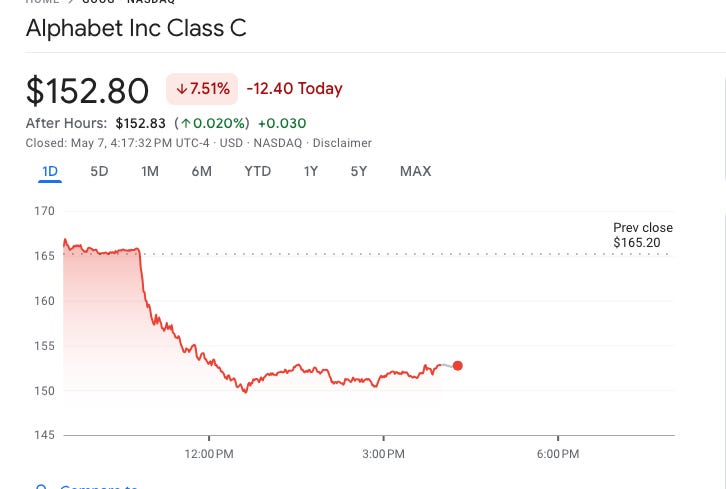

You can see the timing of when Cue went on the stand, but what’s interesting is that the stock drifted down for another two hours, which means that analysts were taking time to internalize what he had said and growing more pessimistic as the full ramifications of his comments sunk in.

So what did Cue say? Well, first, he said Apple is considering a revamp of the search experience on its iPhone. Right now, Google pays Apple more than $20 billion a year to be the search default, which is a key to the search company’s monopoly and the heart of the antitrust case. It’s essentially a shared search rent split between Google and Apple. In 2020 when the case was first filed, Apple considered creating its own search engine, fearing the loss of that revenue stream and looking for ways to replace it. Now it seems like something along that strategy is likely. Cue says that Apple might revamp its Safari browser to incorporate AI-powered search engines, which is a polite way of saying the company knows the game is soon up on selling the lucrative default position in Safari to Google.

The second thing he said is that Google search volume declined last month on the iPhone for the first time ever, presumably because people are beginning to use generative AI tools instead of ordinary search. This change is also a consequence of the antitrust case. Apple has already integrated OpenAI into its Apple Intelligence feature set; it did not choose Google, and one likely factor was the antitrust risk. Perplexity testified in the Google antitrust case, arguing that Google is blocking its distribution. Immediately after, it cut a deal with Motorola for distribution.

In other words, Google’s search monopoly may be starting to crack, which will put significant pressure on the company and force its cash cow ad business to be disciplined by competition. There are parts of Google that do compete, like its cloud business and office suite, but it has a money printing machine that might get taken away.

Wall Street seemed pretty stunned, not just by this legal development, but also Apple’s brutal loss in its unfair competition case against Epic Games, which will also hit the phone giant. I watched a half an hour long CNBC panel talk about Google and Apple and their antitrust problems. Panelists debated whether Google’s monopoly is cooked, how badly Apple’s services revenues are going to be hit, and possible strategies going forward. And that’s without evening mentioning yet another legal development yesterday, which is that the Antitrust Division asked, in a totally different antitrust case that Google lost, to split apart the company’s advertising software division.

There are broader implications here. Most institutional investors have piled into seven big stocks - Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla - such that the name the “Magnificent 7” is now shorthand among investors for this basket. But now that whole world might be ending, and Google and Apple will have to, as a panelist put it, “reinvent itself.” A different commentator went further. "Maybe the best thing ultimately is that Alphabet is split up,” he said. “Maybe that's the best outcome for you as a shareholder."

One of the very first pieces I wrote for BIG, six years ago, was titled Break-ups and stock prices, and in it, I described why investors do well during break-ups.

The granddaddy of all monopolies and break-ups is Standard Oil, John D. Rockefeller’s oil monopoly at the turn of the century that structured the most important business of the era. In 1911, the Supreme Court broke his company into 34 components, many of which went on to be some of the most powerful companies in the world, such as Exxon, Mobil Pennzoil, Conoco, Chevron, and so forth. Shareholders did fantastically well in the break-up, with Rockefeller quintupling his wealth.As with Standard Oil, Google’s model is to leverage its market power across its various lines of business, to self-preference its own properties. There’s a lot of upside here in terms of retaining monopoly profits, but there is also a downside, which is that those lines of business, were they independent, would be more innovative and engage in profitable partnerships with firms outside the Google empire. As antitrust reduces the upside for collusion among Google subsidies, the cost of monopoly goes up. On the flip side, if YouTube, Search, Gmail, Cloud, Play, and Chrome became separate businesses, they’d be among the biggest companies in the world, and likely far more profitable than they are jammed together.

Why did Standard Oil’s component parts do so well? And was the break-up responsible for higher stock prices? The answer is that the older monopolistic business structure was inefficient, and breaking up the company helped unleash technological innovation in the industry by enabling the use of a relatively unimportant part of Standard’s portfolio: gasoline.

In 1909, a Standard-employed chemist named William Burton invented “thermal cracking,” which was a way to vastly improve the process of turning oil into gasoline. The Indiana branch applied to headquarters to put $1 million into developing the process, but HQ said no. The company primarily sold kerosene, and while cars were increasing demand for gasoline - what was then seen as a relatively useless byproduct of oil refining - such an investment was simply too risky to what had become a lazy, slothful monopoly. After the break-up, Standard Oil of Indiana simply went ahead and began using thermal cracking, and eventually the whole industry was licensing patents from the company. While stockholders did fantastically well, Indiana shareholders did even better. The era of cheap gas came, or at least was accelerated dramatically, by the break-up.

by Matt Stollar, BIG | Read more:

Image: NASDAQ

[ed. Interesting times. See also: If Google is forced to give up Chrome, what happens next? (The Register):]***

As well as demanding a Chrome sell-off, American prosecutors also hope to ban Google from paying other browser makers – including Moz – to be the default for web search. Mozilla can't survive without the cash it gets from Google search.

Don't believe me? Would you believe Mark Surman, President of Mozilla? In a blog post, giving Mozilla's response to DoJ's demands on Google, Surman said, "The big unintended consequence here is the handing of power from one dominant player to another. So, from Google Search to Microsoft, or Bing for example – while shutting out the smaller, independent challengers that actually drive browser innovation and offer web users privacy and choice.”

Without this money, Mozilla feels it couldn't develop and maintain Gecko, Firefox's web browser engine. That, in turn, means, Surman claimed, "it's game over for an open, independent web. Look, Microsoft — a $3 trillion company — already gave up its browser engine in 2019, and Opera gave up theirs in 2013. If Mozilla is forced out, Google's Chromium becomes the only cross-platform browser engine left."

:

: