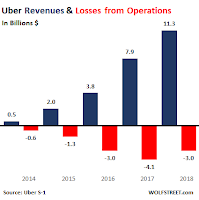

Uber Technologies’ IPO filing was made public today. The 330-page or so S-1 filing disclosed all kinds of goodies, including detailed but still unaudited pro-forma financial statements as of December 31, 2018, huge losses from operations, big tax benefits, large gains from the sale of some operations, stagnating rideshare revenues, and an enormous list of chilling “Risk Factors” that go beyond the usual CYA.

The filing, however, didn’t disclose the share price, the IPO valuation, and how much money the IPO will raise for Uber. On Tuesday, “people familiar with the matter” had told Reuters that Uber plans to raise $10 billion in the IPO. Most of the IPO shares would be sold by the company to raise funds, and a smaller amount would be sold by investors cashing out, the sources said.

The filing, however, didn’t disclose the share price, the IPO valuation, and how much money the IPO will raise for Uber. On Tuesday, “people familiar with the matter” had told Reuters that Uber plans to raise $10 billion in the IPO. Most of the IPO shares would be sold by the company to raise funds, and a smaller amount would be sold by investors cashing out, the sources said.

The filing did not confirm this and instead left blanks or used placeholder amounts. But if true, $10 billion in shares sold would make this IPO one of the biggest tech IPOs. And the rumored $90 billion to $100 billion valuation would make it the biggest since Alibaba’s $169 billion IPO.

Uber will need every dime it raises in the IPO going forward because it’s got a little cash-burn situation in its operations that persists going forward, as it admitted in its “Risk Factors,” and it will need to raise more money, and if it cannot raise more money, it might not make it. Uber is upfront about this.

The company has already raised – and mostly burned through – over $20 billion so far in its 10 years of existence. This includes $15 billion in equity funding and over $6 billion in debt. (...)

The huge section of about 50 densely filled pages of “Risk Factors” contains the usual warnings about the things that might happen to the company that are typical in IPO filings. These items are a CYA exercise. If you get wiped out and sue the company or the underwriters, they will point you to the correct paragraph and tell you that you should have read this, and that if you had read this you would have known that you’d get wiped out, or something.

But Uber’s list contains all kinds of other stuff that is unique to the scandal-infested company that is defending itself in court on numerous life-threatening issues.

The filing, however, didn’t disclose the share price, the IPO valuation, and how much money the IPO will raise for Uber. On Tuesday, “people familiar with the matter” had told Reuters that Uber plans to raise $10 billion in the IPO. Most of the IPO shares would be sold by the company to raise funds, and a smaller amount would be sold by investors cashing out, the sources said.

The filing, however, didn’t disclose the share price, the IPO valuation, and how much money the IPO will raise for Uber. On Tuesday, “people familiar with the matter” had told Reuters that Uber plans to raise $10 billion in the IPO. Most of the IPO shares would be sold by the company to raise funds, and a smaller amount would be sold by investors cashing out, the sources said.The filing did not confirm this and instead left blanks or used placeholder amounts. But if true, $10 billion in shares sold would make this IPO one of the biggest tech IPOs. And the rumored $90 billion to $100 billion valuation would make it the biggest since Alibaba’s $169 billion IPO.

Uber will need every dime it raises in the IPO going forward because it’s got a little cash-burn situation in its operations that persists going forward, as it admitted in its “Risk Factors,” and it will need to raise more money, and if it cannot raise more money, it might not make it. Uber is upfront about this.

The company has already raised – and mostly burned through – over $20 billion so far in its 10 years of existence. This includes $15 billion in equity funding and over $6 billion in debt. (...)

The huge section of about 50 densely filled pages of “Risk Factors” contains the usual warnings about the things that might happen to the company that are typical in IPO filings. These items are a CYA exercise. If you get wiped out and sue the company or the underwriters, they will point you to the correct paragraph and tell you that you should have read this, and that if you had read this you would have known that you’d get wiped out, or something.

But Uber’s list contains all kinds of other stuff that is unique to the scandal-infested company that is defending itself in court on numerous life-threatening issues.