This all sounds rather splendid, but somehow the pump inflating the bubble goes unmentioned: it's the money, Honey, the tens of trillions of yen, yuan, euros, dollars, pesos, etc., being borrowed or conjured into existence since the last spot of bother in 2008, where each unit of currency enters the global free-for-all chasing assets.

Thanks to historically low yields, cash is trash and the way to make a killing is to rotate from AI chip makers to Ferrari to Colgate, and then on to the next hot sector: maybe uranium, maybe bat guano, maybe a new doggy-themed crypto, maybe the next iteration of the yen carry trade, it doesn't really matter because capital is digital and therefore mobile.

Hand-in-hand with the endless spew of new "money" and credit are financialization and globalization, which have transformed every asset into a fully globalized, commoditized asset that can be securitized, packaged, collateralized and leveraged in a financier's Heaven of finance becoming the measure of All Things.

The house across the street is no longer shelter: it's a financialized asset that's now part of a portfolio of rental properties owned (and leveraged) by some entity based in Dubai, which might securitize the portfolio and sell it to pension funds in Norway.

Or it's one of dozens of short-term vacation rentals (STVR) in a wealthy family's private wealth management portfolio.

The same holds true for every asset on the planet. Farmland isn't for growing food--it's for growing wealth as the global "scarcity" of places to stash capital drives its value out of the reach of those who would actually like to use the land to grow food.

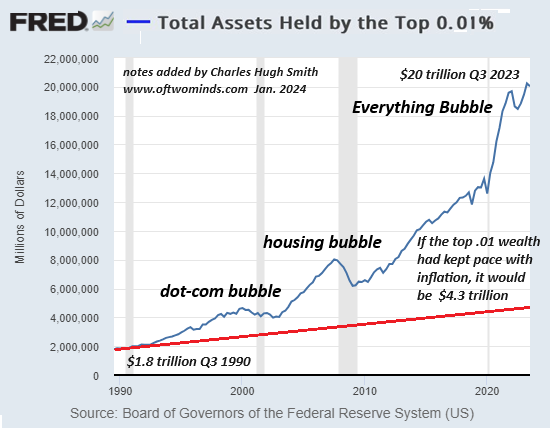

For the wealthy, what's abundant is credit, and what's scarce is assets to soak up the sea of capital sloshing around the wealth management funds, philanthro-capitalist foundations, and other outposts of the top 0.1%, which as this chart illustrates, have ridden the credit-fueled Everything Bubble to unprecedented heights of private wealth.

We're told the bubble is a tide raising all boats, but this is, ahem, misinformation, as the bottom 50%'s share of the financial windfall remains a signal-noise 2.6%. (...)

The primary effect of the Everything Bubble is an extreme of wealth-power inequality. As the chart above illustrates, the wealthy got much richer while everyone else acquired more debt, i.e. the obligation to pay more of one's earnings to the wealthy who own the mortgage, auto loan, student loan. etc.

There's a funny little effect of extreme wealth-power inequality known as social disorder which can manifest in all sorts of equally funny ways, as popular uprising, wildcat strikes, opting out, civil disobedience, and various other ways of expressing no mas.

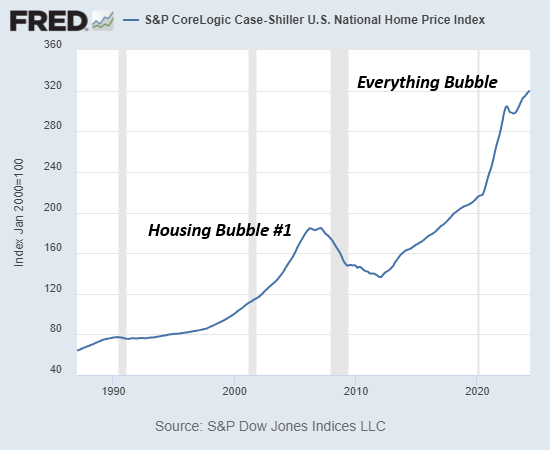

Here we see just how extreme the Everything Bubble has become in residential real estate, nearly doubling the insanity of the 2006 housing bubble. Recall that the Case-Shiller Index tracks the market price of the same houses over time, so there's no way to game the statistics.

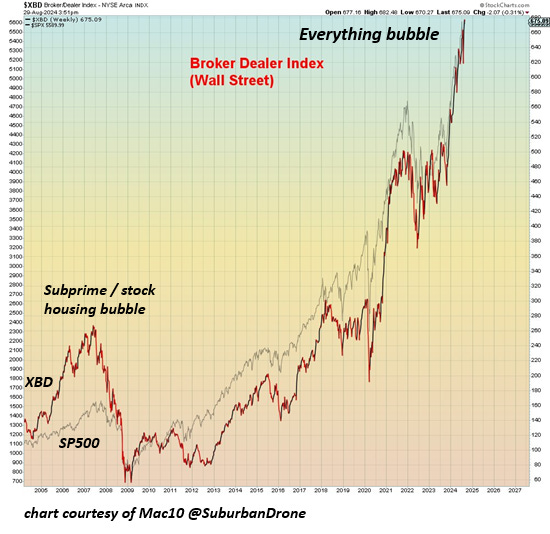

Among the big winners of the Everything Bubble is--yes, I know you're shocked--Wall Street, as the broker-Dealer index has outpaced even the bubblicious S&P 500 stock index.

The reverse wealth effect as the primary store of household wealth wilts will be monumental. Trust isn't just personal; trust is the critical glue in markets and governance. Once trust is lost, it's somewhere between difficult and impossible to win it back.

That the bloom is off the Everything Bubble Rose is visible in anecdotal evidence dribbling in from the real world: housing valuations in various markets are off 25% from their peak, housing inventories are rising, sales are slowing, restaurant chains are going belly-up, credit card debt is soaring to new heights, dollar-store stocks are cratering, and so on. (...)

There are a couple of funny things about amassing $315 trillion in debts globally to drive "growth": one is the interest due on all that debt, which becomes unsustainable should yields rise, and inflation, which either pushes yields higher, making it impossible to continue funding "growth" with more debt, or it lays waste to the purchasing power of wage earners' incomes, popping the bubble of free-spending consumption propping up the global economy and debt bubble.

by Charles Hugh Smith, Of Two Minds/Substack | Read more:

Images: as referenced in the charts