And yet despite those warning signs, there has been nothing even remotely resembling an economic crash yet. Unemployment is rising a little bit but still extremely low, while the prime-age employment rate — my favorite single indicator of the health of the labor market — is still near all-time highs. The New York Fed’s GDP nowcast thinks that GDP growth is currently running at a little over 2%, while the Atlanta Fed’s nowcast puts it even higher.

One possibility is that everything is just fine with the economy — that Trump’s tariffs aren’t actually that high because of all the exemptions, and/or that economists are exaggerating the negative effects of tariffs in the first place. Weak consumer confidence could be a partisan “vibecession”, payroll slowdown could be from illegal immigrants being deported or leaving en masse, and manufacturing’s woes could be from some other sector-specific factor.

Another possibility is that tariffs are bad, but are being canceled out by an even more powerful force — the AI boom. The FT reports:

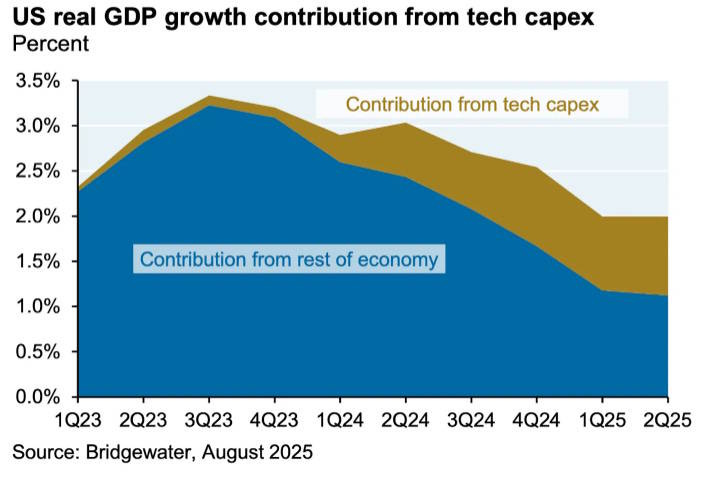

Pantheon Macroeconomics estimates that US GDP would have grown at a mere 0.6 per cent annualised rate in the first half were it not for AI-related spending, or half the actual rate.

Paul Kedrosky came up with similar numbers. Jason Furman does a slightly different calculation, and arrives at an even starker number: [ed. 0.1 percent]

And here’s an impressive chart:

The Economist writes:

[L]ook beyond AI and much of the economy appears sluggish. Real consumption has flatlined since December. Jobs growth is weak. Housebuilding has slumped, as has business investment in non-AI parts of the economy[.]And in a post entitled “America is now one big bet on AI”, Ruchir Sharma writes that “AI companies have accounted for 80 per cent of the gains in US stocks so far in 2025.” In fact, more than a fifth of the entire S&P 500 market cap is now just three companies — Nvidia, Microsoft, and Apple — two of which are basically big bets on AI.

Now as Furman points out, this doesn’t necessarily mean that without AI, the U.S. economy would be stalling out. If the economy wasn’t pouring resources into AI, it might be pouring them into something else, spurring growth that was almost as fast as what we actually saw. But it’s also possible that without AI, America would be crashing from tariffs. (...)

But despite Trump’s tariff exemptions, the AI sector could very well crash in the next year or two. And if it does, it could do a lot more than just hurt Americans’ employment prospects and stock portfolios.

If AI is really the only thing protecting America from the scourge of Trump’s tariffs, then a bust in the sector could change the country’s entire political economy. A crash and recession would immediately flip the narrative on Trump’s whole presidency, much as the housing crash of 2008 cemented George W. Bush’s legacy as a failure. And because Trump’s second term is looking so transformative, the fate of the AI sector could potentially determine the entire fate of the country.

by Noah Smith, Noahpinion | Read more:

Image: Derek Thompson/Bridgewater