Wednesday, October 12, 2022

Clare Woods (British, 1972), Silent Breakdown, 2022.

Tuesday, October 11, 2022

Baijiu

Baijiu (Chinese: 白酒; pinyin: báijiǔ; lit. 'white (clear) liquor'), also known as shaojiu (烧酒/燒酒), is a Chinese colourless liquor typically coming in between 35% and 60% alcohol by volume (ABV). Each type of baijiu uses a distinct type of qū for fermentation unique to the distillery for the distinct and characteristic flavour profile. (...)

Because of its clarity, baijiu can appear similar to several other East Asian liquors, e.g. Japanese shōchū (25%) or Korean soju (20–45%), but it often has a significantly higher alcohol content (35-60%). (...)

Global baijiu market

Baijiu is the world's bestselling liquor, with five billion litres sold in 2016, and 10.8 billion liters sold in 2018, more than whisky, vodka, gin, rum and tequila combined. As well as the most consumed liquor, with 1.2 billion nine-liter cases consumed in 2018, mostly in China - three times the global consumption of vodka.

Baijiu and Chinese business culture

Chinese business culture is known to be intense. It is believed that one's true colour is shown when intoxicated. Therefore, when negotiating a business partnership, there is a tradition of serving high-degree Baijiu on the dinner table, in order to judge one's trustworthiness.

Because of its clarity, baijiu can appear similar to several other East Asian liquors, e.g. Japanese shōchū (25%) or Korean soju (20–45%), but it often has a significantly higher alcohol content (35-60%). (...)

Global baijiu market

Baijiu is the world's bestselling liquor, with five billion litres sold in 2016, and 10.8 billion liters sold in 2018, more than whisky, vodka, gin, rum and tequila combined. As well as the most consumed liquor, with 1.2 billion nine-liter cases consumed in 2018, mostly in China - three times the global consumption of vodka.

Baijiu and Chinese business culture

Chinese business culture is known to be intense. It is believed that one's true colour is shown when intoxicated. Therefore, when negotiating a business partnership, there is a tradition of serving high-degree Baijiu on the dinner table, in order to judge one's trustworthiness.

by Wikipedia | Read more:

Image: Xiaomage de - Own work, CC BY-SA 4.0, https://commons.wikimedia.org

Fen, Bog & Swamp

The Pulitzer Prize-winning author Annie Proulx may be best known for her works of fiction, titles like The Shipping News and Brokeback Mountain.

But the 87-year-old author's newest book, Fen, Bog & Swamp: A Short History of Peatland Destruction and Its Role in the Climate Crisis, is a love letter to ecosystems that are rapidly disappearing — America's wetlands.

"Before the last wetlands disappear I wanted to know about this world we are losing," Proulx writes. "What was a world of fens, bogs and swamps and what meaning did these peatlands have, not only for humans but for all other life on Earth?" (...)

On what she learned in her research on fens, bogs and swamps

We tend to tag everything in the natural world in terms of what use it is to humans. And I was curious to know how it fits in with the great scheme of life, how it belonged to other parts of the world, how land and water and creatures and weather and climate change were all knit together. So that was the thing. I wasn't looking for benefits to humans as an explanation of anything. I was looking for how these guys work with each other. But also, I was very curious about human responses to these wetlands. So that took me into the history. And that, of course, was the fun part. Poking around with the people of the fen, the battle in the bogs and the various swamps in North America that were drained and made into productive soil.

On the history of peatland destruction

The peatlands have never been regarded as something that's a necessary part of life, but as an obstruction, something that's in the way. The ideal, of course, is agriculture. For most people, it wasn't a measure of any kind of utility to talk about a peat-producing wetland as helpful. So it was really a change of attitude more than anything else that I stumbled on. It's really hard to read about this sort of thing because people insist on thinking of the natural world only in terms of utility to humanity. We don't see ourselves as part of this system, but as lords and rulers of the natural world.

But the 87-year-old author's newest book, Fen, Bog & Swamp: A Short History of Peatland Destruction and Its Role in the Climate Crisis, is a love letter to ecosystems that are rapidly disappearing — America's wetlands.

"Before the last wetlands disappear I wanted to know about this world we are losing," Proulx writes. "What was a world of fens, bogs and swamps and what meaning did these peatlands have, not only for humans but for all other life on Earth?" (...)

On what she learned in her research on fens, bogs and swamps

We tend to tag everything in the natural world in terms of what use it is to humans. And I was curious to know how it fits in with the great scheme of life, how it belonged to other parts of the world, how land and water and creatures and weather and climate change were all knit together. So that was the thing. I wasn't looking for benefits to humans as an explanation of anything. I was looking for how these guys work with each other. But also, I was very curious about human responses to these wetlands. So that took me into the history. And that, of course, was the fun part. Poking around with the people of the fen, the battle in the bogs and the various swamps in North America that were drained and made into productive soil.

On the history of peatland destruction

The peatlands have never been regarded as something that's a necessary part of life, but as an obstruction, something that's in the way. The ideal, of course, is agriculture. For most people, it wasn't a measure of any kind of utility to talk about a peat-producing wetland as helpful. So it was really a change of attitude more than anything else that I stumbled on. It's really hard to read about this sort of thing because people insist on thinking of the natural world only in terms of utility to humanity. We don't see ourselves as part of this system, but as lords and rulers of the natural world.

by Julie Depenbock, NPR | Read more:

Image: Stephen B. Morton/AP

Labels:

Biology,

Education,

Environment,

history,

Literature,

Science

Monday, October 10, 2022

Porn on Tumblr is a Complicated Subject

In 2018, Tumblr announced a ban on "adult content." That call was made by Verizon, Tumblr's erstwhile owner, and to call the resulting mess "a shitshow" is an insult to good, hardworking shitshows all over the world.

Verizon enforced this policy with an automated filter, which was charged with analyzing images and categorizing them as "sexual" or "nonsexual." This is risible enough, like asking a computer to sort videos into "virtuous" or "sinful" but that was just for starters.

Verizon's ban included a ban on "female-presenting nipples" – a canonically hard-to-define category – but included exceptions for non-sexual nipple images. Hard to imagine that any serious, disinterested computer scientist promising that an algorithm could cleave "female-presenting nipples" from "male-presenting" ones, let alone decide which ones were "sexual" or not.

The filters were…not good. Verizon posted a selection of images that were explicitly permitted under its policies. That post was blocked by Tumblr's filter.

https://gizmodo.com/tumblrs-porn-filter-flags-its-own-examples-of-permitted-1831151178

It all comes down to chokepoints and liability. It's an open secret that Verizon's Tumblr porn ban was triggered by Apple's threat to block the Tumblr app for iOS users, in the name of preserving the App Store's "child friendly" policy. Remember when Steve Jobs announced that "Folks who want porn can buy an Android phone?" (...)

Playing chicken with Apple's App Store censors is a losing proposition. As Mullenweg describes, the interpretation of the App Store rules varies from day to day, depending on which person is evaluating your app. If you submit an app update, Apple might arbitrarily change its position on whether you're crossing a line and block your app instead. When that happens, it's a big deal. Mullenweg: "If Apple permanently banned Tumblr from the App Store, we’d probably have to shut the service down."

But it's not just the mobile duopoly that holds Tumblr's future in its hands. Mullenweg actually ranks payment processors as more powerful than mobile companies. Credit-card companies hate porn. Adding adult content back to Tumblr threatens Automattic's ability to process payments for all its services, from WordPress hosting to ad-free Tumblr subscriptions. Without money, the company couldn't last long, and its 2,000+ employees would be out of a job. (...)

But even if you bypass the mobile dupology and find a way to live without payment processing, setting up an adult-content-friendly site is still fraught. New rules (including SESTA/FOSTA) create civil and criminal liability for adult content hosting; as do rules against nonconsensual pornography (AKA "revenge porn"). (...)

Today, hosting adult content means finding specialized network connections, hosting, DDoS mitigation and more, because every layer of the "stack" of services other kinds of sites can rely on has been turning into an oligopoly with uniform anti-sex policies.

Verizon enforced this policy with an automated filter, which was charged with analyzing images and categorizing them as "sexual" or "nonsexual." This is risible enough, like asking a computer to sort videos into "virtuous" or "sinful" but that was just for starters.

Verizon's ban included a ban on "female-presenting nipples" – a canonically hard-to-define category – but included exceptions for non-sexual nipple images. Hard to imagine that any serious, disinterested computer scientist promising that an algorithm could cleave "female-presenting nipples" from "male-presenting" ones, let alone decide which ones were "sexual" or not.

The filters were…not good. Verizon posted a selection of images that were explicitly permitted under its policies. That post was blocked by Tumblr's filter.

https://gizmodo.com/tumblrs-porn-filter-flags-its-own-examples-of-permitted-1831151178

It wasn't just that Tumblr's AI couldn't turn its unblinking eye upon the nipples casting their shadows upon the wall of Plato's Cave and divine their true nature. Tumblr's AI thought everything was a nipple – or some other potentially "adult" body-part. (...)

Verizon was not good at running Tumblr, which isn't a surprise, because Verizon's core competencies are lobbying and union-busting. Eventually the company wrote down its online media assets, taking a $4.6B loss...

Tumblrites didn't know what to make of the writedown. There was a lot of trepidation, sure, because even after years of mismanagement by Yahoo and then Verizon, Tumblr was still a community that mattered to its members.

What's more, with the writedown, there was the possibility that someone else – someone less Verizony – would buy the company. That happened! Automattic, creators of WordPress, announced that they would buy Tumblr. Tumblr's filter blocked the announcement...

When Automattic took over Tumblr, there was a lot of hope that the adult content ban would be reversed. Tumblr's adult communities had been hugely important in creating and promulgating a sex-positive, queer-positive, sex-worker-respecting platform, utterly unlike anything else online.

The impact of contributing to and participating in these adult communities can't be overstated. In Tumblr Porn, Ana Valens offers a memoir of how profoundly Tumblr's sex-positive spaces ("vanguard of a user-generated sexual revolution") affected her life:

Verizon's sex ban didn't just shut those communities down – it consigned them to the memory-hole, blocking the archivists who scrambled to preserve them...

But despite the importance of sex to Tumblr's success and the manifest idiocy of Verizon's ban, Automattic did not bring back the adult content, and made it clear they had no immediate plans to change that position.

Now, five years later, Tumblr has made its first tentative moves to open the platform to NSFW materials, with a new dashboard that lets views opt into adult content and a labeling system that lets posters flag their uploads:

https://photomatt.tumblr.com/post/696578252906659840/staff-introducing-community-labels-as-you

This is a far cry from Tumblr's original full-throated, wide-open NSFW policy, and there's a reason for that. In a new post, Automattic CEO Matt Mullenweg describes why Tumblr's old "go nuts, show nuts" policy can't work today:

Verizon was not good at running Tumblr, which isn't a surprise, because Verizon's core competencies are lobbying and union-busting. Eventually the company wrote down its online media assets, taking a $4.6B loss...

Tumblrites didn't know what to make of the writedown. There was a lot of trepidation, sure, because even after years of mismanagement by Yahoo and then Verizon, Tumblr was still a community that mattered to its members.

What's more, with the writedown, there was the possibility that someone else – someone less Verizony – would buy the company. That happened! Automattic, creators of WordPress, announced that they would buy Tumblr. Tumblr's filter blocked the announcement...

When Automattic took over Tumblr, there was a lot of hope that the adult content ban would be reversed. Tumblr's adult communities had been hugely important in creating and promulgating a sex-positive, queer-positive, sex-worker-respecting platform, utterly unlike anything else online.

The impact of contributing to and participating in these adult communities can't be overstated. In Tumblr Porn, Ana Valens offers a memoir of how profoundly Tumblr's sex-positive spaces ("vanguard of a user-generated sexual revolution") affected her life:

Verizon's sex ban didn't just shut those communities down – it consigned them to the memory-hole, blocking the archivists who scrambled to preserve them...

But despite the importance of sex to Tumblr's success and the manifest idiocy of Verizon's ban, Automattic did not bring back the adult content, and made it clear they had no immediate plans to change that position.

Now, five years later, Tumblr has made its first tentative moves to open the platform to NSFW materials, with a new dashboard that lets views opt into adult content and a labeling system that lets posters flag their uploads:

https://photomatt.tumblr.com/post/696578252906659840/staff-introducing-community-labels-as-you

This is a far cry from Tumblr's original full-throated, wide-open NSFW policy, and there's a reason for that. In a new post, Automattic CEO Matt Mullenweg describes why Tumblr's old "go nuts, show nuts" policy can't work today:

It all comes down to chokepoints and liability. It's an open secret that Verizon's Tumblr porn ban was triggered by Apple's threat to block the Tumblr app for iOS users, in the name of preserving the App Store's "child friendly" policy. Remember when Steve Jobs announced that "Folks who want porn can buy an Android phone?" (...)

Playing chicken with Apple's App Store censors is a losing proposition. As Mullenweg describes, the interpretation of the App Store rules varies from day to day, depending on which person is evaluating your app. If you submit an app update, Apple might arbitrarily change its position on whether you're crossing a line and block your app instead. When that happens, it's a big deal. Mullenweg: "If Apple permanently banned Tumblr from the App Store, we’d probably have to shut the service down."

But it's not just the mobile duopoly that holds Tumblr's future in its hands. Mullenweg actually ranks payment processors as more powerful than mobile companies. Credit-card companies hate porn. Adding adult content back to Tumblr threatens Automattic's ability to process payments for all its services, from WordPress hosting to ad-free Tumblr subscriptions. Without money, the company couldn't last long, and its 2,000+ employees would be out of a job. (...)

But even if you bypass the mobile dupology and find a way to live without payment processing, setting up an adult-content-friendly site is still fraught. New rules (including SESTA/FOSTA) create civil and criminal liability for adult content hosting; as do rules against nonconsensual pornography (AKA "revenge porn"). (...)

Today, hosting adult content means finding specialized network connections, hosting, DDoS mitigation and more, because every layer of the "stack" of services other kinds of sites can rely on has been turning into an oligopoly with uniform anti-sex policies.

Labels:

Business,

Journalism,

Law,

Media,

Photos,

Technology

Now Comes the Hard Part

"Given the damage already wrought on the Nasdaq, there is a natural inclination to buy the dip. We believe that there is little merit in doing so. The current market climate is characterized by extremely unfavorable valuations, unfavorable trend uniformity, and hostile yield trends. This combination is what we define as a Crash Warning, and this climate has historically occurred in less than 4% of market history. That 4% of market history includes the 1929 crash and the 1987 crash, as well as a number of less memorable crashes and panics. We prefer to hedge until there is a rational prospect for market gains. When valuations are favorable, stocks are attractive from the standpoint of ‘investment’ – meaning that stock prices are attractive compared to the conservatively discounted value of cash flows which will be thrown off in the future. When trend uniformity is favorable, stocks are attractive from the standpoint of ‘speculation’ – meaning that regardless of valuation, investors are displaying an increased tolerance for risk which favors a further advance in prices.”– John P. Hussman, Ph.D., Hussman Investment Research & Insight, November 15, 2000Surveying the current condition of the financial markets, we presently observe a combination of still historically-extreme valuations, rising yet still only normalizing interest rates, measurably inadequate risk-premiums in both equities and bonds, and ragged, unfavorable market internals, suggesting continued risk-aversion among investors. In this context, it’s worth repeating what I’ve noted across decades of market cycles – a market collapse is nothing but risk-aversion meeting an inadequate risk-premium; rising yield pressure meeting an inadequate yield.

Emphatically, short-term oversold conditions can be followed anytime by fast, furious advances to clear those conditions. As I discuss in more detail below, we also pay ongoing attention to the uniformity or divergence of market internals (what I used to call “trend uniformity”). The above quote from 2000 explains why. “When trend uniformity is favorable, stocks are attractive from the standpoint of ‘speculation’ – meaning that regardless of valuation, investors are displaying an increased tolerance for risk, which favors a further advance in prices.” In that context, the only thing a decade of zero-interest policy did was to remove any reliable upper “limit” to valuations or risk-taking. Even we’ve adapted our discipline to reflect that reality. The danger comes when investors continue to ignore extreme valuations even after investor psychology has shifted to risk-aversion.

The opening quote is from November 15, 2000. From its March 24, 2000 bull market peak of 4816.35, the technology-heavy Nasdaq 100 index had already plunged by -36%. Yet from that lower level, it would go on to lose another -68% by October 2002. That outcome should not have been a surprise. On March 7, 2000, I observed, “Over time, price/revenue ratios come back in line. Currently, that would require an 83% plunge in tech stocks (recall the 1969-70 tech massacre). The plunge may be muted to about 65% given several years of revenue growth. If you understand values and market history, you know we’re not joking.”

At the 2000 market peak, a broad range of reliable valuations implied negative estimated S&P 500 total returns for over a decade, as they did in 1929, and as they unfortunately do today. This is what a decade of zero interest rate policy has set up for investors.

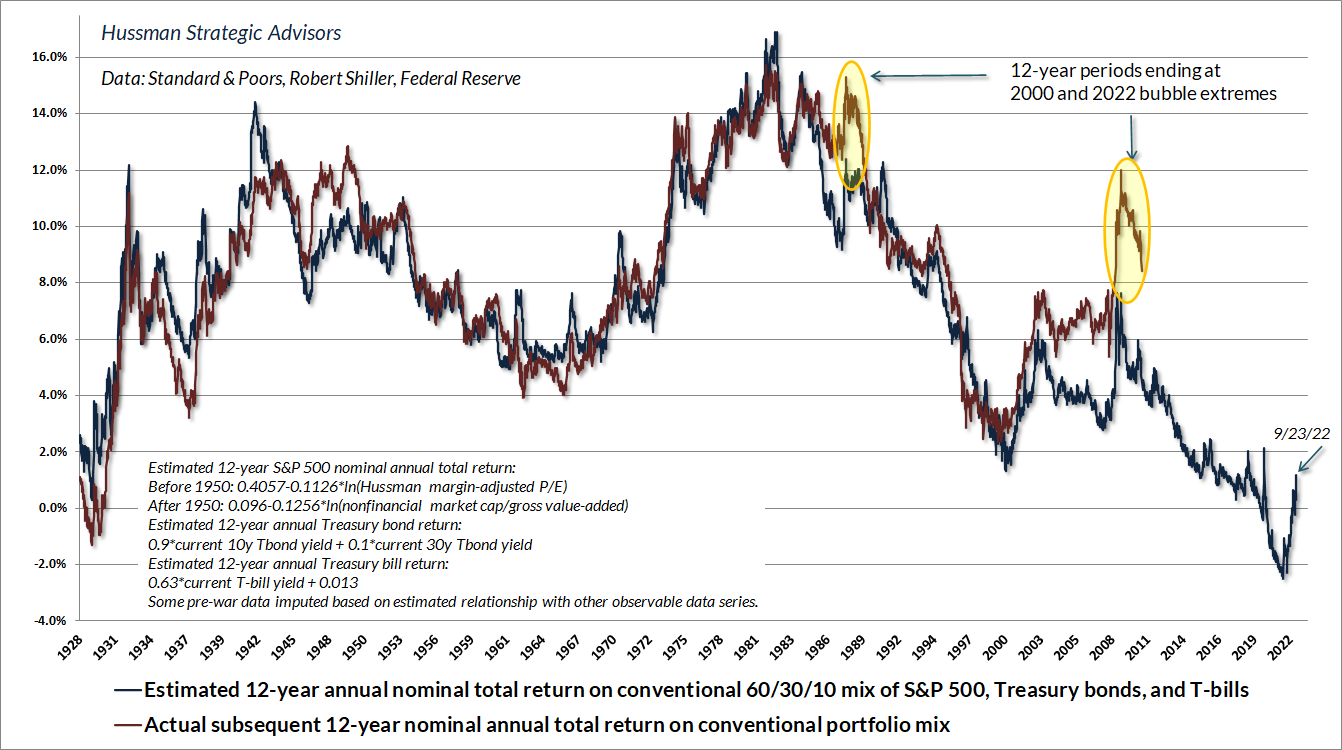

The chart below shows our best estimate of the expected 12-year total return for a conventional passive investment portfolio invested 60% in the S&P 500, 30% in Treasury bonds, and 10% in Treasury bills. Notice that recent market losses have markedly improved prospective returns for a passive investment allocation, yet only to a level of about 1% annually. Indeed, the expected return of the S&P 500 component is still negative.

A decade of deranged Federal Reserve zero-interest rate policy has exerted what former FDIC chair Sheila Bair recently described as a “corrosive” effect on the financial markets and the economy. Faced with zero interest rates, investors became convinced that they had no alternative but to speculate. As speculation drove valuations far beyond their historical norms, investors embraced the idea that valuations simply did not matter. Advancing prices in the rear-view mirror seemed to provide evidence that zero-interest rate cash was an unacceptable alternative to passively investing in stocks, regardless of price.

In 1934, following an 89% market collapse during the Great Depression, Benjamin Graham and David Dodd detailed the beliefs that investors had adopted during the speculative runup to the 1929 peak. They are identical to what we’ve observed in recent years. First, “that the records of the past were proving an undependable guide to investment”; second, “that the rewards offered by the future had become irresistibly alluring”; and third, “a companion theory that common stocks represented the most profitable and therefore the most desirable media for long-term investment.” Taken together, these beliefs ultimately contributed to “the notion that the desirability of a common stock was entirely independent of its price.” Surveying the rubble, Graham and Dodd observed, “The results of such a doctrine could not fail to be tragic.”

Encouraged by the same beliefs, investors drove S&P 500 valuations to levels even beyond the 1929 and 2000 extremes – levels that we associate with over a decade of negative expected returns even from current levels. At present, the stock and bond markets have declined enough to restore positive expected returns for a diversified portfolio that includes both stocks and bonds, but just barely. (...)

Keep in mind that periods of hypervaluation are not resolved in one fell swoop. To imagine otherwise is to minimize the discomfort, uncertainty, and alternation between fear and hope that the collapse of a bubble entails. The way that bubbles unfold into preposterous losses – 89%, 82%, 50%, 55%, and I expect this time between 50-70% – is through multiple periods of decline and even free-fall, punctuated by fast, furious “clearing rallies” that offer hope all the way down. By the time investors experience the second or third free-fall – and we’ve hardly experienced the first one yet – the psychology of investors is not “this is the bottom” – but rather, “there is no bottom.”

Aside from ignoring valuations and market internals, one of the behaviors that will get you eaten in a bear market is placing too much confidence in any single ‘capitulation.’ Speculative episodes typically unwind in waves. The steeper the starting valuations, the more waves one typically observes.– John P. Hussman, Ph.D., Making Friends with Bears Through Math, June 1, 2022Very little confidence in the equity market has been shaken – yet. Consider the surveys from the American Association of Individual Investors (AAII). Sentiment – talk – is lopsided at 60.9% bearish and just 17.7% bullish. Portfolio allocations – actions – are an entirely different story, with an above-average 64.5% allocation to equities, nowhere close to the 40% equity allocations that AAII respondents reported at the 1990, 2002, and 2009 market lows. Put simply, investors are clearly becoming uncomfortable, but in practice, they continue to defend the hill of extreme valuations, in the apparent belief that whatever risk remains must be short-term in nature. “After all,” investors have been trained to repeat, “it always comes back.” It’s easy to forget that the speculative valuations can be followed by S&P 500 returns below T-bills, and even below zero, for more than a decade. (...)

My advice for those who insist that profit margins are inexorably rising over time is simple: quantify it. Even if one runs an upward-sloping trendline through S&P 500 profit margins, one can only justify valuations 20-30% above historical norms, not 2.3-2.5 times those norms. For those that go further and insist that S&P 500 reported profit margins will remain at permanent record highs above 12%, despite a historical average of less than 7%, never exceeding 10% except amid trillions of dollars in pandemic subsidies since 2020, I can’t really help much, because these investors have already decided that history doesn’t matter.

by John P. Hussman, Ph.D, Hussman Funds | Read more:

Image: Hussman Strategic Advisors

No Turning Back

World’s largest radioactive waste melter starts in Central WA

There’s no turning back at the Hanford site’s vitrification plant after the heat-up of the world’s largest melter for radioactive waste started Saturday, 20 years after construction of the plant began.

The 300-ton melter now must remain hot continuously around the clock as it initially makes practice glass and eventually starts glassifying radioactive waste for the first time at the nuclear reservation.

Glassification prepares the waste for permanent disposal. (...)

The Department of Energy’s goal is to start vitrifying radioactive waste stored in underground tanks, some since World War II, by the end of 2023.

The 580-square-mile Hanford nuclear reservation near Richland in Central Washington produced about two-thirds of the nation’s plutonium for its nuclear weapons program from World War II through the Cold War.

Uranium fuel irradiated at Hanford was chemically reprocessed to remove plutonium. The mix of radioactive and other hazardous chemical waste from reprocessing has been stored in underground tanks, many of them prone to leaking. They hold 56 million gallons of the waste until it can be treated for disposal.

The melter that is being heated up is the first of two at the $17 billion plant’s Low Activity Waste Facility and is expected to operate continuously for at least five years.

by Annette Cary, Tri-City Herald/Seattle Times | Read more:

Image: Anna King/Northwest News Network via:

There’s no turning back at the Hanford site’s vitrification plant after the heat-up of the world’s largest melter for radioactive waste started Saturday, 20 years after construction of the plant began.

The 300-ton melter now must remain hot continuously around the clock as it initially makes practice glass and eventually starts glassifying radioactive waste for the first time at the nuclear reservation.

Glassification prepares the waste for permanent disposal. (...)

The Department of Energy’s goal is to start vitrifying radioactive waste stored in underground tanks, some since World War II, by the end of 2023.

The 580-square-mile Hanford nuclear reservation near Richland in Central Washington produced about two-thirds of the nation’s plutonium for its nuclear weapons program from World War II through the Cold War.

Uranium fuel irradiated at Hanford was chemically reprocessed to remove plutonium. The mix of radioactive and other hazardous chemical waste from reprocessing has been stored in underground tanks, many of them prone to leaking. They hold 56 million gallons of the waste until it can be treated for disposal.

The melter that is being heated up is the first of two at the $17 billion plant’s Low Activity Waste Facility and is expected to operate continuously for at least five years.

by Annette Cary, Tri-City Herald/Seattle Times | Read more:

Image: Anna King/Northwest News Network via:

[ed. See also: Turning Hanford’s nuclear waste into glass logs would emit toxic vapors, says document (OPB):]

Miller: I noted that amount of radioactive waste, a number I can’t really fathom, 56 million gallons of this waste. How is it being stored right now?

Stang: It is stored in 177 huge underground tanks that are located in the central part of the site.

Miller: One big fear is that this waste could leach out into the ground, the groundwater, potentially into the Columbia River. How much is that happening?

Stang: At least one million gallons has leaked out into the ground. It takes a while for it to seep down to the ground water, the aquifer, which is 100-200ft beneath the surface, and then it flows toward the Columbia River which is about seven miles away. Some of it’s already reached the Columbia River.

Miller: I noted that amount of radioactive waste, a number I can’t really fathom, 56 million gallons of this waste. How is it being stored right now?

Stang: It is stored in 177 huge underground tanks that are located in the central part of the site.

Miller: One big fear is that this waste could leach out into the ground, the groundwater, potentially into the Columbia River. How much is that happening?

Stang: At least one million gallons has leaked out into the ground. It takes a while for it to seep down to the ground water, the aquifer, which is 100-200ft beneath the surface, and then it flows toward the Columbia River which is about seven miles away. Some of it’s already reached the Columbia River.

The Honest Broker

This particular project brought me to China. I was trying to set up an operation in a remote province, far outside my comfort zone, and couldn’t seem to figure out how to maneuver among the various interests and stakeholders. My patron was one of the wealthiest men in Hong Kong, and by using his contacts, I gained access to people who normally operate behind layers of intermediaries and gatekeepers. But even these contacts led me on an endless runaround. My sources gave me conflicting advice and confusing directions. Everything felt wrong and nothing seemed quite on the level.

I knew I needed help, but had run out of options. Then I met the drunk Australian.

He wasn’t a contact on my list, and I can’t even remember his name. This was a chance encounter in a hotel bar late at night. But this hard-drinking Australian was talkative and had interesting things to say. He had spent most of his life bouncing around the capitals of Asia, and was a high-level operator in his own spheres. He bragged about his insider’s knowledge, and claimed—with some accuracy, as I came to discover—that he knew how to maneuver in China better than the clueless Westerners who were now appearing on the scene. He had traced the secret paths to power and knew all the dangerous mistakes amateurs always make.

He reeled off a list of them. “You go into a province or city and flash around some money, then expect the local officials will help you? Forget it. They’ll rob you blind, and even make you bribe them for the privilege. Same goes for the party leaders. From each according to his ability, and all that, my friend. And forget about lawyers—the legal protections here are like this”—he held up his empty glass, then flipped it over as if to emphasize the nothingness of what he was offering to the gods of Marx and Mao. “As for the bankers, you might as well call them wankers.”

The empty glass was also a sign that I needed to order another round of the local brew, and I quickly complied. My new friend fell into a meditative silence until further libations arrived. Finally, after another sip on the stomach-destroying glass of baijiu that passed for spirits at our watering hole, I asked the obvious question.

“So what do I do? Who can I trust?”

“That’s easy, mate. You need to find the Honest Broker.”

This sounded appealing enough, but I had zero idea what my new acquaintance was talking about. He might just as well have told me to go to Oz and consult with the Wizard.

“Who, exactly, is this Honest Broker?”

“There’s at least one in every city. But don’t expect their business cards to say ‘Honest Broker’—that’s just what I call them. But that’s exactly what they are. Sometimes they don’t even have an official position. But they are the key to everything.”

He proceeded to explain how Honest Brokers play a hidden but vital role in communities without a history of legal protections and stable institutions. Their influence and power is built solely on a reputation for straight talk and trustworthy dealings. “They are true brokers, intermediaries between others. They aren’t going to participate in your deal, no matter what it is. They are go-betweens, really. But do not underestimate the power of this kind of brokerage. Whatever you need—a loan, a building permit, political influence, a place to land a private jet, whatever—they will introduce you to the right people and steer you away from the sharks.

“And they do this for a very simple reason: their prestige is enhanced by making these connections. In many cases, they don’t even want to be paid. Or let me put that differently—you repay them by becoming a trusted contact for them in future dealings. The Honest Broker may help you for free right now, but don’t be surprised to get asked for assistance on something completely different months or even years later. You Yanks have a hard time grasping it, and are always looking for shortcuts. But the Honest Broker plays the long-term game, mate.

“Find your Honest Broker, and your problems will be solved.”

This proved to be valuable advice, worth far more than the cost of drinks. Over the next few weeks, I changed my approach completely. I made inquiries, compared notes, and finally found my Honest Broker—who did solve my problems, just as promised. My mission accomplished, I returned back home to California and tried to forget all about it.

I put my passport out of sight. My world shrank back to manageable dimensions, and my days were spent at the two keyboards, the piano and the word processor. I was getting back into my music groove again.

A long time went by before I realized the real importance of what I had learned in China, and how it applied to the other half of my split and fractured life.

I knew I needed help, but had run out of options. Then I met the drunk Australian.

He wasn’t a contact on my list, and I can’t even remember his name. This was a chance encounter in a hotel bar late at night. But this hard-drinking Australian was talkative and had interesting things to say. He had spent most of his life bouncing around the capitals of Asia, and was a high-level operator in his own spheres. He bragged about his insider’s knowledge, and claimed—with some accuracy, as I came to discover—that he knew how to maneuver in China better than the clueless Westerners who were now appearing on the scene. He had traced the secret paths to power and knew all the dangerous mistakes amateurs always make.

He reeled off a list of them. “You go into a province or city and flash around some money, then expect the local officials will help you? Forget it. They’ll rob you blind, and even make you bribe them for the privilege. Same goes for the party leaders. From each according to his ability, and all that, my friend. And forget about lawyers—the legal protections here are like this”—he held up his empty glass, then flipped it over as if to emphasize the nothingness of what he was offering to the gods of Marx and Mao. “As for the bankers, you might as well call them wankers.”

The empty glass was also a sign that I needed to order another round of the local brew, and I quickly complied. My new friend fell into a meditative silence until further libations arrived. Finally, after another sip on the stomach-destroying glass of baijiu that passed for spirits at our watering hole, I asked the obvious question.

“So what do I do? Who can I trust?”

“That’s easy, mate. You need to find the Honest Broker.”

This sounded appealing enough, but I had zero idea what my new acquaintance was talking about. He might just as well have told me to go to Oz and consult with the Wizard.

“Who, exactly, is this Honest Broker?”

“There’s at least one in every city. But don’t expect their business cards to say ‘Honest Broker’—that’s just what I call them. But that’s exactly what they are. Sometimes they don’t even have an official position. But they are the key to everything.”

He proceeded to explain how Honest Brokers play a hidden but vital role in communities without a history of legal protections and stable institutions. Their influence and power is built solely on a reputation for straight talk and trustworthy dealings. “They are true brokers, intermediaries between others. They aren’t going to participate in your deal, no matter what it is. They are go-betweens, really. But do not underestimate the power of this kind of brokerage. Whatever you need—a loan, a building permit, political influence, a place to land a private jet, whatever—they will introduce you to the right people and steer you away from the sharks.

“And they do this for a very simple reason: their prestige is enhanced by making these connections. In many cases, they don’t even want to be paid. Or let me put that differently—you repay them by becoming a trusted contact for them in future dealings. The Honest Broker may help you for free right now, but don’t be surprised to get asked for assistance on something completely different months or even years later. You Yanks have a hard time grasping it, and are always looking for shortcuts. But the Honest Broker plays the long-term game, mate.

“Find your Honest Broker, and your problems will be solved.”

This proved to be valuable advice, worth far more than the cost of drinks. Over the next few weeks, I changed my approach completely. I made inquiries, compared notes, and finally found my Honest Broker—who did solve my problems, just as promised. My mission accomplished, I returned back home to California and tried to forget all about it.

I put my passport out of sight. My world shrank back to manageable dimensions, and my days were spent at the two keyboards, the piano and the word processor. I was getting back into my music groove again.

A long time went by before I realized the real importance of what I had learned in China, and how it applied to the other half of my split and fractured life.

by Ted Gioia, The Honest Broker | Read more:

Image: Ted Gioia

Labels:

Business,

Critical Thought,

Culture,

Journalism,

Music,

Relationships

Sunday, October 9, 2022

One Take

[ed. This is awesome. Expand and keep rewinding/replaying to see all the details.]

In the scene, guest star Riki Lindhome plays Shaina, a woman who’s inspired to turn her life around after watching an episode of “Mr. Pickles’ Puppet Time,” the kids’ show hosted by Carrey’s character. In one take, viewers see Lindhome’s world evolve as she renovates her apartment, starts exercising, invites friends over and celebrates her new life.

Behind the scenes, the “Kidding” crew physically transformed the set multiple times in real time. In this exclusive clip, the network gives a side-by-side comparison to how the scene looked on camera, vs. the hairy moments behind the camera as Lindhome and the show’s crew managed to pull it off.

by Michael Schneider, IndieWire | Read more:

Video: Kidding

[ed. I went searching for this post to show to a friend... clicked on the Movies category to the right and up it came, along with a few other interesting posts I'd forgotten about (below) - My Dinner With Andre; Network/Picketty; Jane Fonda, etc. Check out the other categories too, there's a lot of good stuff in there.]

Same As It Ever Was: Capital in the Twenty-First Century

“There is no America. There is no democracy. There is only IBM, and ITT, and AT&T, and DuPont, Dow, Union Carbide, and Exxon. Those are the nations of the world today. What do you think the Russians talk about in their councils of state, Karl Marx? They get out their linear programming charts, statistical decision theories, Minimax solutions, and compute the price-cost probabilities of their transactions and investments, just like we do. We no longer live in a world of nations and ideologies, Mr. Beale. The world is a college of corporations, inexorably determined by the immutable bylaws of business. The world is a business, Mr. Beale. It has been since man crawled out of the slime.”

― from Network, screenplay by Paddy Chayefsky

And thus spoke “Arthur Jensen”, CEO of fictional media conglomerate “CCA” in what is for me the most defining scene in director Sidney Lumet’s prescient 1976 satire. Jensen (wonderfully played by Ned Beatty) is calling “mad prophet of the airwaves” Howard Beale (Peter Finch) on the carpet for publicly exposing a potential buyout of CCA by shadowy Arab investors. Cognizant that Beale is crazy as a loon, yet a cash cow for the network, Jensen hands him a new set of stone tablets from which he is to preach (the corporate cosmology of Arthur Jensen). It is screenwriter Chayefsky’s finest monologue. (...)

So how did the world become “…a college of corporations, inexorably determined by the immutable bylaws of business”? And come hell, high water, or killer virus, why is it that “Thou shalt rally the unwashed masses to selflessly do their part to protect the interests of the Too Big to Fail” (whether it’s corporations, the dynastic heirs of the 1% or the wealth management industry that feeds off of them) remains the most “immutable bylaw” of all?

It’s not like “the people” haven’t tried through history to level the playing field between the “haves” and the “have-nots”. Take, for example the French Revolution, which ultimately did not change the status quo, despite the initial “victory” of the citizenry over the power-hoarding aristocracy. As pointed out in Justin Pemberton’s documentary Capital in the Twenty-First Century, while there was initial optimism in the wake of the revolution that French society would default to an egalitarian model, it never really took.

Why? Because the architects of the revolution overlooked what is really needed to establish and maintain true equality: strong political institutions, an education system, health care (*sigh*), a transport system, and a tax system that targets the highest incomes.

Same as it ever was. (...)

As the film was produced before Covid-19 shut down much of the world’s economy, it does not delve into the possibilities of a post-pandemic restructuring. As luck would have it though, a fitting postscript for my review presented itself the day after I screened the film when Thomas Piketty popped up as a guest on The Daily Social Distancing Show with Trevor Noah. Curiously, he was not there to promote the documentary, but did share some interesting thoughts on possible post-pandemic shifts in current economic models:

[Piketty] I think this is one of these crises we see that can really change people’s views about the world and how we should organize the economy. What we see at this stage is a big increase in inequality. […]

With this crisis right now, I think people are going to be asking for proof that we can also use this power of money creation and the Federal Reserve in order to invest in people; investing in hospitals, in public infrastructure, increasing wages for unskilled workers…all the low-wage and middle-wage people which we see today are necessary for our existence and our society.

In the longer run, of course we cannot just pay for everything with public debt and money creation…so we have to re-balance our tax system. […]

In the past three decades in America, we’ve seen a lot more billionaires; but we’ve seen a lot less growth. So in the end, the idea that you get prosperity out of inequality just didn’t work out. […]

[Noah] What do you think about the “worst case scenario”, then…if you live in a world where the inequality just keeps growing; the rich get richer and the poor get poorer, what do we inevitably get to?

[Piketty] Well to me the worst scenario is that some skilled politicians like Donald Trump, or [President of the National Front Party] Marie Le Pen in my country in France will use the frustration coming from wage and income stagnation and rising inequality in order to point out some foreign workers or “some people” [are] to blame. […] And this is what really worries me-that if we don’t change our discourses, if we don’t come up with another economic model that is more equitable, more sustainable…then, in effect we re-open the door for all this nationalist discourse.

by Dennis Hartley, Den of Cinema | Read more:

Image: Network/YouTube

Jane Fonda: ‘I'm Very Rarely Afraid. Maybe Emotional Intimacy Scares Me’

When Jane Fonda was arrested in Washington DC last December, days shy of her 82nd birthday, there was an overwhelming sense of history repeating, and not just because this was the fifth time she had been arrested in almost as many weeks. Fonda was taking part in her very public – and ongoing, albeit now online – protest against what she sees as the US government’s criminal inertia over the climate crisis. When he heard about Fonda’s arrests, President Donald Trump crowed to a rally: “They arrested Jane Fonda – nothing changes! I remember 30, 40 years ago they arrested her. She’s always got the handcuffs on, oh man.”

Trump was partially right, although he underestimated the time. Fonda was first arrested in 1970; half a century later she is still protesting, still being arrested and still being mocked by US presidents. On Richard Nixon’s notorious White House tapes, he can be heard discussing Fonda in 1971, dismissing her even more public protests against US involvement in the Vietnam war. “Jane Fonda. What in the world is the matter with Jane Fonda?” he said. “I feel so sorry for Henry Fonda, who’s a nice man. She’s a great actress. She looks pretty. But boy, she’s often on the wrong track.” Less than a year later, Nixon would be taped plotting the Watergate cover-up. Someone should tell Trump that Fonda has an excellent track record of winning the long game, and that her critics don’t.

As an adult, Fonda swapped one dominating male figure for three: her husbands. When she was with the film director Roger Vadim, who was previously married to Brigitte Bardot, she became a Bardot-esque sex kitten in Barbarella and engaged in threesomes with him, eventually leaving him after the birth of their daughter, Vanessa. Married to Hayden, she took to the barricades with him. When she married media mogul Ted Turner in 1991, she swapped her off-grid life for that of a billionaire’s wife.

“I always wanted to date someone who was the opposite of my father,” she explains. “I didn’t realise that, in the ways that really mattered, I picked men who were just like him because they all had a hard time with intimacy.” (...)

In the past, Fonda has said that she allied herself to strong men because she felt so unsure of herself. But isn’t it more likely that she needed strong people because she is an extraordinarily strong character herself?

“Oh yeah, whenever I’ve been with men who are not strong I’ve had a really hard time,” she agrees. “I’m now five years older than my dad was when he died and I’ve realised that I am, in fact, stronger than he was. I’m stronger than all the men that I’ve been married to.”

by Hadley Freeman, The Guardian | Read more:

Trump was partially right, although he underestimated the time. Fonda was first arrested in 1970; half a century later she is still protesting, still being arrested and still being mocked by US presidents. On Richard Nixon’s notorious White House tapes, he can be heard discussing Fonda in 1971, dismissing her even more public protests against US involvement in the Vietnam war. “Jane Fonda. What in the world is the matter with Jane Fonda?” he said. “I feel so sorry for Henry Fonda, who’s a nice man. She’s a great actress. She looks pretty. But boy, she’s often on the wrong track.” Less than a year later, Nixon would be taped plotting the Watergate cover-up. Someone should tell Trump that Fonda has an excellent track record of winning the long game, and that her critics don’t.

Still, being derided by the most powerful people on the planet must take some getting used to. Does Fonda ever feel scared?

“The fear part – I don’t know why this is true, but I am very rarely afraid. I’ve been in all kinds of situations: I’ve been shot at, I’ve had bombs dropped on me; but I tend not to be afraid. Maybe emotional intimacy scares me. That’s where my fear lives,” she says from her home in Los Angeles, with a self-mocking laugh. (...)

She has won two Oscars (for Klute and Coming Home), but Fonda’s extraordinary life has, for many, long overshadowed her career. To some, she will for ever be Hanoi Jane; for others, she is the queen of aerobics. To this day, Jane Fonda’s Workout remains one of the biggest-selling home videos ever. But Fonda only made it to raise money for the Campaign for Economic Democracy (CED), the non-profit organisation she ran with her second husband, the radical left-wing firebrand Tom Hayden. Wealthy housewives doing pelvic thrusts to the Workout had no idea they were contributing to a cause that wasn’t a million miles from socialism, and Fonda raised more than $17m for the CED. (In classic man-of-the-left style, Hayden occasionally made “disparaging remarks” about the Workout. “I would just think, OK, I’m vain. [But] where else would you have got $17m?” Fonda writes in her 2005 memoir, My Life So Far.)

As if to prove how little things change, during lockdown Fonda has been making workout TikToks to raise awareness of her environmental protests, still exercising for activism at 82. “It’s fun and it attracts a younger demographic, doing TikTok,” she says, with the breeziness of one fully fluent in social media. (...)

While it is easy to mock celebrity activism, no one can doubt Fonda’s bona fides; she has been shouting about the environment since the 1960s, after learning that car emissions damaged the atmosphere. But why keep doing it? Why endure prison with its metal slab of a bed (“I’m quite bony, so that was painful,” she admits) instead of enjoying a nice, quiet life in her ninth decade?

She has won two Oscars (for Klute and Coming Home), but Fonda’s extraordinary life has, for many, long overshadowed her career. To some, she will for ever be Hanoi Jane; for others, she is the queen of aerobics. To this day, Jane Fonda’s Workout remains one of the biggest-selling home videos ever. But Fonda only made it to raise money for the Campaign for Economic Democracy (CED), the non-profit organisation she ran with her second husband, the radical left-wing firebrand Tom Hayden. Wealthy housewives doing pelvic thrusts to the Workout had no idea they were contributing to a cause that wasn’t a million miles from socialism, and Fonda raised more than $17m for the CED. (In classic man-of-the-left style, Hayden occasionally made “disparaging remarks” about the Workout. “I would just think, OK, I’m vain. [But] where else would you have got $17m?” Fonda writes in her 2005 memoir, My Life So Far.)

As if to prove how little things change, during lockdown Fonda has been making workout TikToks to raise awareness of her environmental protests, still exercising for activism at 82. “It’s fun and it attracts a younger demographic, doing TikTok,” she says, with the breeziness of one fully fluent in social media. (...)

While it is easy to mock celebrity activism, no one can doubt Fonda’s bona fides; she has been shouting about the environment since the 1960s, after learning that car emissions damaged the atmosphere. But why keep doing it? Why endure prison with its metal slab of a bed (“I’m quite bony, so that was painful,” she admits) instead of enjoying a nice, quiet life in her ninth decade?

“Oh my God, for my own sanity! Last year, I was going insane, I was so depressed, knowing things were falling apart and I wasn’t doing enough. Once I decided what to do, all that dropped away,” she says. (...)

As an adult, Fonda swapped one dominating male figure for three: her husbands. When she was with the film director Roger Vadim, who was previously married to Brigitte Bardot, she became a Bardot-esque sex kitten in Barbarella and engaged in threesomes with him, eventually leaving him after the birth of their daughter, Vanessa. Married to Hayden, she took to the barricades with him. When she married media mogul Ted Turner in 1991, she swapped her off-grid life for that of a billionaire’s wife.

“I always wanted to date someone who was the opposite of my father,” she explains. “I didn’t realise that, in the ways that really mattered, I picked men who were just like him because they all had a hard time with intimacy.” (...)

In the past, Fonda has said that she allied herself to strong men because she felt so unsure of herself. But isn’t it more likely that she needed strong people because she is an extraordinarily strong character herself?

“Oh yeah, whenever I’ve been with men who are not strong I’ve had a really hard time,” she agrees. “I’m now five years older than my dad was when he died and I’ve realised that I am, in fact, stronger than he was. I’m stronger than all the men that I’ve been married to.”

by Hadley Freeman, The Guardian | Read more:

Image: Tiffany Nicholson

[ed. I've always been fond of Jane. What a full and interesting life. Also, her show with Lily Tomlin is great - Grace and Frankie]

[ed. I've always been fond of Jane. What a full and interesting life. Also, her show with Lily Tomlin is great - Grace and Frankie]

Saturday, October 8, 2022

Alaska’s Special House Race Stunned America. Here’s What November Could Bring.

In August, former Democratic state legislator Mary Peltola beat Republican candidate Sarah Palin in Alaska’s special House election to replace the late Republican Rep. Don Young. The win was a stunning upset and a huge victory for Democrats, who haven’t scored a House seat in the state in 50 years. The victory also highlighted a number of idiosyncrasies in Alaska politics — not just the state’s famous independent streak that made many voters choose Peltola over Palin, but also ranked choice voting, which was adopted in 2020 and which many supporters say encourages the election of moderates over more ideological candidates.

Now, a rematch in November for a full two-year term promises to show whether the August results were a fluke or a feature of Alaskans’ preferences and their voting system.

In Alaska’s ranked choice system, the top four vote-getters in an open primary advance to a general election where voters rank the candidates. The fourth-place finisher is eliminated and their votes are distributed to the second-choice candidate of those voters who preferred the fourth-place candidate. The process continues until one candidate gets 50 percent plus one of the votes. Since the process encourages policies and personalities that might win second or third choice among voters, many argue candidates are more likely to pursue middle-of-the-road platforms and act civilly on the campaign trail under a ranked choice system.

Now, a rematch in November for a full two-year term promises to show whether the August results were a fluke or a feature of Alaskans’ preferences and their voting system.

In Alaska’s ranked choice system, the top four vote-getters in an open primary advance to a general election where voters rank the candidates. The fourth-place finisher is eliminated and their votes are distributed to the second-choice candidate of those voters who preferred the fourth-place candidate. The process continues until one candidate gets 50 percent plus one of the votes. Since the process encourages policies and personalities that might win second or third choice among voters, many argue candidates are more likely to pursue middle-of-the-road platforms and act civilly on the campaign trail under a ranked choice system.

As more and more jurisdictions consider ranked choice voting — and as the discussion over how to temper political polarization nationwide remains unresolved — many political observers have wondered whether Alaska is a state that might point the way to a more moderate, more nuanced way of doing politics. Ivan Moore is a longtime Alaska pollster who is considered one of the foremost experts on the state’s politics. And he has some thoughts about what the rest of the country can learn from Alaska, what to watch for in November and what came first: Alaska’s independence, or the state’s ranked choice experiment that allowed those independents to have more of a say.

Moore said he’s not sure if Alaskans are actually all that different from most other voters on the issues, but in one crucial respect, Alaskans are different. “We are less strictly partisan,” he said. “It allows us to more readily embrace nontraditional ideas like ranked choice voting, because it’s like, we think, ‘Well, what the hell, why not? Let’s give it a shot.’”

This conversation has been condensed and edited for clarity.

Ben Jacobs: What happened in Alaska’s recent special House election, what does it say about ranked choice voting in general and whether it’s responsible for Democrats winning the special election?

Ivan Moore: I think it says a few things. Number one, that ranked choice voting worked well. Pretty flawless performance by the Alaska Division of Elections.

I don’t think everyone agrees with that. I gather that national Republicans have been making critical noises as if ranked choice voting was responsible for what happened. But ranked choice voting was not responsible for what happened. Well, obviously, if it had been done under the old system, with late Republican Rep. Don Young having passed away, the parties would have nominated replacements and there would have been a single special election between those nominees.

But when we consider whether ranked choice voting was responsible for Democratic Rep. Mary Peltola being elected, if you look at a traditional primary, Sarah Palin would, in all likelihood, have run away with the Republican primary. … And then a general election between Sarah Palin and Mary Peltola would have looked very similar to what the final ranked choice result was.

So it isn’t some kind of scurrilous result of ranked choice voting that Alaska has elected a Democrat to federal office for the first time [since 2008.]

And then the second thing that we found out is that Sarah Palin is indeed very unpopular. And that’s why she lost. The interesting thing that came out of our poll results in July, was that while she had a 60 percent negative among all voters, she had a 70 percent negative among [Republican candidate] Nick Begich voters. That’s remarkable. And that just goes to show that it isn’t all about partisanship and issues.

You would imagine, correctly, that the great majority of Begich’s voters are Republican and conservative. I actually remember running the results and finding that just over 60 percent of Begich voters were registered Republicans. Very few of them were Democrats, and the rest were nonpartisan/undeclared, but the majority of them were conservative-leaning. People got the message, without any doubts, that he was a conservative Republican. And yet, Sarah Palin was more unpopular amongst that group of voters than she was overall, which is astounding and just goes to show that it’s not all about politics. It’s also about likability and competence and the respect that people have for the candidate. If she does win second place [in November], she will almost certainly lose again. [Because her negative ratings would seem to indicate that she would not get many second- or third-choice votes.]

Moore said he’s not sure if Alaskans are actually all that different from most other voters on the issues, but in one crucial respect, Alaskans are different. “We are less strictly partisan,” he said. “It allows us to more readily embrace nontraditional ideas like ranked choice voting, because it’s like, we think, ‘Well, what the hell, why not? Let’s give it a shot.’”

This conversation has been condensed and edited for clarity.

Ben Jacobs: What happened in Alaska’s recent special House election, what does it say about ranked choice voting in general and whether it’s responsible for Democrats winning the special election?

Ivan Moore: I think it says a few things. Number one, that ranked choice voting worked well. Pretty flawless performance by the Alaska Division of Elections.

I don’t think everyone agrees with that. I gather that national Republicans have been making critical noises as if ranked choice voting was responsible for what happened. But ranked choice voting was not responsible for what happened. Well, obviously, if it had been done under the old system, with late Republican Rep. Don Young having passed away, the parties would have nominated replacements and there would have been a single special election between those nominees.

But when we consider whether ranked choice voting was responsible for Democratic Rep. Mary Peltola being elected, if you look at a traditional primary, Sarah Palin would, in all likelihood, have run away with the Republican primary. … And then a general election between Sarah Palin and Mary Peltola would have looked very similar to what the final ranked choice result was.

So it isn’t some kind of scurrilous result of ranked choice voting that Alaska has elected a Democrat to federal office for the first time [since 2008.]

And then the second thing that we found out is that Sarah Palin is indeed very unpopular. And that’s why she lost. The interesting thing that came out of our poll results in July, was that while she had a 60 percent negative among all voters, she had a 70 percent negative among [Republican candidate] Nick Begich voters. That’s remarkable. And that just goes to show that it isn’t all about partisanship and issues.

You would imagine, correctly, that the great majority of Begich’s voters are Republican and conservative. I actually remember running the results and finding that just over 60 percent of Begich voters were registered Republicans. Very few of them were Democrats, and the rest were nonpartisan/undeclared, but the majority of them were conservative-leaning. People got the message, without any doubts, that he was a conservative Republican. And yet, Sarah Palin was more unpopular amongst that group of voters than she was overall, which is astounding and just goes to show that it’s not all about politics. It’s also about likability and competence and the respect that people have for the candidate. If she does win second place [in November], she will almost certainly lose again. [Because her negative ratings would seem to indicate that she would not get many second- or third-choice votes.]

The third thing that we’re finding out since the primary is that Palin and Begich can’t seem to stop squabbling. And they don’t seem to understand that this is a very bad thing to do, in the context of ranked choice voting. … Do you think that Palin having repeatedly and continually run Begich down and demanded that he get out of the race and calling him “negative Nick” is the kind of thing that will make his people more likely to put her second? And does it make her voters less likely to put him second? I mean, they just kill themselves with this in both directions. And Mary Peltola is sitting there probably rather enjoying the spectacle.

by Ben Jacobs, Politico | Read more:

Image: POLITICO illustration/iStockFriday, October 7, 2022

The Boomtown That Shouldn’t Exist

"Gulf American unloaded tens of thousands of low-lying Cape Coral lots on dreamseekers all over the world before the authorities cracked down on its frauds and deceptions. It passed off inaccessible mush as prime real estate, sold the same swampy lots to multiple buyers, and used listening devices to spy on its customers. Its hucksters spun a soggy floodplain between the Caloosahatchee River and the Gulf of Mexico as America’s middle-class boomtown of the future, and suckers bought it.

The thing is, the hucksters were right, and so were the suckers. Cape Coral is now the largest city in America’s fastest-growing metropolitan area. Its population has soared from fewer than 200 when the Rasos arrived to 180,000 today. Its low-lying swamps have been drained, thanks to an astonishing 400 miles of canals—the most of any city on earth—that serve not only as the city’s stormwater management system but also its defining real estate amenity. Those ditches were an ecological disaster, ravaging wetlands, estuaries and aquifers. Cape Coral was a planning disaster, too, designed without water or sewer pipes, shops or offices, or almost anything but pre-platted residential lots. But people flocked here anyway. The title of a memoir by a Gulf American secretary captured the essence of Cape Coral: Lies That Came True." (...)

The Rosens’ real innovation was selling Cape Coral as frenetically as they sold their magic hair products. They gave away homes on game shows like “The Price Is Right.” They brought celebrities like Bob Hope and Anita Bryant to promote the dream. They had telemarketers hawking lots with Glengarry Glen Ross-style blarney. They sent sales reps across the ocean—Gloria Raso Tate’s dad pitched paradise in London and Rome—and planted touts at Florida hotels and attractions, luring tourists to free steak dinners interrupted by salesmen shouting, “Lot No. 18 is sold!” and paid ringers, yelling, “I just bought one!” Prospective buyers were offered free stays at the company motel—where rooms were bugged to help salesmen customize their pitches—and taken on company Cessnas for “fly-and-buys” to see lots the pilots reserved by dropping sacks of flour from the sky. Sometimes the fly-and-buyers ended up with marshy lots nowhere near the drained ones where the sacks landed, but for all the fibs and propaganda, Cape Coral really did boom.

“Cape Coral was brilliantly orchestrated and terribly planned,” says Florida historian Gary Mormino, author of Land of Sunshine, State of Dreams. “They built an instant city on steroids—with none of the stuff you need to make a city work.”

The thing is, the hucksters were right, and so were the suckers. Cape Coral is now the largest city in America’s fastest-growing metropolitan area. Its population has soared from fewer than 200 when the Rasos arrived to 180,000 today. Its low-lying swamps have been drained, thanks to an astonishing 400 miles of canals—the most of any city on earth—that serve not only as the city’s stormwater management system but also its defining real estate amenity. Those ditches were an ecological disaster, ravaging wetlands, estuaries and aquifers. Cape Coral was a planning disaster, too, designed without water or sewer pipes, shops or offices, or almost anything but pre-platted residential lots. But people flocked here anyway. The title of a memoir by a Gulf American secretary captured the essence of Cape Coral: Lies That Came True." (...)

The Rosens’ real innovation was selling Cape Coral as frenetically as they sold their magic hair products. They gave away homes on game shows like “The Price Is Right.” They brought celebrities like Bob Hope and Anita Bryant to promote the dream. They had telemarketers hawking lots with Glengarry Glen Ross-style blarney. They sent sales reps across the ocean—Gloria Raso Tate’s dad pitched paradise in London and Rome—and planted touts at Florida hotels and attractions, luring tourists to free steak dinners interrupted by salesmen shouting, “Lot No. 18 is sold!” and paid ringers, yelling, “I just bought one!” Prospective buyers were offered free stays at the company motel—where rooms were bugged to help salesmen customize their pitches—and taken on company Cessnas for “fly-and-buys” to see lots the pilots reserved by dropping sacks of flour from the sky. Sometimes the fly-and-buyers ended up with marshy lots nowhere near the drained ones where the sacks landed, but for all the fibs and propaganda, Cape Coral really did boom.

“Cape Coral was brilliantly orchestrated and terribly planned,” says Florida historian Gary Mormino, author of Land of Sunshine, State of Dreams. “They built an instant city on steroids—with none of the stuff you need to make a city work.”

[ed. See also: Ian will 'financially ruin' homeowners and insurers (Politico)]

MLB: Mariners in Playoffs and a Superstar is Born

Julio Rodriguez’s star power knows no bounds. Now he’s ready to shine in the playoffs. (Seattle Times).

Image: Ken Lambert/The Seattle Times

[ed. Go Mariners! First playoff appearance in 21 years. Update: They did it!]

[ed. Go Mariners! First playoff appearance in 21 years. Update: They did it!]

House Prices: 7 Years in Purgatory

Earlier this year, I argued the most likely path for house prices was for nominal prices to “stall”, and for real prices (inflation adjusted) to decline over several years. The arguments for a stall included historically low inventory levels, mostly solid lending over the last decade, and that house prices tend to be sticky downwards.

As I noted, homeowners resist selling for less than the recent sale prices of similar homes in their neighborhood. However, there are always the homeowners that need to sell (death, divorce, moving for employment, etc.), and sometimes these homes will sell for less than previous sales. Note that house prices were not sticky downwards during the housing bust due to the all the forced sales. (...)

10%+ Nominal Price Declines Now Seem Likely

Since national house prices increased very quickly during the pandemic - up over 40% - it seems likely that some of the usual “stickiness” will not apply. I think the most likely scenario now is nominal house prices declining 10% or more from the peak, and real house prices declining 25% or so over the next 5 to 7 years.

by Bill McBride, Calculated Risk | Read more:

Image: www.calculatedriskblog.com

[ed. See also: Office Markets Are the Real Estate Crash We Need to Worry About (Bloomberg).]

[ed. See also: Office Markets Are the Real Estate Crash We Need to Worry About (Bloomberg).]

Manufacturing Nostalgia

For much of my childhood in the early 2000s, my parents would drive me to the local sports card shop to pick a pack or two from the ever-rotating boxes of licensed card products. Like top shelf liquor, their names emphasized swank: Topps Finest, Bowman’s Best, Skybox Premium, Donruss Elite, Playoff National Treasures, Leaf Limited, Pacific Crown Royale, Upper Deck Black Diamond. The cards and foil wrappers alike conformed to a simple visual grammar, with action shots of professional athletes printed on the fronts and rows of statistics printed on the backs. In place of seasonal batting averages or shooting percentages, the foil wrapper versos instead reported statistical probabilities concerning the manufacturer: the odds of “pulling” an autographed card, a holographic card, or a card containing a clipped swatch of a game-worn jersey. Accompanying the mathematical ratios were instructions for entering “No Purchase Necessary” promotions for a chance to obtain free cards by mailing in a 3×5 index card with one’s name and address. Initially codified in response to a prevalence of contest scams, North American sweepstakes laws compelled trading card companies—purveyors of chance—to run these NPN promotions, as they were called, in order to put their products on shelves. Legally speaking, the NPNs were all that separated opening the foil packs from buying scratch-offs, or betting on horses.

For an adolescent, the local card shop was a crash course in the economics of nostalgia. Sports card enthusiasts waxed poetic about their youths spent collecting and cards that their mothers had thrown away, while speculating on the futures of rookies and stars and speaking of “investments.” Glass display cases housed rows of rare cards for sale or trade. Dollar bins held countless others strewn about, the mass-produced cards from the late ’80s and cards of forgotten draft picks. Always within the line of sight was a Beckett Sports Card Monthly price guide, which standardized card values across the country based on an inscrutable combination of variables such as upcoming Hall of Fame inductions, recent Super Bowl victories, previous sales, and card condition. And so the price stickers in the card shop’s display cases bore the markings of grades and other signifiers: “gem mint,” “3x MVP,” “#/100.” Within the brick and mortar confines of the suburban Maryland strip mall, the local card shop was a veritable marketplace with liquid assets, commodities forecasting, and market making.

Like many other card shops across the country, my local card shop had sprung up in the 1990s to capitalize on the demands of a growing hobby. To increase profit margins with this cardboard craze, trading card companies began releasing hobby-only versions of products, distinguished from retail products by exclusivity—they couldn’t be found at the local drugstore or K-Mart—and named accordingly as luxury brands. With these hobby products, the card companies followed a simple economic calculus: a higher price tag meant more favorable probabilities on the foil wrappers, as well as exclusive, “hobby-only” cards. The mark-ups were lucrative. By the time I had started collecting in the early 2000s, hobby products were already reaching unconscionable prices ($100 for a sealed box of sports cards was a common sight). But 2003 saw the release of a new tier of product: Upper Deck’s Exquisite Collection. Replacing the foil wrappers, each etched wooden box housed just five cards and retailed for $500. Exquisite Collection was seemingly a reductio ad absurdum of manufactured scarcity. Each card on the checklist was individually serial numbered to no more than 225 copies. The basketball card release built on an already exciting year for the hobby, the rookie season of budding phenom LeBron James. The product sold like wildfire. Fifteen years later, an unopened box would sell for $43,200 at auction.

Today, the situation is, astonishingly, even worse. The $5,000 padlocked metal suitcases of Panini Flawless have replaced the $500 wooden boxes of Upper Deck Exquisite. A secondary industry of live-streamed “box breaks” has cropped up, enticing collectors to bid on the right to receive all cards of a specific team or player in a box opened via livestream by professional “breakers,” viewed on Twitch with masturbatory anticipation. Opportunistic middlemen waited for hours in lines at Target during COVID in order to clear the shelves of boxes and packs ostensibly intended for children. Card grading companies are backlogged by months due to the paucity of staff trained to numerically evaluate card condition, including corner sharpness and centering. Condition is so critical that card companies have started releasing cards that are already encased in thick plastic holders in boxes. (...)

The sheer complexity emerging from the marketization of the sports card hobby begs a simple question: what happened to the days of baseball cards in shoeboxes or dime-store wax packs with slabs of bubble gum? And what does this tell us about nostalgia?

Though people often associate baseball cards with bubblegum, it wasn’t until the 1930s that the two were sold together, an innovation widely credited to the Goudey Gum Company.

by Benjamin Charles Germain Lee, Current Affairs | Read more:[ed. Milk caps, pogs, beanie babies, (tulips...) cards are the undisputed kings.]

For an adolescent, the local card shop was a crash course in the economics of nostalgia. Sports card enthusiasts waxed poetic about their youths spent collecting and cards that their mothers had thrown away, while speculating on the futures of rookies and stars and speaking of “investments.” Glass display cases housed rows of rare cards for sale or trade. Dollar bins held countless others strewn about, the mass-produced cards from the late ’80s and cards of forgotten draft picks. Always within the line of sight was a Beckett Sports Card Monthly price guide, which standardized card values across the country based on an inscrutable combination of variables such as upcoming Hall of Fame inductions, recent Super Bowl victories, previous sales, and card condition. And so the price stickers in the card shop’s display cases bore the markings of grades and other signifiers: “gem mint,” “3x MVP,” “#/100.” Within the brick and mortar confines of the suburban Maryland strip mall, the local card shop was a veritable marketplace with liquid assets, commodities forecasting, and market making.

Like many other card shops across the country, my local card shop had sprung up in the 1990s to capitalize on the demands of a growing hobby. To increase profit margins with this cardboard craze, trading card companies began releasing hobby-only versions of products, distinguished from retail products by exclusivity—they couldn’t be found at the local drugstore or K-Mart—and named accordingly as luxury brands. With these hobby products, the card companies followed a simple economic calculus: a higher price tag meant more favorable probabilities on the foil wrappers, as well as exclusive, “hobby-only” cards. The mark-ups were lucrative. By the time I had started collecting in the early 2000s, hobby products were already reaching unconscionable prices ($100 for a sealed box of sports cards was a common sight). But 2003 saw the release of a new tier of product: Upper Deck’s Exquisite Collection. Replacing the foil wrappers, each etched wooden box housed just five cards and retailed for $500. Exquisite Collection was seemingly a reductio ad absurdum of manufactured scarcity. Each card on the checklist was individually serial numbered to no more than 225 copies. The basketball card release built on an already exciting year for the hobby, the rookie season of budding phenom LeBron James. The product sold like wildfire. Fifteen years later, an unopened box would sell for $43,200 at auction.