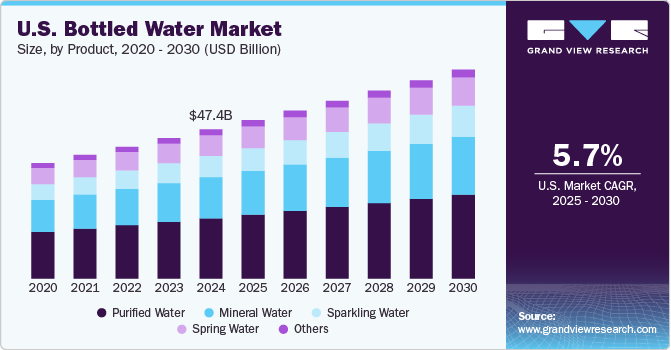

The U.S. bottled water market size was estimated at USD 47.42 billion in 2024 and is projected to grow at a CAGR of 5.7% from 2025 to 2030. This can be attributed to increasing health and wellness trends among consumers, the rising need for convenience and accessibility, and robust production innovation. The growing demand and consumption of bottled water can largely be attributed to increasing health consciousness among consumers. With rising awareness about the harmful effects of sugary beverages, such as sodas and juices, people are shifting towards healthier hydration options.

Bottled water is viewed as a simple and effective way to stay hydrated without the added sugars, calories, or artificial ingredients associated with other drinks. As more individuals prioritize wellness and hydration in their daily lives, bottled water has become a go-to choice, especially for those with active and health-conscious lifestyles.

Convenience also plays a crucial role in the rising demand for bottled water. It offers unmatched portability, making it easy for consumers to stay hydrated while on the go. Bottled water is readily available in grocery stores, convenience shops, and vending machines, which enhances its appeal as a staple beverage choice. This accessibility has solidified bottled water's position as one of the most popular beverage categories in the country.

Marketing strategies have further contributed to the growth of the bottled water industry. Companies have successfully created strong brand loyalty through campaigns that emphasize the purity and safety of bottled water compared to tap water. In some regions, concerns about tap water quality have bolstered consumer preference for bottled options, positioning them as a reliable source of hydration. Innovations in product offerings have also played a significant role in market expansion. The emergence of functional bottled waters-enhanced with vitamins, minerals, or flavor infusions-has attracted health-oriented consumers looking for added benefits beyond basic hydration. This segment is expected to grow substantially in the coming years, driven by consumer demand for beverages that provide health advantages. In addition, advancements in eco-friendly packaging are addressing environmental concerns while appealing to sustainability-minded consumers.

A notable factor propelling the growth of the bottled water industry is robust production innovation. This involves the introduction of enhanced manufacturing processes and the development of new product variants to meet diverse consumer demands and preferences. Innovations in packaging, such as eco-friendly materials and convenient designs, along with advancements in water purification and flavor infusion technologies, have significantly contributed to making bottled water more attractive to consumers. These innovative efforts not only aim to improve product quality and sustainability but also seek to differentiate offerings in a highly competitive market, thus driving consumer interest and market growth. (...)

Convenience also plays a crucial role in the rising demand for bottled water. It offers unmatched portability, making it easy for consumers to stay hydrated while on the go. Bottled water is readily available in grocery stores, convenience shops, and vending machines, which enhances its appeal as a staple beverage choice. This accessibility has solidified bottled water's position as one of the most popular beverage categories in the country.

Marketing strategies have further contributed to the growth of the bottled water industry. Companies have successfully created strong brand loyalty through campaigns that emphasize the purity and safety of bottled water compared to tap water. In some regions, concerns about tap water quality have bolstered consumer preference for bottled options, positioning them as a reliable source of hydration. Innovations in product offerings have also played a significant role in market expansion. The emergence of functional bottled waters-enhanced with vitamins, minerals, or flavor infusions-has attracted health-oriented consumers looking for added benefits beyond basic hydration. This segment is expected to grow substantially in the coming years, driven by consumer demand for beverages that provide health advantages. In addition, advancements in eco-friendly packaging are addressing environmental concerns while appealing to sustainability-minded consumers.

A notable factor propelling the growth of the bottled water industry is robust production innovation. This involves the introduction of enhanced manufacturing processes and the development of new product variants to meet diverse consumer demands and preferences. Innovations in packaging, such as eco-friendly materials and convenient designs, along with advancements in water purification and flavor infusion technologies, have significantly contributed to making bottled water more attractive to consumers. These innovative efforts not only aim to improve product quality and sustainability but also seek to differentiate offerings in a highly competitive market, thus driving consumer interest and market growth. (...)

Product Insights

Purified water accounted for a revenue share of 40.4% in 2024 in the U.S. market. Purified bottled water offers a convenient, portable hydration option, especially for people on the go, making it easy to access clean water anytime and anywhere. The increasing focus on personal health and wellness has led to a growing preference for purified water, which is perceived as a cleaner, more beneficial option compared to tap or other types of bottled water. Health-conscious consumers view purified water as free of impurities like chemicals, heavy metals, and bacteria, aligning with their desire for healthier hydration choices. (...)

As consumers seek healthier beverage alternatives, the demand for bottled water in on-trade settings continues to rise. For instance, in July 2024, Chipotle introduced a new lineup of ready-to-drink beverages available at all of its U.S. restaurants. This includes Open Water, which is canned water in aluminum bottles. (...)

Packaging Insights

PET bottled water accounted for a revenue share of 80.1% in 2024, owing to its significant advantages in convenience, recyclability, and lightweight nature compared to other packaging materials. The widespread preference for PET bottles among consumers stems from their ease of transport and use, alongside a growing awareness and concern for environmental sustainability. PET bottles, being fully recyclable, align with increasing global initiatives towards reducing plastic waste and promoting circular economies. Furthermore, the lightweight characteristics of PET bottles reduce transportation costs and carbon footprint, making them a favored choice among manufacturers and consumers alike, thus driving their market growth. [ed. ...and disposal]

In October 2023, Coca-Cola India launched its first 100% recycled polyethylene terephthalate (PET) bottle, specifically for its Kinley packaged drinking water brand. This initiative marks a significant step towards promoting sustainability and plastic circularity in the country. The company introduced these bottles as part of its broader commitment to environmental responsibility and aims to reduce its carbon footprint.

The canned bottled water segment is expected to grow at a CAGR of 7.0% from 2025 to 2030. This can be primarily attributed to increasing consumer awareness towards environmental sustainability. It can offer an eco-friendlier alternative to plastic bottles due to their higher recyclability rate and efficiency in transportation, which contributes to lower carbon emissions. In addition, the convenience and durability of cans appeal to active and on-the-go lifestyles, making them a popular choice among consumers. As a result, both beverage companies and consumers are shifting towards canned water, driving significant growth in this market segment. For instance, in April 2024, Coca-Cola’s Smartwater brand unveiled 12-ounce aluminum cans with a new design, marking the first instance of vapor-distilled water being offered in this packaging format. The cans feature both Smartwater Original and SmartWater Alkaline with Antioxidant, catering to consumer preferences for convenient and environmentally friendly options. (...)

Key U.S. Bottled Water Companies:

- Adidas AG

- Nestlé

- PepsiCo

- The Coca-Cola Company

- DANONE

- Primo Water Corporation

- FIJI Water Company LLC

- Gerolsteiner Brunnen GmbH & Co. KG

- VOSS WATER

- Nongfu Spring

- National Beverage Corp.

- Keurig Dr Pepper Inc.

- Recent Developments

by Grandview Research | Read more:

Image: Grandview Research

[ed. What is wrong with people. Rhetorical question of course, too many answers.]