The most common fare I’ve paid on Empower over the last six months is $7.65.

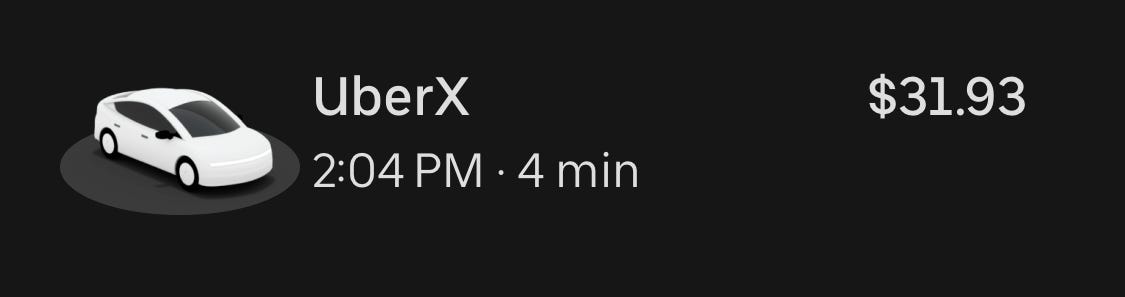

For a recent trip from downtown to the airport, Uber wanted $32. Empower wanted $17.25.

I use it constantly, and so do a lot of car-less people I know. That price difference is a pretty big deal!

For many, it can be the difference between getting to the clinic or skipping an appointment. Between getting a ride after a night shift or walking home alone after buses stop running.

DC is trying to shut Empower down, primarily over liability insurance. DC law requires $1 million in coverage per ride.

The $1 million requirement isn’t sized to typical accidents. When $100,000 is the limit available for an insurance claim, 96% of personal auto claims settle below $100,000.

The high ceiling shifts incentives: plaintiffs' attorneys have reason to pursue cases they'd otherwise drop and push for larger settlements. Fraud rings have emerged to exploit these policies. The American Transit Insurance Company, which focuses on NY rideshare insurance, estimates 60-70 percent of its claims are fraudulent. Uber recently filed racketeering lawsuits against networks of law firms and clinics allegedly staging fake accidents in New York, Florida, and California.

That $1 million requirement traces back to Uber’s early days. When the company was fighting for legality across America, taxi commissions called ridesharing dangerous. To win over skeptical politicians, Uber proposed $1 million in coverage, matching limousine services and interstate charter bus companies, not taxis. It became the national template. Had Uber aimed to match taxi limits, the mandates would be $100,000 to $300,000.

Now Uber is advocating to lower the $1 million mandates. The company (and its drivers) complain that insurance is around 30% of fares, particularly in states like California, New Jersey, and New York which also require additional $1 million uninsured motorist coverage and/or no-fault insurance. Even in DC, with very strong anti-fraud protections, the base $1 million requirement makes up about 5% of every fare—roughly a quarter of Empower’s advertised price advantage. (...)

Empower shows people want options. The app doesn’t let you schedule rides in advance, store multiple cards, or earn airline miles. Drivers don’t always turn off their music. Empower’s not trying to target the same audience as Uber. But the New York Times estimates Empower handles 10% of DC’s ride share market. People are comfortable with the rideshare industry’s scrappy options.

I think the core question is: now that society has accepted rideshare, should we revisit the rules that helped us get there?

Coverage of the potential shutdown rarely focuses on who stands to lose most: price-sensitive riders. Most coverage focuses on Empower’s lack of commercial insurance without explaining that the mandate is three to ten times higher than what taxis carry. Few explore whether or how Empower’s model actually differs: drivers can set their own prices. Drivers fund the platform through monthly fees rather than a cut of each fare. Drivers who get commercial insurance can also use it for private clients.

People now trust and rely on this mode of transportation. Ridesharing has become pseudo-infrastructure for car-less Americans and a tool against drunk driving. In areas of Houston where rideshare first rolled out, drunk driving incidents appear to have dropped 38%.

We should want rideshare to remain affordable, especially as we build the excellent public transit we need.

by Abi Olivera, Positive Sum | Read more:

Image: uncredited

[ed. Learn something new every day. I'll certainly look into this new company. The pricing of Uber is getting crazy (I've never used Lyft). Unfortunately, expansion won't be easy. As noted: High mandates also act as a moat. In DC, becoming a licensed rideshare company requires a $5,000 application fee, a $250,000 security fee, and infrastructure for that $1 million coverage. You have to be well-capitalized before you serve your first rider. This is likely why we see few bare-bones apps or local competitors to turn to when Lyft and Uber are surging.]