Doing so would undermine economic growth and housing affordability gains certain red states have recently seen. Worse, we’ve already run this experiment and know where it leads: a California-style de-growth death spiral that slams the door in the faces of young working families.

I begin by explaining why property tax elimination is a bad idea:

1. States will never actually do itThen, I conclude by showing how to pragmatically reform property taxes in a way that delivers both meaningful tax relief and the sustainable pro-growth, pro-family, results craved by red and blue states alike.

2. The alternatives are worse

3. Blue state experiences serve as a warning

1. States will never actually do it

The first reason eliminating property taxes is bad is that local politicians don’t have the guts to actually pull the trigger. As soon as it’s time for implementation, intra-party fighting overwhelms the legislative process, causing lawmakers to throw up their hands, slap on a band-aid, declare victory, and go home.

Why you can’t eliminate property taxes

In my home state of Texas, Republicans have tried and failed twice in back-to-back legislative sessions to eliminate property taxes. This is despite the fact that Texas has been under complete Republican domination for over twenty years.

First, it’s just too expensive. In 2024, the legislative budget board found that replacing property taxes would cost $81.5 billion dollars, more than the annual state budget of $72 billion. Read here:

“This is not something that you can find $81 billion on a per-year basis and not have a major impact on the remaining sales tax rates, because that is a huge amount of money to be able to replicate,” said state Sen. Paul Bettencourt, a Houston Republican and [Lt. Governor Dan] Patrick’s chief lieutenant on property taxes.Second, replacing all property taxes with sales taxes would require raising the sales tax rate to over 19%, according to the Texas Taxpayers and Research Association. Just in case state leaders don’t think prices on everyday goods have risen high enough yet, they should note that inflation is the number one most important issue1 among Republicans. [...]

Property taxes are less hated than you think

At least according to recent polling, the #1 most hated tax is not the property tax, but the Federal Income tax: [...]

Note the change in the last two decades: a net 20 percentage point swing in most-hated status between property tax and federal income tax. The large drop in housing affordability over that time period has surely contributed towards that change in sentiment...

Also, if property taxes are so desperately hated, why do states keep voting to keep them in place?

Every single state has some form of state or local property tax. Meanwhile, over a quarter of states opt out of at least one of sales, corporate, or income taxes.

In short, while it is often claimed that property taxes are the least popular tax by stated preferences, if we look at revealed preferences, they could actually be the most popular local tax. Perhaps this is why every time a red state tries to abolish property taxes, strident opposition crops up from unexpected places: [video]

But maybe you don’t care. In that case, pick an alternative.

2. The Alternatives are worse

An OECD report ranks different taxes by which are the most harmful to growth:

1. Corporate taxes (worst)Overly high corporate taxes cause investment to flow to other states instead, and sufficiently high income taxes are a commonly cited driver of outmigration from blue states to red states. Modest sales taxes are the least distortionary of the three, but they’re still worse for growth overall than a well run property tax.

2. Personal income taxes

3. Consumption/sales taxes

4. Property taxes (best)

In conservative states like Texas, raising income and corporate taxes is already dead in the water (if not explicitly banned in the state constitution), which just leaves sales taxes. Since people say they hate property taxes more, shouldn’t we just bite the bullet and go all in on sales taxes?

The problem with this line of thinking is that the polling is based on sales taxes at current rates. The highest sales taxes in the nation cap out at 10%—rates as high as 19% are completely unprecedented. Even worse, the Texas Taxpayers and Research Association found that at those levels you start triggering tax avoidance, so you will inevitably have to raise the rate even higher to compensate, pushing it well past 20%.

We don’t even need to argue about whether this is popular or not because this exact proposal has been proposed twice already in Texas and it’s failed twice. Texans do not want to replace all property taxes with 20% state-imposed inflation on goods and services.

Ironically, reducing property taxes might actually be hardest in red states like Texas, precisely because the state is so anti-tax that there just aren’t many alternatives left. It’s no surprise then that the most famous instances of states that have “succeeded” in undermining property taxes are blue states.

The results have not been good.

3. Blue state experiences serve as a warning

Don’t California my Texas

One anti-property tax measure is not to lower tax rates so much as to completely undermine the entire system of property valuation itself, and there is no example more infamous than California’s Proposition 13. This 70’s-era reform fell far short of abolishing the property tax, settling for simply unleashing one of the most wildly unequal and unfair taxation schemes in the nation instead.

Prop 13 works like this:

- Assessed values are frozen at their 1976 valuations

- The tax rate is limited to 1%

- Increases in assessed values are limited to 2% a year

- New reassessments are allowed only for new construction or when property changes hands

The results have been an absolute disaster for both housing affordability and any semblance of basic fairness. Side-by-side houses have wildly unequal property assessments (source):

Again, complete property tax elimination never actually arrives. What arrives instead is special treatment for one class at the expense of everyone else in the state. But that’s not all; on top of the much higher property tax burdens young working families face for the audacious crime of moving in last year, the state has extra treats in store (source):

The state’s top marginal individual income tax rate of 13.3 percent is compounded by a 1.1 percent newly uncapped payroll tax, bringing the all-in top rate to 14.4 percent. Additionally, nonresidents must file income taxes if they work even a single day in the state, and California is one of only four states to still impose an alternative minimum tax.Don’t forget that California also has among the highest corporate taxes in the nation as well, just in case you were thinking of starting a business, or investing in one.

Honestly, the fact that it’s taken this long for California to start to bleed population really shows you what an incredible natural advantage California has long held over every other location in the United States. Even though the game has always been California’s to lose, if you spend multiple decades repeatedly punching yourself in the face, the crown eventually slips from your head.

NOTE: as much fun as it is to get high huffing California schadenfreude, Republicans would do well to remember that Prop 13 was pushed for in large part by members of their own party.

Unfortunately, California isn’t the only blue state with gorgeous weather and Edenic geography that’s been steadily sending its children into exile.

Aloha ‘Oe

The state with the lowest property taxes in the nation, at an effective tax rate of 0.27%, is Hawaii. Incidentally, Hawaii has the second highest top income tax rate at 11%. It also has the third highest net domestic outmigration rate of all US states between 2020-2024.

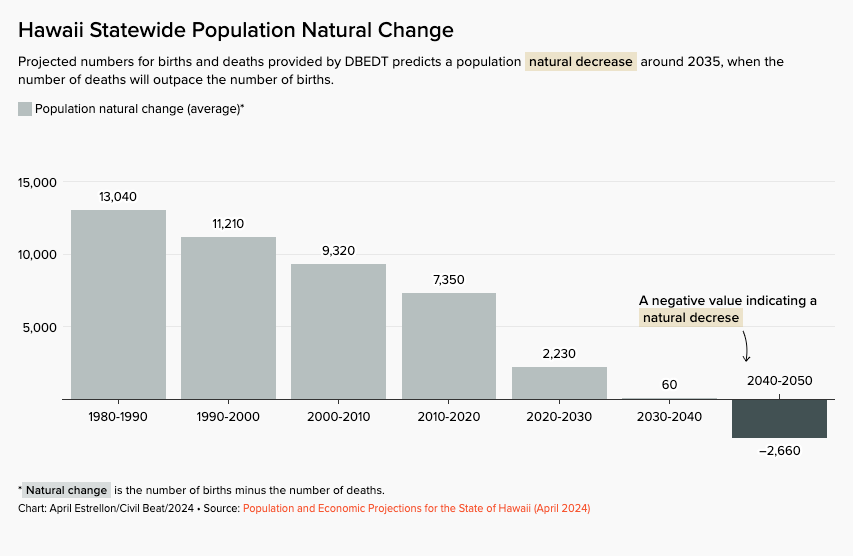

Even worse, the overall population “natural change” (births minus deaths) is steadily shrinking:

What’s not shrinking is the size of billionaire landholdings. Just 37 billionaires own more than 218,000 acres of Hawaii, roughly 5.3% of all land in the state, a figure equal to 11.1% of all privately held land.

Just one of those billionaires owns more than 1.27% of the entire state—Larry Ellison, founder of Oracle, who owns 98% of the entire island of Lānaʻi.

Meanwhile, Mark Zuckerberg & Priscilla Chan have seen their landholdings in Kaua’i more than triple, from 700+ acres in 2014 to over 2,300 acres today over the last ten years. Oprah Winfrey now owns over 1,000 acres on Maui after a recent purchase, the same island on which Jeff Bezos owns 14 acres. But what Jeff lacks in quantity, he makes up for in quality: he paid $78M for his land in La Perouse Bay, a full $13M more than Zuck paid for his 1,000-acre Kawai’i purchase in 2025.

As a quick aside, this underscores another problem with rock-bottom property taxes: it turns real estate into the perfect speculative financial asset in which to park money. When so little cost to hold it, real estate becomes an attractive passive investment, and over time tends to take up an ever-increasing share of bank loans, as expertly illustrated in the paper The Great Mortgaging, by Jordà, Schularick, and Taylor. This has a double-whammy effect on the economy: real estate sucks up all the loans, bidding up its price, while leaving all other sectors (like actually providing productive jobs) with less investment...

Making real estate the perfect speculative asset for the ultra-rich is never a good idea, but Hawaii faces other problems too: the top reasons cited for leaving the state include high cost of living, limited economic opportunities, housing challenges, quality of life concerns, and education. That last one is exacerbated by chronically underfunded public schools.

Hawaii’s high income taxes and low property taxes have done little to curb the island state’s steady transformation into a paradise for the rich, but a port of exile for the young working families its future depends on.

Five thousand miles away, on the cold and distant far shore of the mainland, another blue state grapples with a similar challenge. [ed. hint: New York]:

In any case, whether it’s Texas, Florida, Hawaii, California, New York, or any of the other forty-five of these great United States, there’s a solution out there that meets everybody’s needs.

It delivers meaningful property tax relief to the median homeowner, without excluding renters and businesses or pitting seniors against young working families, all while driving overall economic efficiency and setting the state up for a pro-growth flywheel that keeps the budget balanced and taxes competitive.

That policy is Universal Building Exemption.

3. Universal Building Exemption is better

There is a problem with property taxes: it’s a good tax combined with a bad tax. The bad part of the tax is the portion of the tax that falls on buildings and improvements. We’re in a housing crisis, so why are we taxing houses? We’re in an age of rising unemployment, so why are we taxing workplaces? We want more construction, not less.

A universal building exemption fixes this by shifting the tax off of buildings and onto the unimproved value of land. Crucially, it’s revenue-neutral: it raises the same amount of property tax dollars as before, so it doesn’t break the budget.

Here’s why it’s the solution to the property tax debate:

Economists and key conservative thinkers support it

1. It balances the budget

2. It’s pro-growth and pro-natal

3. It’s better than the homestead exemption

4. It’s politically viable

[specific details...]

No, because the beauty of universal building exemption is that the biggest losers are the ones holding the most valuable downtown urban land out of use, and the chief beneficiaries are everybody else.

Who are the losers? The big losers are surface parking lots and vacant land, particularly those situated downtown next to skyscrapers. This shifts the tax burden off of locations people actually live in, to massively valuable locations where nobody lives.

This isn’t just a handout to homeowners, developers, and landlords, either—it’s a carrot and a stick. The carrot of building exemption rewards everybody who actually contributes more of what contributes to growth in our society—namely, homes, neighborhoods, and jobs—a category which includes the best kinds of property managers and builders. The stick of a higher effective tax rate on land pokes everyone in the butt who is sitting on the most valuable locations—which includes the worst kinds of slumlords and land-banking “developers”— to either build something already, or sell it to someone who will.

Lars Doucet, Progress and Poverty | Read more:

Images: uncredited/Gallup/James Medlock

[ed. Agree 100%. There should be some kind of penalty for developers holding dead land and letting it appreciate through scarcity and the sacrifice of their more productive neighbors. Also, the California Prop 13 issue is insane. Didn't know that's how it all played out. For a new way of taxing property (and easing the tax burden on productive businesses), see this video (and transcript) of LVT (land value taxes) that encourage more building and less vacant land speculation here.]