you put in. The 1970s were a bad decade to be rich. No wonder John Lennon sang about working class heroes. No wonder the children of millionaires dressed like farmers or factory workers. In the 1970s, a union cameraman made more money than most stockbrokers. But the glory days of labor were about to evaporate.

In 1980, capital struck back.

World War II finally ended the Depression and proved Keynes right. New Deal deficit spending was too small, too timid to restore the animal spirits of entrepreneurs battered by years of debt deflation. War is the least productive, most destructive of human activities with negative economic benefit, but the US government, by printing money and using it to hire workers knocked unemployment, which had been close to 20 percent in 1938 down to barely over 1 percent six years later.

It is important to understand that making bombs and blowing up cities is not what shrunk unemployment. It was the printing of money, the hiring of workers, the creation of demand by deficit spending. Had the US government spent as much as it had on fighting Hitler on promoting the arts, or building schools or even digging ditches and then filling them, it would have had just as beneficial an economic effect as did the war. Blowing stuff up is the opposite of investment. From an economic point of view, bombs and bullets are purely consumption goods, not nearly as beneficial as education or infrastructure. The reason defence spending has become the common means of stimulating demand is largely political. Conservatives who cannot stomach deficit spending for any other reason are willing to forgo their hard money prejudices in time of national emergency.

When the war ended, policy makers feared that without the stimulus of defence spending, the United States and the world would sink back into recession. The end of wars had been the cause of economic slowdowns in 1818, after the Napoleonic Wars, and in 1919, after World War I, and indeed, 1946 saw the US GDP shrink slightly. But the economy soon recovered and for the next 25 years, the world experienced the greatest growth in its history. The fundamental source of Golden Age growth was rising incomes that brought millions out of poverty and into the middle class. Their demand for luxuries that were fast becoming necessities created a mass consumer market, and corporations grew rapidly by satisfying it. In 1939, 25 percent of Americans didn’t have running water, only 65 percent had indoor toilets, and none had television.

The rich grew richer during the Golden Age, but so did everyone else. Golden Age policies of progressive taxation, unionization, regulation are the opposite of what conservatives advocate today, but they were much more successful than the supply side policies that have dominated our more inequitable era. Inflation adjusted GDP growth was greater in the 1950s, 1960s, and even 1970s, than it ever has been since.

In the 1970s, for a variety of reasons, corporate profitability went south. The positive feedback loop that raised the income of workers and businessmen alike fell apart. The Golden Age depended on capital and labour cooperating, and both profiting. In the 1970s, their social pact fell apart. The inflation of that era can be seen as capital and labor each trying to shift the cost of oil price hikes to the other. At first, organized labour won that battle and grabbed a larger share of the pie. Workers, especially organized workers did well in the 1970s. Wage growth, even taking inflation into account, was greater than it ever has been since. Capital, on the other hand, had a terrible decade. From 1966 to 1982, the stock market fell more than three quarters in real terms. Bonds did even worse. With inflation greater than nominal interest rates, putting money into the bank meant that after a year you had less money than you put in. The 1970s were a bad decade to be rich. No wonder John Lennon sang about working class heroes. No wonder the children of millionaires dressed like farmers or factory workers. In the 1970s, a union cameraman made more money than most stockbrokers. But the glory days of labor were about to evaporate.

In 1980, capital struck back.

by Tom Streithorst, LA Review of Books | Read more:

Image: uncredited

Thursday, July 11, 2013

How Clothes Should Fit

Your appearance; whether sharp and confident, relaxed and cool, or sloppy and juvenile – is often reduced to the fit of your clothing. Finding the right tailor may be crucial, but there is nothing nearly as significant as sharing a critical eye with the fitting-room mirror. Fortunately for most of us, picking the right fit doesn’t require much natural talent. All that’s required is some quality time with apparel and an attention to detail. The following serves as a general fit guide for the novice.

Before we jump in, let us note that clothes best flatter a fit body. When it comes to your appearance, apparel is only part of the equation. It is important to eat well, drink well, and exercise occasionally. Many of us have busy lives and we cannot all be models, but you don’t need six-pack abs to look good. It is much easier for clothing to look great for someone in shape. However, losing weight isn’t the only thing that matters – if you’re lanky and stick-like, start working out. It will help you fill out your clothes. Additionally, before beginning have someone accurately take all of your measurements. These are very useful numbers when shopping for clothing in-store, and they are absolutely crucial when shopping online.

Dress Shirts

The collar should just graze your neck without constricting it. If turning your head causes the collar to turn with it, the collar is too tight. You should be able to comfortably fit two fingers inside of your buttoned collar without it tightening against your skin.

Your cuffs should meet the point where your palm begins (about 2cm up from your wrist bone). It should be tight enough that your thumb notch at your wrist will stop the cuff from moving up your hand. It should be a bit looser than a properly fitting watch, and not go farther up your wrist than that watch.

The shoulder seam should be at your shoulder bone. This is the point on your shoulder that is the greatest distance away from your sternum.

Sleeves should not be so tight that you can see the details of your arms, but they should also not be so loose as to billow. When you bend your arm, your cuff should not move more than an inch up your wrist.

Shirt length should be such that bending and making natural movements does not cause the shirt to become untucked. Additionally, your shirt should remain tucked if you fold your hands behind your head. If this is a problem, the shirt may be too short or the armholes may be too low. Alternatively, armholes should not be tight around the shoulder.

Before we jump in, let us note that clothes best flatter a fit body. When it comes to your appearance, apparel is only part of the equation. It is important to eat well, drink well, and exercise occasionally. Many of us have busy lives and we cannot all be models, but you don’t need six-pack abs to look good. It is much easier for clothing to look great for someone in shape. However, losing weight isn’t the only thing that matters – if you’re lanky and stick-like, start working out. It will help you fill out your clothes. Additionally, before beginning have someone accurately take all of your measurements. These are very useful numbers when shopping for clothing in-store, and they are absolutely crucial when shopping online.

Dress Shirts

The collar should just graze your neck without constricting it. If turning your head causes the collar to turn with it, the collar is too tight. You should be able to comfortably fit two fingers inside of your buttoned collar without it tightening against your skin.

Your cuffs should meet the point where your palm begins (about 2cm up from your wrist bone). It should be tight enough that your thumb notch at your wrist will stop the cuff from moving up your hand. It should be a bit looser than a properly fitting watch, and not go farther up your wrist than that watch.

The shoulder seam should be at your shoulder bone. This is the point on your shoulder that is the greatest distance away from your sternum.

Sleeves should not be so tight that you can see the details of your arms, but they should also not be so loose as to billow. When you bend your arm, your cuff should not move more than an inch up your wrist.

Shirt length should be such that bending and making natural movements does not cause the shirt to become untucked. Additionally, your shirt should remain tucked if you fold your hands behind your head. If this is a problem, the shirt may be too short or the armholes may be too low. Alternatively, armholes should not be tight around the shoulder.

Blazers & Suit Jackets

About 2cm of shirt collar should be revealed by the jacket collar.

The shoulder seam should lie on the edge of your shoulder. The aim is to reduce the amount of buckling, as the shoulders should have no apparent wrinkles or divots while the arms are down at the sides.

Similarly to shirts, armholes must be sufficiently high, and alternatively should not be cutting into your armpit. The arms should move somewhat independently of the jacket during normal motions.

While buttoned, the jacket should not pull across the chest (fabric making an ‘X’ shape across your abdomen). Similarly, it should not pull across the shoulders when arms are folded.

Holding your hand flat, you should easily be able to fit it inside the jacket under the lapels.

The jacket’s second button from the bottom should lie just above your belly-button, never below.

With your arms at your sides, the sleeves should cover the wrist bone.

If a jacket doesn’t fit your shape properly, sometimes the bottoms will flare out, a product of the jacket being too slim in the waist, so your hips push out the fabric.

A suit jacket’s length – like a good lawyer – should cover your ass.

About 2cm of shirt collar should be revealed by the jacket collar.

The shoulder seam should lie on the edge of your shoulder. The aim is to reduce the amount of buckling, as the shoulders should have no apparent wrinkles or divots while the arms are down at the sides.

Similarly to shirts, armholes must be sufficiently high, and alternatively should not be cutting into your armpit. The arms should move somewhat independently of the jacket during normal motions.

While buttoned, the jacket should not pull across the chest (fabric making an ‘X’ shape across your abdomen). Similarly, it should not pull across the shoulders when arms are folded.

Holding your hand flat, you should easily be able to fit it inside the jacket under the lapels.

The jacket’s second button from the bottom should lie just above your belly-button, never below.

With your arms at your sides, the sleeves should cover the wrist bone.

If a jacket doesn’t fit your shape properly, sometimes the bottoms will flare out, a product of the jacket being too slim in the waist, so your hips push out the fabric.

A suit jacket’s length – like a good lawyer – should cover your ass.

by N. Taverna, Howclothesshouldfit | Read more:

Image: P.Altair

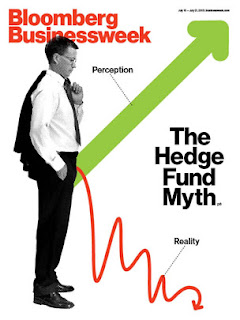

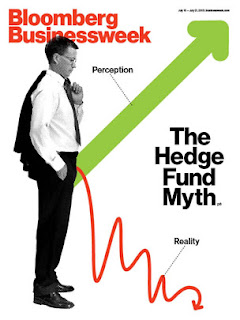

Hedge Funds Are for Suckers

At the height of the financial crisis in 2008, a group of famous hedge fund managers was made to stand before Congress like thieves in a stockade and defend their existence to an angry public. The gilded five included George Soros, co-founder of the Quantum Fund; James Simons of Renaissance Technologies; John Paulson of Paulson & Co.; Philip Falcone of Harbinger Capital; and Kenneth Griffin of Citadel. Each man had made hundreds of millions, or billions, of dollars in the preceding years through his own form of glorified gambling, and in some cases, the investors who had poured money into their hedge funds had done OK, too. They were brought to Washington to stand up for their industry and their paychecks, and to address the question of whether their business should be more tightly regulated. They all refused to apologize for their success. They appeared untouchable.

What’s happened since then is instructive. Soros, considered by some to be one of the greatest investors in history, announced in 2011 that he was returning most of his investors’ money and converting his fund into a family office. Simons, a former mathematician and code cracker for the National Security Agency, retired from managing his funds in 2010. After several spectacular years, Paulson saw performance at his largest funds plummet, while Falcone reached a tentative settlement in May with the U.S. Securities and Exchange Commission over claims that he’d borrowed money from his fund to pay his taxes, barring him from the industry for two years. Griffin recently scaled back his ambition of turning his firm into the next Goldman Sachs (GS) after his funds struggled to recover from huge losses in 2008.

What’s happened since then is instructive. Soros, considered by some to be one of the greatest investors in history, announced in 2011 that he was returning most of his investors’ money and converting his fund into a family office. Simons, a former mathematician and code cracker for the National Security Agency, retired from managing his funds in 2010. After several spectacular years, Paulson saw performance at his largest funds plummet, while Falcone reached a tentative settlement in May with the U.S. Securities and Exchange Commission over claims that he’d borrowed money from his fund to pay his taxes, barring him from the industry for two years. Griffin recently scaled back his ambition of turning his firm into the next Goldman Sachs (GS) after his funds struggled to recover from huge losses in 2008.

As a symbol of the state of the hedge fund industry, the humbling of these financial gods couldn’t be more apt. Hedge funds may have gotten too big for their yachts, for their market, and for their own possibilities for success. After a decade as rock stars, hedge fund managers seem to be fading just as quickly as musicians do. Each day brings disappointing headlines about the returns generated by formerly highflying funds, from Paulson, whose Advantage Plus fund is up 3.4 percent this year, after losing 19 percent in 2012 and 51 percent in 2011, to Bridgewater Associates, the largest in the world.

This reversal of fortunes comes at a time when one of the most successful traders of his time, Steven Cohen, founder of the $15 billion hedge fund firm SAC Capital Advisors, is at the center of a government investigation into insider trading. Two SAC portfolio managers, one current and one former, face criminal trials in November, and further charges from the Department of Justice and the SEC could come at any moment. The Federal Bureau of Investigation continues to probe the company, and the government is weighing criminal and civil actions against SAC and Cohen. Cohen has not been charged and denies any wrongdoing, but the industry is on high alert for the possible downfall of one of its towering figures.

Despite all the speculation and the loss of billions in investor capital, Cohen’s flagship hedge fund managed to be the most profitable in the world in 2012, making $789.5 million in the first 10 months of the year, according to Bloomberg Markets. His competitors haven’t fared as well. One thing hedge funds are supposed to do—generate “alpha,” a macho term for risk-adjusted returns that surpass the overall market because of the skill of the investor—is slipping further out of reach.

What’s happened since then is instructive. Soros, considered by some to be one of the greatest investors in history, announced in 2011 that he was returning most of his investors’ money and converting his fund into a family office. Simons, a former mathematician and code cracker for the National Security Agency, retired from managing his funds in 2010. After several spectacular years, Paulson saw performance at his largest funds plummet, while Falcone reached a tentative settlement in May with the U.S. Securities and Exchange Commission over claims that he’d borrowed money from his fund to pay his taxes, barring him from the industry for two years. Griffin recently scaled back his ambition of turning his firm into the next Goldman Sachs (GS) after his funds struggled to recover from huge losses in 2008.

What’s happened since then is instructive. Soros, considered by some to be one of the greatest investors in history, announced in 2011 that he was returning most of his investors’ money and converting his fund into a family office. Simons, a former mathematician and code cracker for the National Security Agency, retired from managing his funds in 2010. After several spectacular years, Paulson saw performance at his largest funds plummet, while Falcone reached a tentative settlement in May with the U.S. Securities and Exchange Commission over claims that he’d borrowed money from his fund to pay his taxes, barring him from the industry for two years. Griffin recently scaled back his ambition of turning his firm into the next Goldman Sachs (GS) after his funds struggled to recover from huge losses in 2008.As a symbol of the state of the hedge fund industry, the humbling of these financial gods couldn’t be more apt. Hedge funds may have gotten too big for their yachts, for their market, and for their own possibilities for success. After a decade as rock stars, hedge fund managers seem to be fading just as quickly as musicians do. Each day brings disappointing headlines about the returns generated by formerly highflying funds, from Paulson, whose Advantage Plus fund is up 3.4 percent this year, after losing 19 percent in 2012 and 51 percent in 2011, to Bridgewater Associates, the largest in the world.

This reversal of fortunes comes at a time when one of the most successful traders of his time, Steven Cohen, founder of the $15 billion hedge fund firm SAC Capital Advisors, is at the center of a government investigation into insider trading. Two SAC portfolio managers, one current and one former, face criminal trials in November, and further charges from the Department of Justice and the SEC could come at any moment. The Federal Bureau of Investigation continues to probe the company, and the government is weighing criminal and civil actions against SAC and Cohen. Cohen has not been charged and denies any wrongdoing, but the industry is on high alert for the possible downfall of one of its towering figures.

Despite all the speculation and the loss of billions in investor capital, Cohen’s flagship hedge fund managed to be the most profitable in the world in 2012, making $789.5 million in the first 10 months of the year, according to Bloomberg Markets. His competitors haven’t fared as well. One thing hedge funds are supposed to do—generate “alpha,” a macho term for risk-adjusted returns that surpass the overall market because of the skill of the investor—is slipping further out of reach.

by Sheelah Kolhatkar, Bloomberg Businessweek | Read more:

Image: indecipherable

Subscribe to:

Comments (Atom)